Morgan Stanley cut its rating on Meta Platforms Inc. for the first time ever, forecasting the stock will lag until the social media giant’s “outsized investments” in the metaverse start to pay off.

(Bloomberg) — Morgan Stanley cut its rating on Meta Platforms Inc. for the first time ever, forecasting the stock will lag until the social media giant’s “outsized investments” in the metaverse start to pay off.

Shares of the Facebook parent were down 20% in premarket trading after it gave a disappointing quarterly revenue outlook.

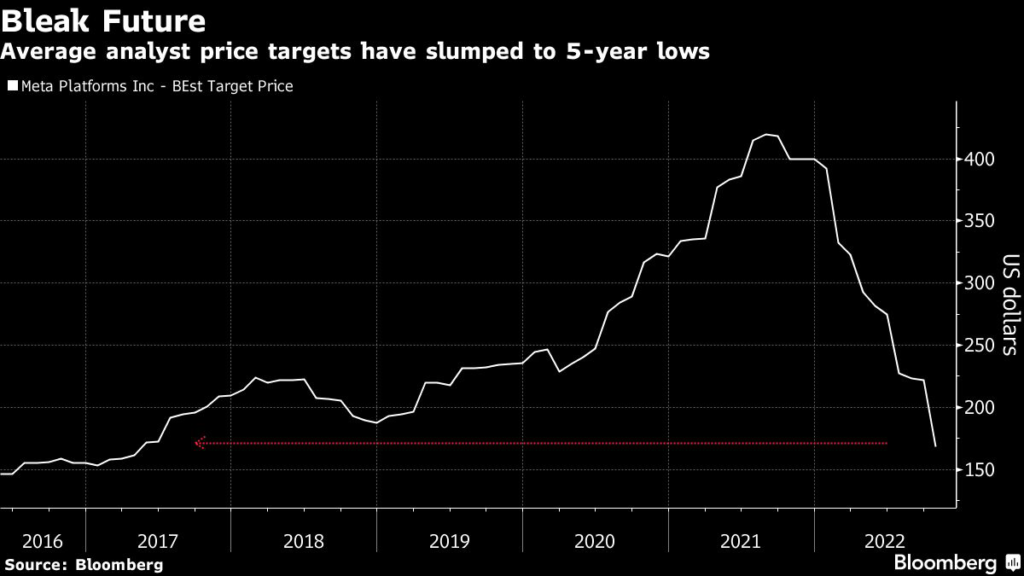

Analysts led by Brian Nowak downgraded the stock for the first time since taking up coverage in 2015, saying they expect free cash flow to slump by 60% in 2023. The analysts also slashed their price target — or prediction for the firm’s stock 12 months from now — by nearly half to $105. Meta’s shares closed on Wednesday at $129.82.

The brokerage was joined by analysts from Cowen and KeyBanc Capital Markets, who also downgraded the stock for the first time ever. All three brokerages were not immediately available to comment further on their downgrades.

“Over the long term we see these AI investments as likely being differentiated for engagement and ad monetization,” Nowak writes in a note. “Not many companies have the ability to spend $69 billion of capex in two years to rebuild their server stack like META is.”

–With assistance from James Cone.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.