Microsoft Corp. accused Britain’s competition watchdog of relying on “self-serving” input from fierce rival Sony Group Corp. in its decision to probe the tech giant’s $69 Billion takeover of Activision Blizzard Inc..

(Bloomberg) — Microsoft Corp. accused Britain’s competition watchdog of relying on “self-serving” input from fierce rival Sony Group Corp. in its decision to probe the tech giant’s $69 Billion takeover of Activision Blizzard Inc..

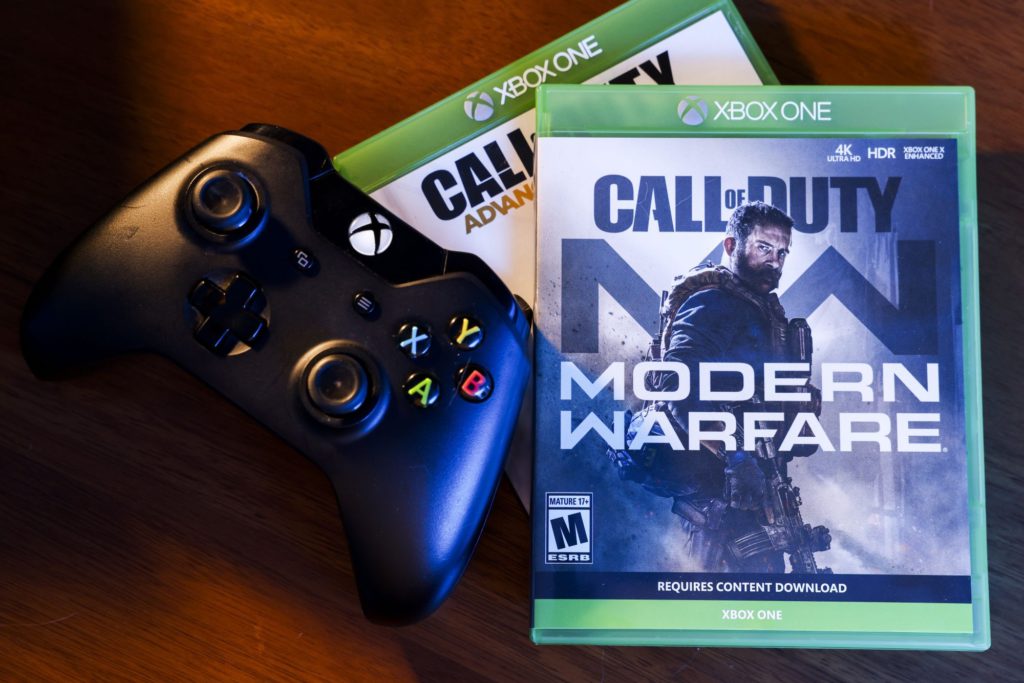

The Competition and Markets Authority opened a longer review of the deal last month citing concerns it could hamper markets, for example by restricting players of Activision’s Call of Duty to Microsoft’s Xbox console.

In the agency’s full decision published Wednesday it said “the main rival that could be affected by this conduct would be Sony,” whereas other competitor Nintendo competes less closely. The CMA also pointed to past “strategies” used by Microsoft to justify taking a closer look at the tie-up.

Microsoft hit back, saying the CMA “incorrectly relies on self-serving statements by Sony which significantly exaggerate the importance of Call of Duty.” In a response to the CMA statement, seen by Bloomberg, it said the authority has adopted the complaints of market leader Sony without the “appropriate level of critical review.”

The combination with Activision — which owns some of the most popular franchises including World of Warcraft and Guitar Hero — will make Microsoft the world’s third-largest gaming company and boost the Xbox maker’s roster of titles for its Game Pass subscribers.

“Our inquiry is about protecting competition in the interests of UK gamers and businesses,” a CMA spokesperson said. “The Phase 1 decision identified three areas where the deal could cause harm: gaming consoles, multi-game subscription services and cloud gaming services.”

Sony didn’t immediately respond to requests for comment.

Microsoft is facing scrutiny from global regulators including in the US. The European Union has also formally opened a probe and will next update in November. The UK regulator has until March 1 to come to a final decision on whether it will allow the deal to go ahead.

(Updates with CMA comment in sixth paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.