Global markets sank to two-year lows on Wednesday as surging borrowing costs and a worsening energy crisis fuelled fears that the world will tip into a recession but by the local closing bell, markets were mixed with some in the green while others, like in Asia, closed in the red.

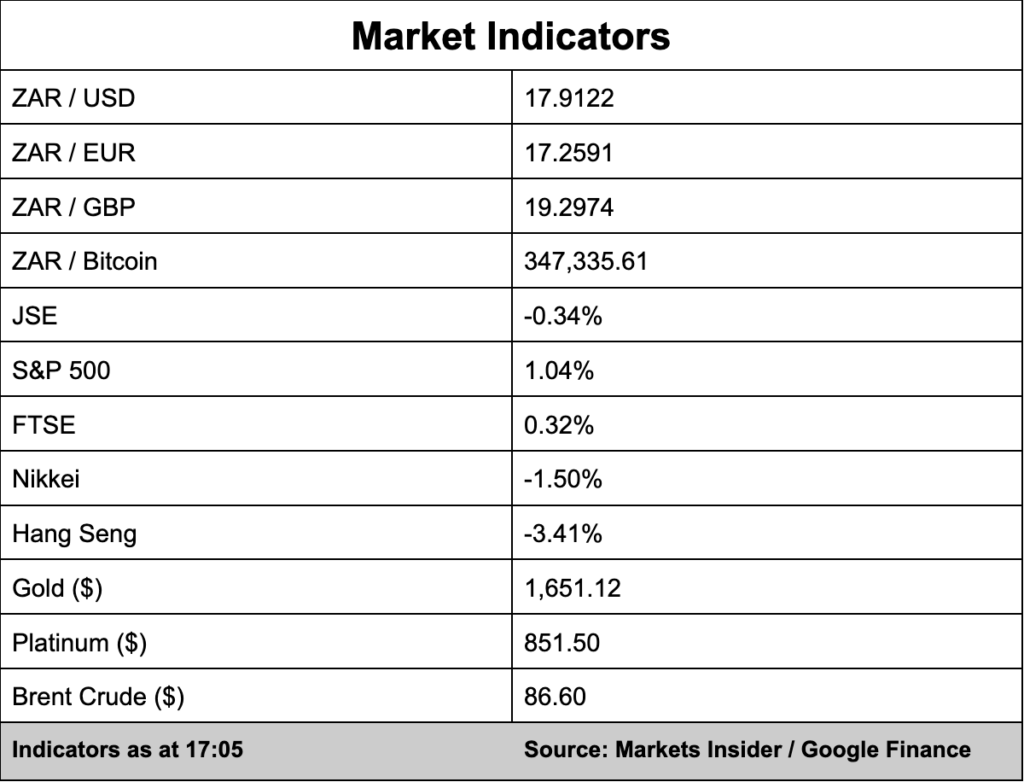

The Nikkei closed 1.50% down while Hong Kong’s Hang Seng is down 3.41% today. The Shanghai Stock Exchange closed 1.58% lower.

The local bourse reversed the modest gains it made this week with the All Share Index dropping 0.34% to 63,808 points as reactionary fears begin to weigh again. A sell-off overnight during the previous US session saw sentiment weigh globally as investors run towards the safe-haven dollar.

The message coming from the US Federal Reserve overnight was loud and clear with multiple speakers reiterating the American central bank’s stance that interest rates will go higher despite crashing asset prices.

There is growing concern that central banks the world over are too hawkish and moving too quickly with rate hikes.

In the currency markets, the greenback opened around the R18.10 level but the rand has clawed back some of that ground with the local unit currently trading at R17.91 against the dollar.