Good morning. Here are the top stories you need to know today:

Musk Proposes to Buy Twitter for Original Price of $54.20 a Share

In a stunning reversal (of a reversal) the world’s richest individual, Elon Musk, said he was prepared to buy Twitter for the original price of $54.20 a share in the purchase agreement he offered back in April. Musk formally tried to pull out of the deal in July after he alleged the social media company had lied to him about the number of bot accounts on the platform with Twitter responding by suing him in the Delaware Chancery Court to force the deal to continue. The trial was set to begin on October 17, but the judge as asked both parties to decide how they would like to proceed following Musk’s decision to reverse his wish to pull out of the acquisition. (Bloomberg)

Twitter surges as Musk proposes going through with deal

The news sent Twitter’s share price surging 22% to $52 a share and trading of the stock was halted following the release of the Bloomberg report that Musk would go through with his $44 billion acquisition and take the company private. Over $27 billion of Tesla shares were exchanged, the highest since mid-August while investors are worried over how many shares chief executive Musk might sell off of the electric car manufacturer to fund his Twitter purchase. Twitter is up over 20% in value for the year to date while Facebook owner Meta is down 50% in market value . (Reuters)

The big winners in Musk’s Twitter deal? Merger arbitrage traders

The decision by Musk to go through with the deal was good news for arbitrage traders, which includes legendary investor Carl Icahn – who acquired a $500 million stake in the deal at around the $30 a share mark. The surge in share price will see Icahn pocket around $250 million in profit. “Arbitrage traders make money by betting on mergers agreements, with the potential for millions of dollars in profits if the deals go through. Now, all that’s left is to wait for the agreement to close.” (Daily Maverick/Bloomberg)

Here’s what else we’re reading today:

SA Business

- Service SMMEs can fuel economic growth in SA – Ventureburn

- Govt is prepared to defend Shell survey decision, says Mantashe – News24

- Cost of living: Choosing between bread and phone data in SA – News24/Al Jazeera

Global Business

- France begins nationalisation of power giant – News24/AFP

- OPEC+ expected to slash oil output – AFP

- US pushing OPEC+ not to cut oil output – Source – SABC/Reuters

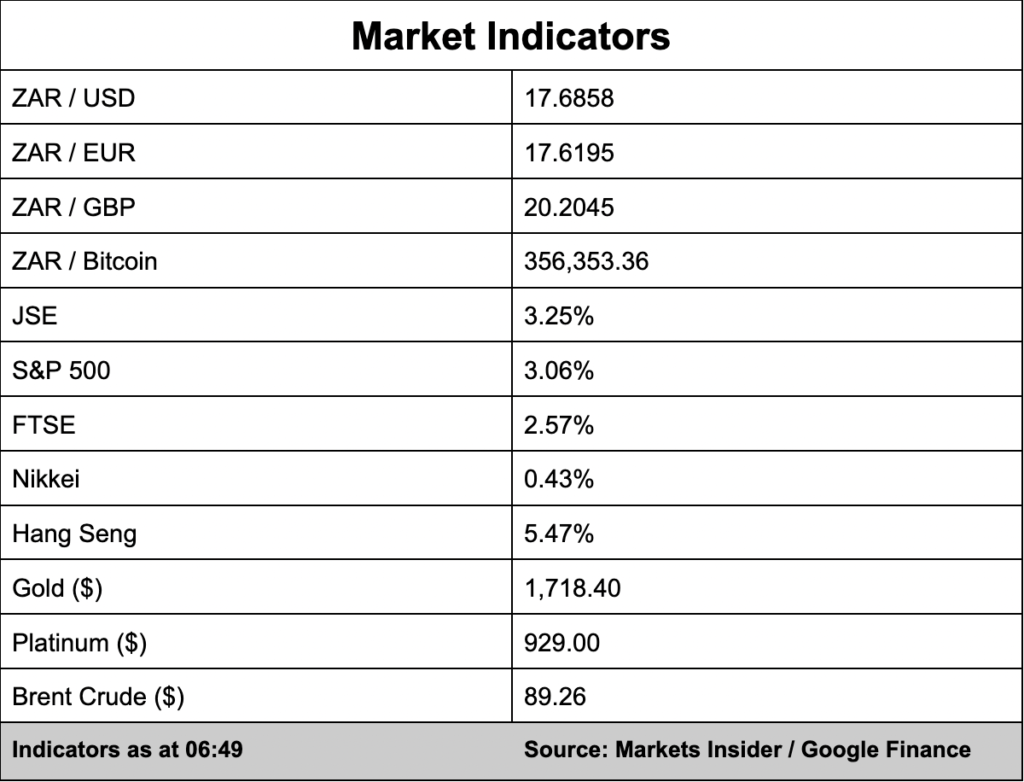

Markets