(Bloomberg) — Retail traders returned in force on Monday, creating a volatile session for meme stock favorites including GameStop Corp. as well as de-SPAC firms like Getty Images Holdings Inc..

(Bloomberg) — Retail traders returned in force on Monday, creating a volatile session for meme stock favorites including GameStop Corp. as well as de-SPAC firms like Getty Images Holdings Inc..

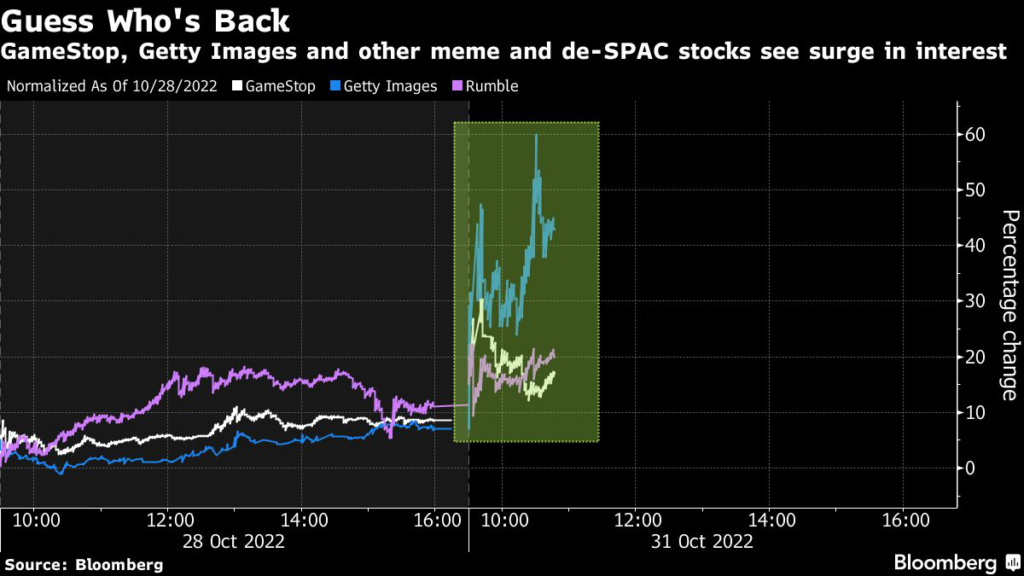

Shares of video-game retailer GameStop surged as much as 24%, triggering at least one volatility-related pause in trading. Getty, which went public earlier this year after merging with a blank-check firm, saw its shares jump as much as 50%, also causing its trading to briefly be halted. Meanwhile, the broader S&P 500 Index is down 0.5% and the Nasdaq 100 Index is lower by 1.1%.

“The first thing you have to realize with these stocks is there’s no rhyme or reason,” said Keith Lerner, chief market strategist at Truist Advisory Services Inc. “They don’t trade based on the big macro trends normally. They trade on speculation and liquidity.”

A basket of so-called meme stocks tracked by Bloomberg rose 1.4%, while the De-SPAC index is lower by about 0.2%. Both gauges have plunged this year as concerns about a possible US recession diminished investor demand for shares of riskier assets.

The sudden resurgence in interest for the group comes ahead of what is likely to be a bumpy two weeks for the stock market. A Federal Reserve rate decision on Wednesday will kick off a span of seven trading sessions that will feature four major events including a key jobs report, mid-term elections and inflation data for October.

Other stocks popular with retail traders also gained on Monday. Bed Bath & Beyond Inc. and AMC Entertainment, two stocks synonymous with the meme stock movement, both gained at least 2%. Shares of Rumble Inc., a Peter Thiel-backed conservative video network which went public last month in a SPAC merger with CF Acquisition Corp. VI, jumped as much as 9.8%.

“Stocks that can move up that much in one day on no news can move down just as quickly,” Lerner added. “That’s the warning flag for investors.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.