A Hong Kong court has issued an order that a Chinese developer’s unit that defaulted on offshore debt be wound up, the first such instance against a major builder during the country’s property-debt crisis and opening the door to more such decisions.

(Bloomberg) — A Hong Kong court has issued an order that a Chinese developer’s unit that defaulted on offshore debt be wound up, the first such instance against a major builder during the country’s property-debt crisis and opening the door to more such decisions.

The order regarding Yango Justice International Ltd. was dated Oct. 17, according to a winding up search report done through the website of Hong Kong’s Official Receiver’s Office. The case’s first hearing date was Sept. 14 and the adjourned hearing was Oct. 17, the same day of the order. The firm is a unit of Yango Group Co.

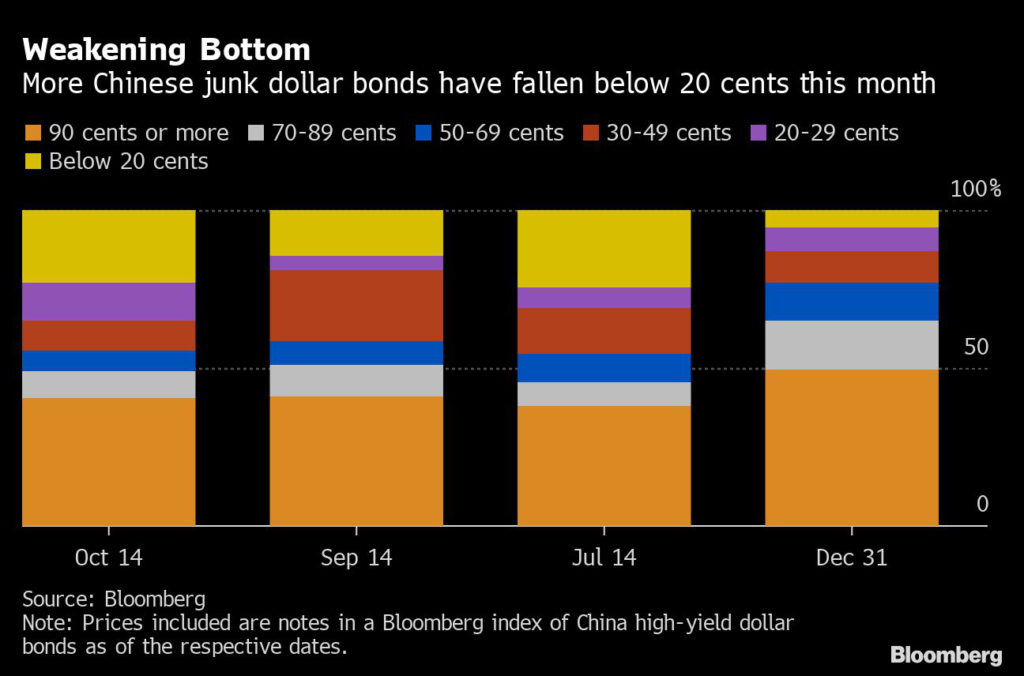

Hong Kong has acted as a gateway for investors to access China’s high-yield credit, a market dominated by builders but which has slid into unprecedented distress this year, reversing what was once one of the world’s most lucrative debt trades.

The tumble comes as China grapples with a real estate crisis fueled in part by a clampdown started in 2020 on excessive borrowing by property firms and speculation by home buyers. Some builders have left projects unfinished as they struggle to pay suppliers and creditors, causing defaults to surge.

That’s sparked a flurry of winding-up petitions filed in Hong Kong or Cayman Islands courts against developers, including China Evergrande Group — the giant whose default on dollar notes in late 2021 exacerbated the broader industry crisis. Evergrande has said that it’s actively pushing forward offshore debt restructuring work with its financial and legal advisers.

Creditors file winding-up petitions when they get frustrated with the lack of restructuring progress at a firm, fixed-income research analysts at BOC International Holdings Ltd. including Wu Qiong wrote in an Oct. 13 report. “In most cases, creditors seek more serious negotiations with the debtor by putting the debtor company under pressure or a solution through the court process,” they said.

If a Hong Kong court gives a winding-up order and appoints a provisional liquidator, the latter takes control of the firm in question and disposes of realizable assets, according to an explanation posted on the Official Receiver’s Office website. Any remaining funds are distributed to creditors whose claims have been admitted.

When Yango Group was asked by Bloomberg News on Friday whether it could confirm the winding-up order, the company wouldn’t comment on any issuance of an order, but said it is still actively negotiating and handling matters with creditors.

The search report from Hong Kong’s Official Receiver’s Office lists “official receiver” in the line for provisional liquidator, without giving further details.

Yango Justice defaulted for the first time in February when it missed paying $27.3 million of interest on two dollar bonds within a 30-day grace period, capping months of debt struggles that included seeking payment extensions.

Parent Yango disclosed a winding-up petition against its unit in July involving an $8.5 million payment for offshore notes and said it “strongly” opposed the filing. It’s unclear whether the order is related to that case.

Yango Group was China’s 19th-largest builder by contracted sales in 2021 but has fallen to 36th so far this year, according to China Real Estate Information Corp.

The developer said in a July exchange filing that Hong Kong-incorporated Yango Justice made up less than 10% of its net assets as of the end of 2021.

Below is a table of some winding-up petitions filed in Hong Kong against Chinese builders. Some of the creditor information is based on court records.

–With assistance from Emma Dong.

(Updates with comments in the sixth paragraph and adds table of winding-up petitions.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.