European phone carriers are under threat from rising energy prices and climbing wages, offsetting the rich dividends, stable revenue streams and tempting price tags that typically make them one of the safest places to sit out bouts of stock-market turmoil.

(Bloomberg) — European phone carriers are under threat from rising energy prices and climbing wages, offsetting the rich dividends, stable revenue streams and tempting price tags that typically make them one of the safest places to sit out bouts of stock-market turmoil.

Vodafone Group Plc to Telenor ASA have warned that energy bills could eat into earnings, workers at BT went on strike to demand higher wages, while inflation-hit customers shop for more discounts at Liberty Global Plc.

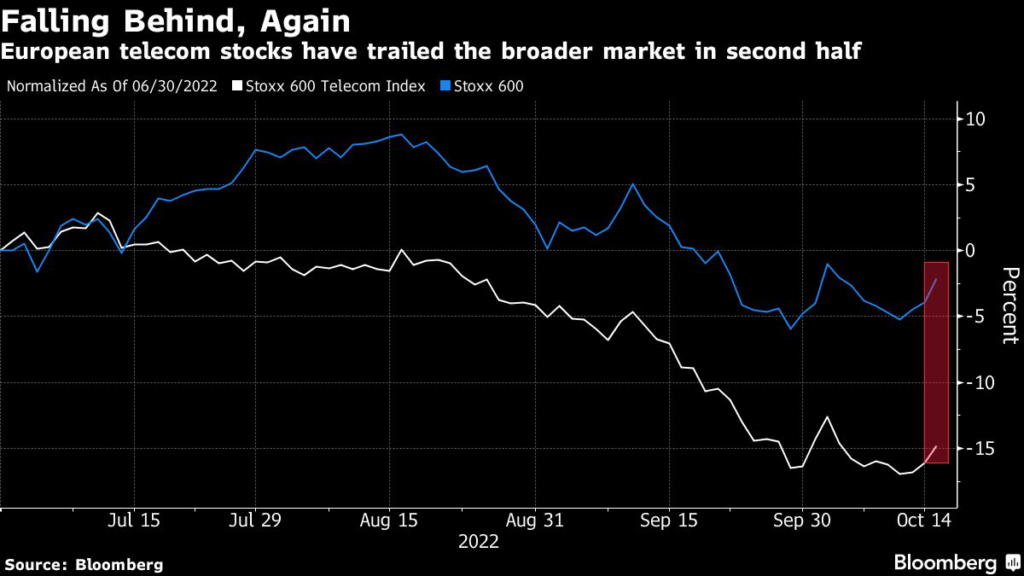

That’s compounding the sector’s flip from second-best performer in the Stoxx 600 index in the first half of the year to the second-worst laggard since June. The Stoxx Telecom Index is down 15% in the second half, with BT Group plc and Telefonica SA stumbling by more than 30%.

“Energy costs are definitely a pain point,” said Bloomberg Intelligence analyst Erhan Gurses. Interest in telecom stocks has waned as some investors predict a slowdown in earnings growth, while others trim positions to lock in profits, he said.

The 2% to 3% energy-crisis hit to European telcos’ earnings before interest, taxes, depreciation, and amortization that Berenberg analysts predict next year may not sound too harsh. But it’s still a major blow for an industry with low growth rates. Meanwhile, Citigroup Inc. analysts estimate wage inflation could carve an additional 2% from carriers’ Ebitda.

Central-bank moves to tackle quickening inflation are adding to the headwinds, spurring the cost of refinancing and piling pressure on indebted carriers like Telecom Italia SpA and tower companies like Cellnex Telecom SA.

The climbing rates are weighing on the valuations and financing costs for potential deals, prompting activist investor Cevian Capital AB to sell most of its stake in Vodafone earlier this year, according to a Bloomberg report.

Ranged against other asset classes, even the higher-income telecom stocks have seen their luster increasingly dimmed by the upward march of government yields.

“Bonds have become more attractive,” said EdenTree fund manager Christopher Hiorns. “When you see yields explode to where they are now, I’m probably still in the equity camp, but the margin is a lot lower.”

The current crises haven’t entirely quashed the industry’s allure.

Deals are coming at a faster pace: Vodafone sealed a pact for a fiber joint venture with Altice Europe NV in Germany. It’s also planning to sell a stake in its towers unit, Vantage Towers AG.

And valuations are on telcos’ side. Priced at 11 times forward earnings, the industry is the cheapest it’s been since March 2020 and boasts the highest dividend yield in two years.

Even with the earnings revisions, the sector still appeals to Mandana Hormozi, a portfolio manager at Franklin Mutual European Fund, which is overweight the sector.

“If you are looking at earnings revisions in the 1% to 5% range for the next year, that’s not a bad place to be,” she said. “That’s pretty defensive.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.