Good morning. Here’s what you need to know today:

- Former Steinhoff CEO Markus Jooste expected to apply ‘Stalingrad’ legal tactics after properties were raided.

- Eskom to be given more funding from government to service heavy debt burden.

- Telkom shares plunge by nearly a quarter after MTN pulls out of merger talks.

Not true that we should expect Stalingrad tactics from Jooste – family trustee

There have been no public comments from disgraced former Steinhoff chief executive Markus Jooste following raids on his properties conducted by the SA Reserve Bank on Tuesday. Industry experts expect Jooste to apply ‘Stalingrad’ legal tactics as the wheels of justice begin to turn after years of inaction. Accounting irregularities and Jooste’s sudden resignation in 2017 led Steinhoff’s share price to crash by 90% in a single day on the JSE, which saw around R200 billion in market value erased from the company. But Rian du Plessis, who is a trustee of Jooste’s personal family trust, the Silver Oak Trust, says we should not expect Jooste to delay his day in court. (EWN)

More money on the cards for Eskom, where the anti-corruption turnaround is gaining momentum

Finance minister Enoch Godongwana will make an announcement on Eskom debt relief funding during next week’s Medium-Term Budget Policy Statement says Eskom CFO Calib Cassim. The power utility’s finance chief was speaking after a five-hour session before parliament’s spending watchdog, the Standing Committee on Public Accounts. Eskom has a massive R400 billion debt burden and talks that the government may transfer some of the debt to its balance sheet or provide other debt relief has gained momentum in recent months. If the minister does announce such action, it will be the second time in four years that the government has had to provide support to the failing state-owned enterprise. (Daily Maverick)

Rain the only suitor left as jilted Telkom sheds 22% of its value

Telkom was hit with a battering ram on Wednesday after it suffered its worst day of trading on the JSE since the telecoms firm first listed on the stock exchange in 2003. Telkom’s share price plunged by almost a quarter after rival MTN formally withdrew its takeover bid amid interest from data-only network provider Rain. MTN has previously voiced its displeasure at Rain’s approach to Telkom over a merger and it seems South Africa’s second-largest network provider has had enough of Rain’s meddling. (Business Day, for subscribers)

Here’s what else we’re reading today:

SA Business

- Bad news for load-shedding after four more units break down – MyBroadband

- Steinhoff former CEO Markus Jooste’s conduct regarding accounting irregularities were complex: Wiese – SABC

- WATCH: How the Reserve Bank seized Markus Jooste’s assets – Business Day

Global Business

- Wall Street Dealmakers Are Entering a New Era for Buyouts – Bloomberg

- Key iPhone Supplier Warns Smartphone Demand Will Continue to Fall – Bloomberg

- Crypto Assets to Be Treated as Financial Products in South Africa – Bloomberg

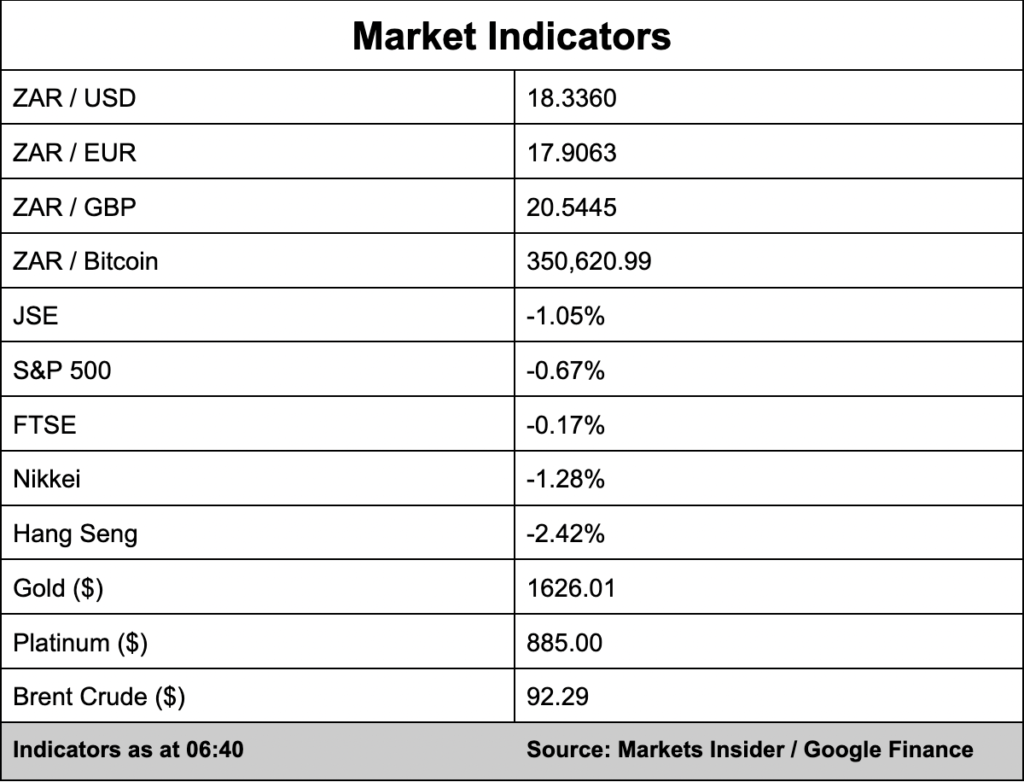

Markets