Trading of Wall Street’s most-liquid tools is surging as investors look to navigate the latest wave of volatility across assets.

(Bloomberg) — Trading of Wall Street’s most-liquid tools is surging as investors look to navigate the latest wave of volatility across assets.

Exchange-traded fund volumes in the US soared to 29% of total equity transactions on Tuesday, the highest proportion since December 2018, according to data from Susquehanna International Group. The spike came as the S&P 500 fell to a fresh bear-market low and the Cboe Volatility Index rose to its highest level in three months.

Activity in ETFs tends to jump at times of turmoil because they’re easy to trade — investors can quickly pare risky positions, shift into safety or place directional bets.

While such increases correspond to periods of macro-induced market stress, they also usually precede a rebound in prices, according to Amy Wu Silverman of RBC Capital Markets.

“I don’t think we are quite there yet but these are the hallmarks of what folks are looking for so we can ultimately say ‘this is capitulation’,” she said.

Volatility is rippling through currency and bond markets amid global central bank tightening, fueling downward pressure in equities as well. Some of the tension eased on Wednesday after the Bank of England said it would resume buying gilts to aid market functioning. US stocks welcomed the move, with the S&P 500 climbing more than 1% after six straight days of losses.

“This increase in ETF volume as a percentage of overall volume is a clear indication that the focus right now is squarely on the macro environment, on finding liquidity and on playing momentum,” said Chris Murphy, co-head of derivatives strategy at Susquehanna.

Meanwhile, the volume of trading in inverse ETFs hit a high versus that of leveraged long funds on Monday, according to Bloomberg Intelligence data that tracks back to 2020. That could mark a peak in pessimism and be a sign of a near-term bottom, according to BI’s Athanasios Psarofagis.

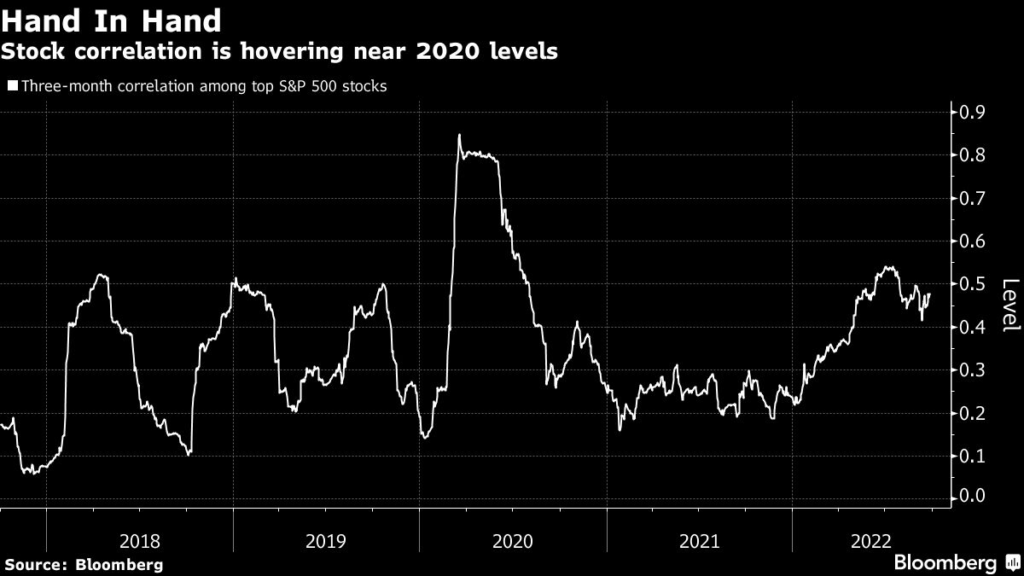

As long as stress lingers in markets, ETF activity could stay elevated. One of the byproducts of rising volatility is that stocks are increasingly moving in lockstep. In that environment, traders tend to gravitate toward ETFs where the market is dominated by large index-hugging funds.

“Stock selection becomes both more difficult and potentially less effective,” said Steve Sosnick, chief strategist at Interactive Brokers. “ETFs that allow one to invest in a broad index or an industry group as a whole become a much more viable methodology.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.