The JSE dropped lower on Monday after markets were spooked by Chinese president Xi Jinping’s decision to hand key economic posts to loyalists who back his zero-covid policy.

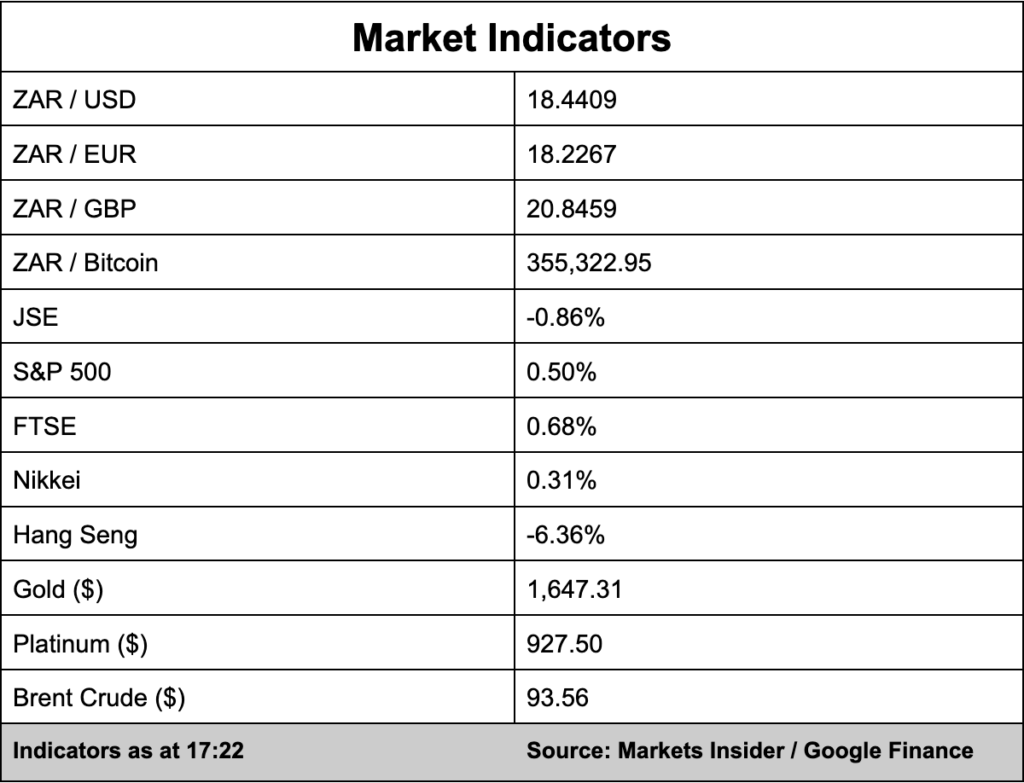

The Chinese president’s moves saw Hong Kong’s Hang Seng Index slump 6.36% to 15,180.69 points, its weakest level since 2009 during the global financial crisis, reports AFP.

Market giant Tencent lost 11%, while Alibaba and JD.com were all down around double digits and the Hang Seng tech index was almost 10 per cent down.

Naspers and Prosus, which have exposure to China via holdings in Tencent, plunged 17.40% and 15.19% respectively while the local bourse closed 0.86% down with the All Share Index at 64,976 points.

Meanwhile, in the UK the FTSE responded positively to the news that former Chancellor of the Exchequer Rishi Sunak has been appointed as the new leader of the Conservative Party and therefore prime minister of the United Kingdom.

The positive market response may indicate that investors have confidence in predicting what kind of prime minister Sunak might be given they know how he operates from his time as chancellor. The FTSE 100 posted its best day since June while the pound is trading at a two-week high.

In the currency markets, the dollar is currently trading 2% higher against the rand with the local unit changing hands at R18.44/$.

All eyes will be on the Medium-Term Budget Policy Statement from finance minister Enoch Godongwana, which will be tabled in parliament on Wednesday. Godongwana is expected to centre the budget on Eskom debt relief as well as social grants.