From Tokyo to San Francisco, mobile game studios have sparred for years to captivate a fickle audience, fostering an overlooked problem — the average title has become so huge that players can no longer fit more than a few on their phones.

(Bloomberg) — From Tokyo to San Francisco, mobile game studios have sparred for years to captivate a fickle audience, fostering an overlooked problem — the average title has become so huge that players can no longer fit more than a few on their phones.

Japanese games publisher Gree Inc. expects an impending reckoning over escalating costs and ballooning file sizes, as developers pack their games with increasingly intricate graphics, voice acting and larger storylines, all to get players spending. That’s creating a winner-takes-all situation that could winnow out smaller studios in coming years, Gree Senior Vice President Yuta Maeda said in an interview. The situation will only get worse as console veteran Sony — no stranger to space-hogging hits — prepares to invade the mobile arena.

“Production of mobile games can’t avoid becoming more complex, time-consuming and larger-scale, which will inevitably result in bigger app sizes,” Maeda said. “Companies that survive in the market will only be the ones that can keep up with that trend.”

The spending poured into today’s A-list mobile titles — MiHoYo Co.’s Genshin Impact, for instance, started with a $100 million budget — rivals Hollywood blockbusters and is yielding better production values than ever, but also an outsized footprint. That game can occupy upwards of 20 gigabytes of storage, which is a huge chunk of what most people have available on their phones. With memory upgrades not keeping pace, the result is fewer games can vie for attention.

“Even if gamers show interest in our games, we have found some of them are giving up on installing the apps because their phones are already full,” said Gree’s Yoshihide Koizumi, who leads marketing for the company’s latest game, Heaven Burns Red.

Sony, one of the giants of console gaming, has laid out plans to bring its high-profile PlayStation franchises to mobile platforms. Rival Microsoft Corp. is also building an Xbox mobile gaming store. All of that piles pressure on the entrenched free-to-play business model followed by Gree and others. These publishers rely on monetizing in-game items and upgrades, regularly adding more content players can buy and play with.

The most common workaround from game studios is to put only a basic installer in app stores, which then downloads further game assets once the player starts. Gree uses it with Heaven Burns Red, which is an initial 1GB and grows beyond 10GB for players who want the full experience.

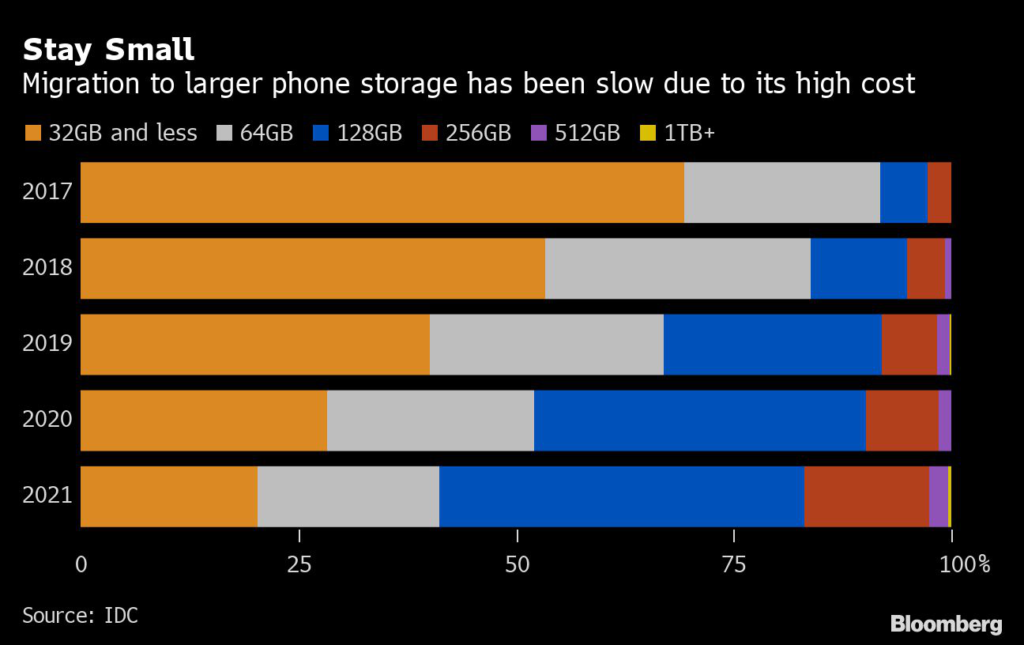

The typical flagship smartphone today starts with 128GB of storage, but many devices already in people’s hands have far less. Necessary operating system files also take up a significant chunk of the basic allowance, leaving even less room for large games. But memory upgrades are costly.

“As smartphone prices have come up significantly over the years, users tend to buy the cheapest versions of the latest devices, which have lower storage,” said Francisco Jeronimo, a vice president of analytics at IDC. “Devices with more storage can cost up to 50% more, and most users don’t realize that apps require a lot more space and they will be downloading a lot more apps.”

Gree’s Maeda and Koizumi said cutting data demands at the cost of game quality is not an option. Surpassing player expectations is now seen as the minimum requirement for a game to stick around for the long term, driving studios to be more aggressive in their spending and marketing.

To fan attention, the company hired a celebrated writer to pen the script for Heaven Burns Red. Fellow mobile publishers have been pushing the envelope with higher-fidelity graphics, video and voice actors in their titles — and Gree’s chunky 10GB game won’t be the exception but the rule going forward, Maeda said. He expects mobile games to keep growing as expectations ratchet up with more big-budget console and PC games on mobile.

“Most of the big-size mobile game hits are from Asian developers, but I think the Western studios are poised to follow that trend,” said Tokyo-based industry analyst Serkan Toto. “Users expect better and better quality from mobile games. File sizes definitely only have one direction in the future: up and to the right.”

Cloud gaming, the long-promised next stage in connected play that would host all game progress, assets and computationally intensive work in remote servers, has yet to materialize in a meaningful fashion to rectify the storage crunch. Alphabet Inc.’s Google Stadia service was one of the best-funded such initiatives, but the company recently decided to shut it down due to lack of player adoption — it now serves as a cautionary tale.

Read: Google to Shut Down Unpopular Stadia Cloud Gaming Service

Offloading other phone content like photos and videos — which are also growing larger with more advanced cameras — to the cloud is becoming an expensive affair. Free online storage from the likes of Google, Apple Inc. and Microsoft Corp. is inadequate for the job, in part because those companies want to push users to subscribe for paid storage.

The threat to smaller companies now is that ever grander game productions will simply take over with the brute force of their marketing budgets and reach.

“The only hope would be handset makers realizing that this is a critical issue to their ecosystem and offering larger-storage models,” said Toyo Securities analyst Hideki Yasuda. “Without them changing course, the future for mobile game companies is grim and consolidation of the industry is likely ahead.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.