Weary cryptocurrency investors pining for a recovery in beaten-down Bitcoin can take some solace from an unusual intraday price recovery that’s tended to presage rallies in the largest digital token.

(Bloomberg) — Weary cryptocurrency investors pining for a recovery in beaten-down Bitcoin can take some solace from an unusual intraday price recovery that’s tended to presage rallies in the largest digital token.

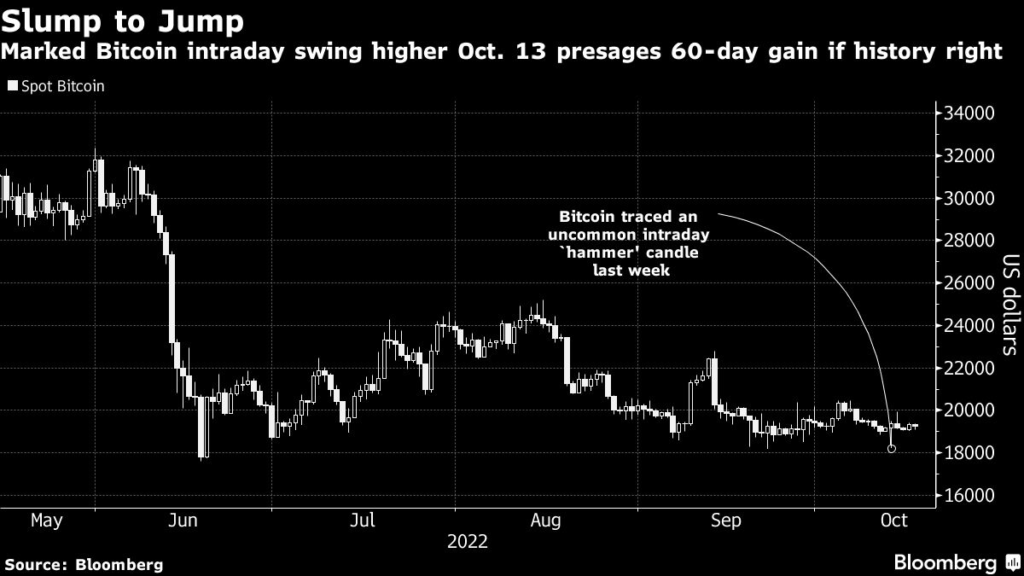

The pattern emerged on Oct. 13, when Bitcoin stormed back from a 5% swoon during the trading session to end up more than 1%. The about-face was overshadowed by a five-percentage-point turnaround in the S&P 500 equity index on the same day, a revival that left strategists open-jawed.

There have been 15 sessions since December 2018 when Bitcoin wiped out a minimum 5% intraday slide to finish with a gain of at least 1%. It averaged a 19% advance 60 days after such signals, data compiled by Bloomberg shows.

Bitcoin slid to about $18,201 last Thursday before closing at roughly $19,387. The token has shed 58% in 2022, hurt but rapid-fire central bank interest-rate hikes that drained liquidity from markets in a fight against inflation.

It’s been stuck in a low-volume, low-volatility trading range since mid-June, leaving some onlookers fretting that the overall weight of evidence raises the risk of further declines.

“The current inflationary environment remains challenging for risk assets, including cryptocurrencies,” but Bitcoin has continued to respect a support level around $18,000, said John Toro, the head of trading at digital-asset exchange Independent Reserve in Sydney.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.