Sagging used-car prices are starting to hurt the profits of car dealers and rental car companies — a good sign for policy makers trying to tame inflation.

(Bloomberg) — Sagging used-car prices are starting to hurt the profits of car dealers and rental car companies — a good sign for policy makers trying to tame inflation.

Hertz Global Holdings Inc. said Thursday that rising depreciation costs are starting to dent profits at the rental car company. AutoNation Inc., the largest US car retailer, warned of skimpier margins on used-car sales next year as prices come down from their peak. That echoed a warning from CarMax Inc. last month, which missed earnings forecasts after writing down the value of its used-car inventory.

Soaring prices for new and used cars have helped drive inflation in the US to the highest level in 40 years. Now, the semiconductor bottlenecks that starved dealers of inventory last year are starting to ease, unwinding a shortage that made used cars appreciate after they were driven off the lot. At the same time, the Federal Reserve’s interest-rate increases are scaring off price-sensitive car buyers.

“Used retail inventory can be your biggest asset but it also can bite you,” AutoNation Chief Executive Officer Mike Manley said on an earnings call Thursday. “It’s something we need to watch carefully, because wholesale prices haven’t fully come into the retail process. That will happen.”

The Fed is raising interest rates to help cool demand in the economy, part of its fight against inflation. Data from the US Commerce Department on Thursday showed that the nation’s gross domestic product rose 2.6% at an annualized rate in the third quarter, more than economists predicted and enough to keep traders convinced the Fed will raise its benchmark rate by another 75 basis points next week.

Read more: AutoNation warns of used-car price drop

Luxury-vehicle values are holding up well because affluent consumers are less impacted by rising interest rates, Manley said. General Motors Co. demonstrated that this week with robust profits wrung from sales of Cadillac SUVs and fully loaded pickup trucks.

New-car prices will be steadier because automakers want to maintain tight inventories to protect profit margins and fund electrification, Manley said. He predicts the annual pace of new-car sales this year will be about 13.5 million vehicles, still well below pre-pandemic levels.

But for the 40 million Americans who typically buy used cars each year, relief may be close at hand. Wholesale prices for used cars will likely end the year down 14%, researcher Cox Automotive said earlier this month.

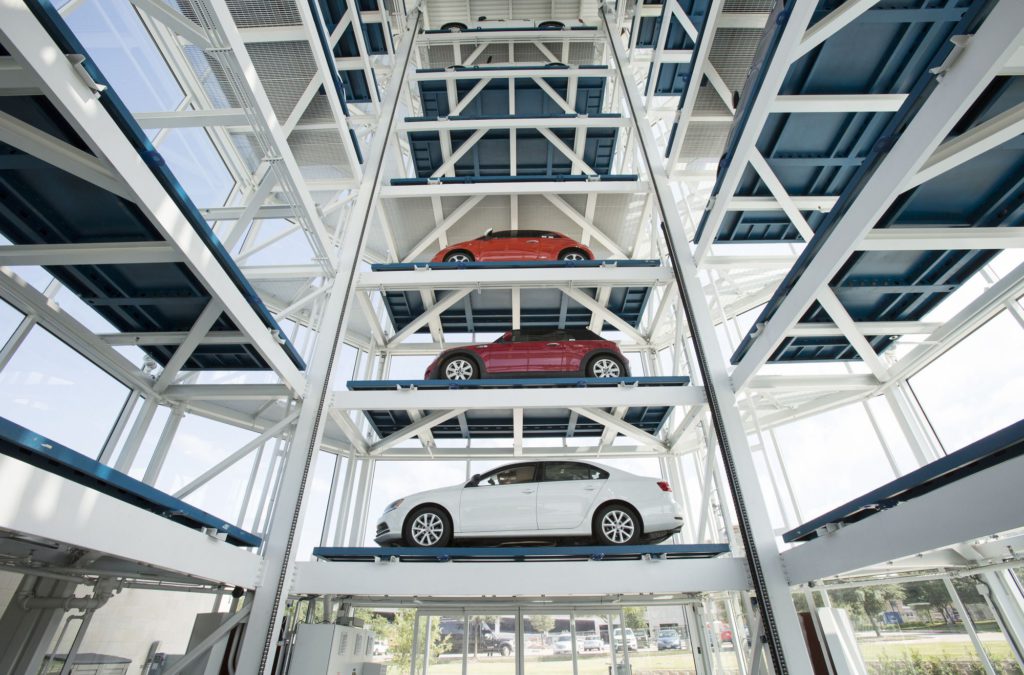

For rental-car companies, which sell vehicles at the end of their time in the fleet, the bonanza they enjoyed from record used-car prices is coming to an end. Hertz’s profits fell in the third quarter as the value of its rental fleet started depreciating at rates more in line with historic norms.

Hertz’s monthly depreciation costs per vehicle in the US climbed to $198 — up from just $21 in the third quarter of 2021. In more normal markets, depreciation was $250 and $300 monthly a car. That’s a very different story than Hertz had in the first quarter, when the company actually reported a gain on the value of its cars in service.

Looking ahead, Hertz CEO Stephen Scherr said he doubts automakers will be able able to return to full production rates due to the ongoing semiconductor shortage. That means there will be sustained demand for used cars.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.