Recession worries are weighing on equities

Stock markets and oil prices slumped Tuesday as investors grow increasingly fearful that more big interest rate hikes will tip economies into deep recessions.

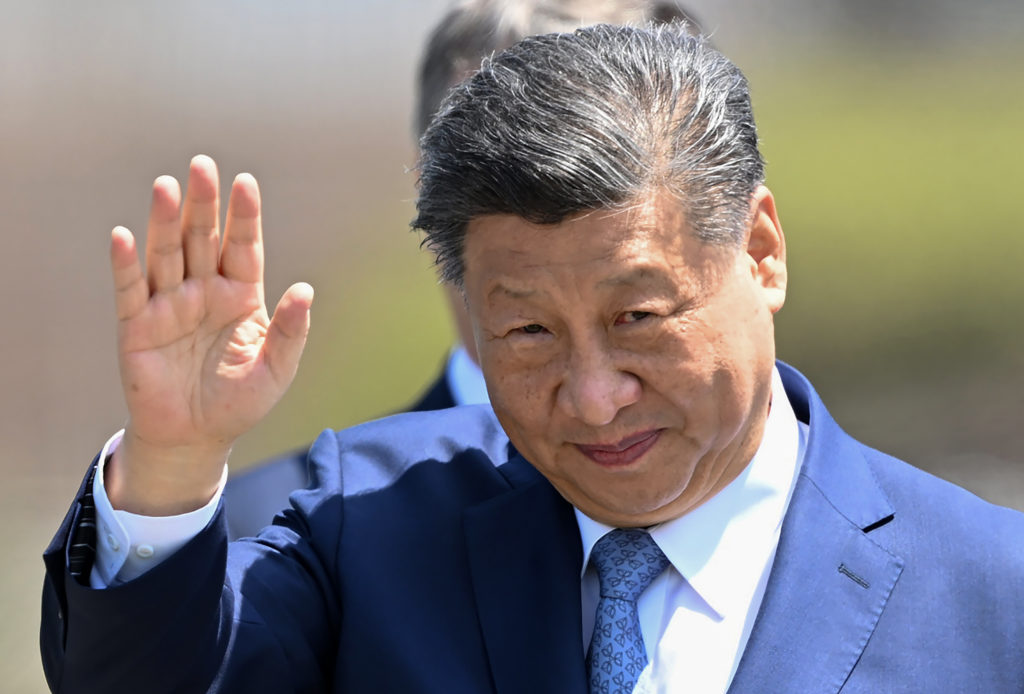

The mood darkened also on the worsening Ukraine war and weaker demand expectations in China.

With the focus on inflation, analysts said US consumer price index data released later this week will be crucial to the direction of risk assets.

Another big reading could spark a fresh equity selloff and surge in the dollar.

“There is growing pessimism in the markets now and with some big data points to come from the US this week, not to mention the start of earnings season,” noted Craig Erlam, analyst at Oanda trading group.

“Investors should probably brace for more volatility.”

Traders had hoped that bumper rate increases by the US Federal Reserve this year would begin to drag on the economy and slow runaway prices, allowing policymakers to reduce the pace of monetary tightening.

But a forecast-beating US jobs report on Friday highlighted the tough work the country’s central bank has slowing inflation from four-decade highs, and many observers warn recession is virtually inevitable.

– ‘Real danger’ –

World Bank chief David Malpass said there was a “real danger” of a global contraction next year, adding that the surge in the dollar was weakening the developing nations’ currencies and pushing their debt to “burdensome” levels.

And JP Morgan boss Jamie Dimon told CNBC that while the US economy was holding up, it faced several headwinds including rising rates, surging inflation, Fed tightening and the Ukraine war.

He added that he saw a US recession in six to nine months, and that the S&P 500 could fall another 20 percent.

Barings strategist Christopher Smart said: “It’s little wonder investors enter the week in a dreary mood, especially with headlines from Ukraine signalling a further escalation in geopolitical tensions.

“Of course, markets are meant to look ahead, but it’s hard not to see the next few quarters bringing more of the same.”

Chip manufacturers globally took a pounding from new US export controls aimed at restricting China’s ability to buy and make high-end chips with military applications.

The Philadelphia Stock Exchange Semiconductor Index saw its lowest close since late 2020, while Bloomberg News reported that $240 billion had been slashed from companies’ market values worldwide.

– Dollar steady –

Taipei led the losses in Asia — diving more than four percent — as chip giant TSMC plunged 8.3 percent, while a hefty selloff in Samsung Electronics dragged Seoul down 1.6 percent. Tokyo was also sharply lower owing to a hit to tech firms.

All three markets had been closed Monday and were reacting to Friday’s US announcement for the first time.

On currency markets, the dollar steadied after recent strong gains as the US heads the monetary tightening drive.

The pound remained under pressure, despite the Bank of England unveiling further measures to calm markets rocked by a UK budget, saying it would extend purchases of government bonds.

– Key figures around 1045 GMT –

London – FTSE 100: DOWN 1.1 percent at 6,884.70 points

Frankfurt – DAX: DOWN 0.9 percent at 12,165.15

Paris – CAC 40: DOWN 0.7 percent at 5,801.48

EURO STOXX 50: DOWN 0.9 percent at 3,328.03

Tokyo – Nikkei 225: DOWN 2.6 percent at 26,401.25 (close)

Hong Kong – Hang Seng Index: DOWN 2.2 percent at 16,832.36 (close)

Shanghai – Composite: UP 0.2 percent at 2,979.79 (close)

New York – Dow: DOWN 0.3 percent at 29,202.88 (close)

Euro/dollar: UP at $0.9710 from $0.9708 on Monday

Pound/dollar: UP at $1.1060 from $1.1059 on Monday

Euro/pound: FLAT at 87.76 pence

Dollar/yen: DOWN at 145.68 yen from 145.72 yen

West Texas Intermediate: DOWN 2.4 percent at $88.98 per barrel

Brent North Sea crude: DOWN 2.2 percent at $94.10 per barrel