(Bloomberg) — Europe’s automakers warned they’re likely headed for another year of shrinking sales and called for policy makers to step up their support of the industry struggling to recover from the pandemic.

(Bloomberg) — Europe’s automakers warned they’re likely headed for another year of shrinking sales and called for policy makers to step up their support of the industry struggling to recover from the pandemic.

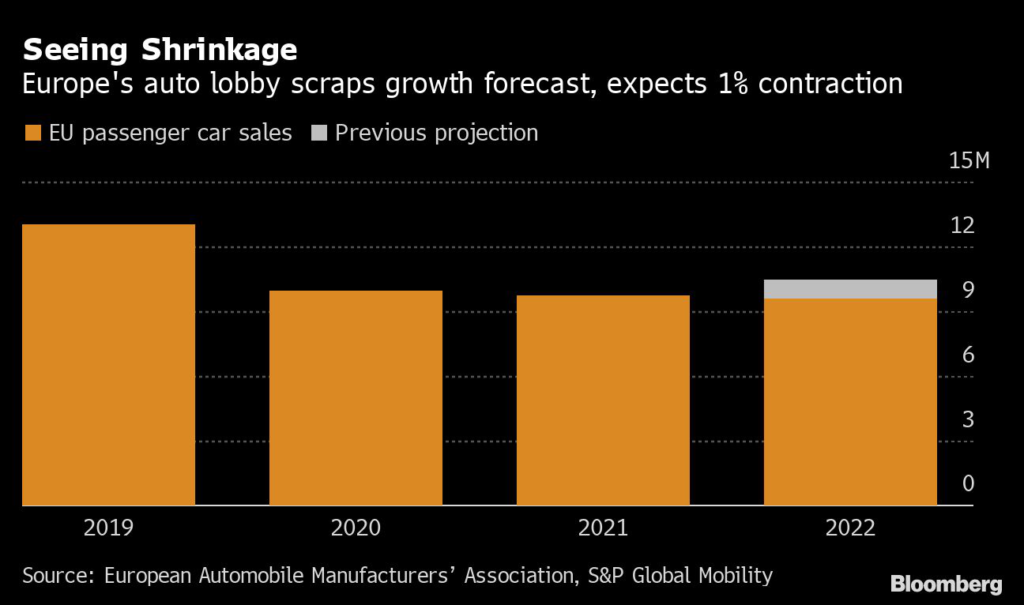

Passenger car sales will probably drop 1% to 9.6 million this year, the European Automobile Manufacturers’ Association said Friday. While that outlook suggests there may be some recovery in the closing months — registrations were down almost 12% through August — the lobby group doesn’t expect enough of a bounce back to stick with its forecast toward the beginning of the year for a bit of growth.

A pile-up of setbacks — including Brexit, semiconductor shortages, the war in Ukraine and the resulting energy crisis — have contributed to the industry struggling to get back to pre-pandemic volumes, Oliver Zipse, the ACEA’s president and the chief executive officer of BMW AG, said in a statement. Until recently, carmakers’ concerns were about constraints on production limiting vehicle supply. Now, runaway inflation and fears of recession are weighing on demand.

“To ensure a return to growth — with an even greater share of electric vehicle sales so climate targets can be met — we urgently need the right framework conditions to be put in place,” Zipse said. “These include greater resilience in Europe’s supply chains, an EU Critical Raw Materials Act that ensures strategic access to the raw materials needed for e-mobility, and an accelerated roll-out of charging infrastructure.”

Read more: Global Car Sales Seen Below Pre-Pandemic Level for Fourth Year

European Commission President Ursula von der Leyen said during an address last month that the bloc’s ambition to become the first climate-neutral continent is at risk without secure access of raw materials including lithium and rare earths. The act the ACEA is throwing its weight behind would streamline procedures and improve access to financing for strategic mining, refining, processing and recycling projects.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.