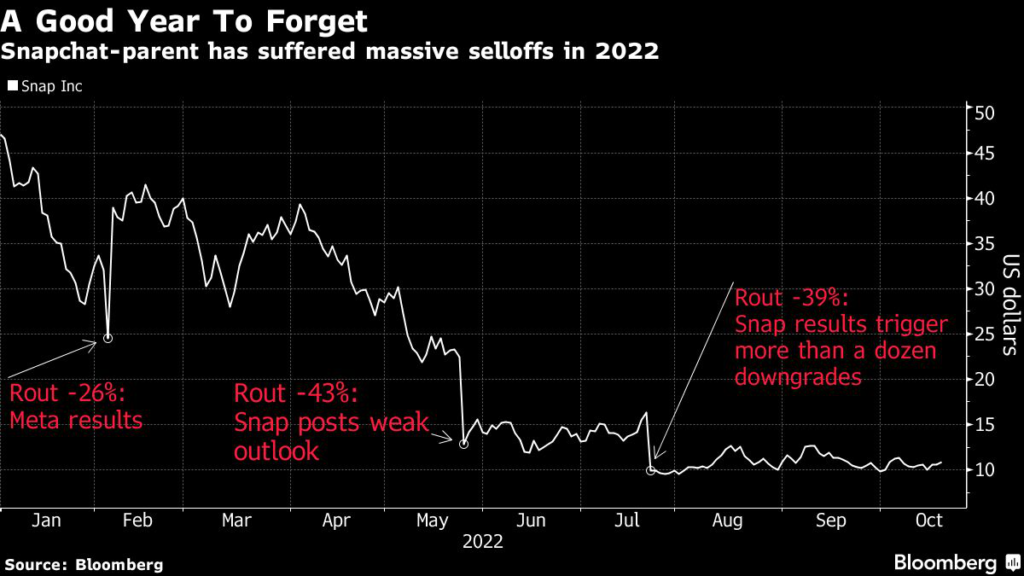

Snap Inc. may have at least one more shock in store for investors before the social-media company closes out its year to forget.

(Bloomberg) — Snap Inc. may have at least one more shock in store for investors before the social-media company closes out its year to forget.

The Snapchat owner reports third-quarter earnings late Thursday and, based on option volatilities, traders are pricing in a 23% stock move in either direction on Friday, according to data compiled by Bloomberg. Over the past five years, the average move up or down in Snap shares has been 20% the day after earnings, the data show.

Snap shares have tumbled 87% from their record close in September 2021. It owns the distinction of being the only US company that was worth more than $100 billion a year ago and is now worth less than $20 billion. So much bad news is priced in now that the surprise this time may be a positive one, said Angelo Zino, senior equity analyst at CFRA Research.

The “set up looks more favorable for bulls given price action in recent months,” he said. “Estimates have been coming down all year and we expect a relatively conservative outlook when the company reports.”

Snap’s report will be the first from big internet companies that depend on advertising, so it will set the stage for what investors can expect when larger players like Alphabet Inc. and Meta Platforms Inc. announce next week.

Social media platforms like Snapchat, Facebook and Instagram have had to work around privacy rules that Apple Inc. introduced last year that have made it more difficult to serve up ads to customers based on their online activity.

To make things worse, 2022 has been ruthless on the technology sector, with the Federal Reserve spooking investors by raising interest rates to control inflation and ad dollars coming under pressure as fears of a global recession loom.

Over the past 12 months, analysts have slashed their 2022 revenue estimates for Snap by almost a quarter. They now expect growth of 14%, which would be the company’s slowest ever, according to Bloomberg data. After its dismal second-quarter results in July, at least 14 brokerages and investment banks have cut their recommendations on the stock.

“They’ve disappointed us so many times it’s almost expected that they’re gonna disappoint us again,” said Dennis Dick, head of markets structure and a proprietary trader at Bright Trading. “You never know with Snapchat. You lower the bar and they seem to find a way to get under the lower bar.”

Tech Chart of the Day

Netflix Inc. has rallied 65% from its May low as the video streaming giant makes changes to its business to attract more subscribers onto its platform. Share soared 13% on Wednesday after the company handily beat estimates for paid subscribers, signaling the worst of the slowdown is likely over. However, heavy losses in the beginning of the year means that the stock is still down 55%, putting it on track for its worst year in more than a decade.

Top Tech Stories

- Elon Musk said he and other investors are “obviously overpaying” for Twitter Inc. The billionaire said he is “excited about the Twitter situation,” describing the social media company as an asset that has “sort of languished for a long time” but has “incredible potential.”

- China’s top technology overseer convened a series of emergency meetings over the past week with leading semiconductor companies, seeking to assess the damage from the Biden administration’s sweeping chip restrictions and pledging support for the critical sector.

- Amazon.com Inc. faces a UK class-action lawsuit over claims the tech giant uses a “secretive” algorithm to abuse its dominant position in the online marketplace.

- Indonesia’s largest tech company GoTo Group is in talks with its major owners for a controlled sale of roughly $1 billion of their stakes, aiming to avoid a potential stock crash when a lock-up on their holdings ends next month.

- The Biden administration’s trade restrictions on China are wreaking havoc with the chip-equipment industry, but ASML Holding NV and Lam Research Corp. forecasts show that the pain won’t be spread evenly.

- Murata Manufacturing Co. expects this year’s drop in smartphone sales to keep going well into 2023, led by a sharp downturn in China.

- Tesla Inc. shares declined in early trading after the electric-car maker reported lower-than-expected revenue and acknowledged it isn’t immune from economic headwinds.

- China is experiencing a downturn similar to a recession driven by the housing market slump that has lasted for over a year, according to Musk.

- Musk said it’s likely that Tesla Inc. will do a “meaningful” share buyback.

–With assistance from Tom Contiliano.

(Updates to market open.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.