Asian stocks traded higher on Tuesday, which helped to lift the mood locally after Chinese tech giant Tencent surged over 10 per cent, which lead JSE heavyweight duo Naspers/Prosus to trade higher, pulling the local bourse up with them.

Naspers (8.22%) and Prosus (8.51%) rallied despite denials that the pair is in discussions with Chinese state-owned CITIC to sell their lucrative stake in Tencent valued at $70.5 billion

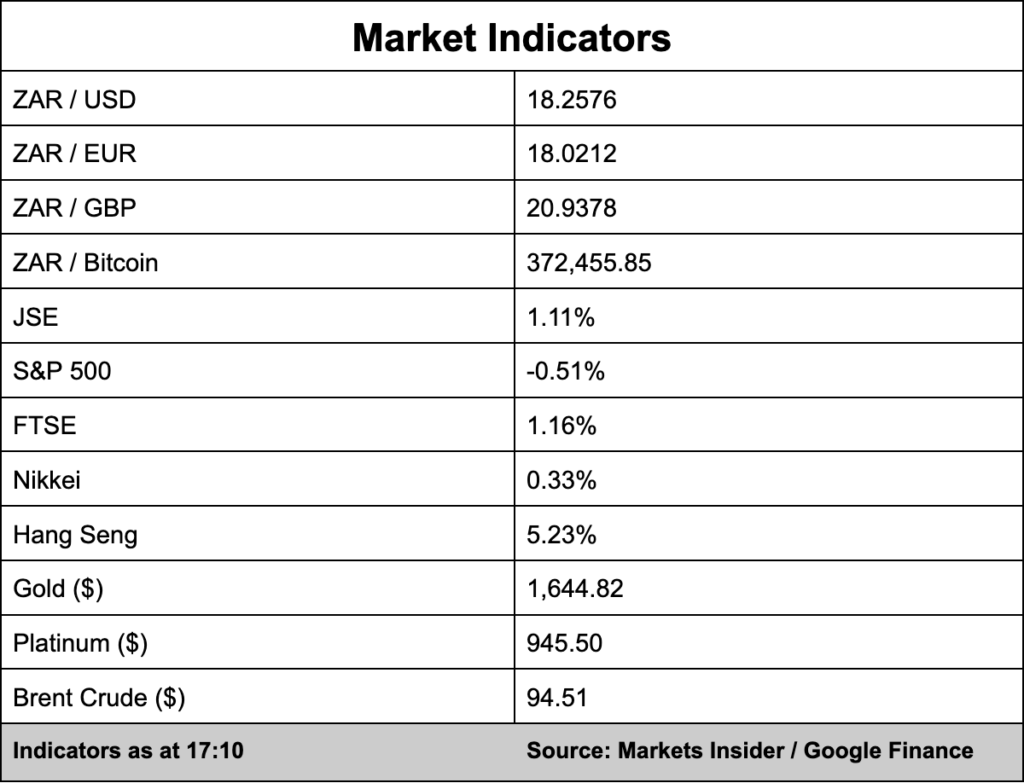

The JSE closed 1.11% higher as traders turned their attention away from Asia to the US ahead of the Federal Reserve’s interest rate decision.

Bloomberg reports Chinese stocks listed in the US were trading higher during pre-market, fuelling speculation that Beijing is ready to phase out its covid-zero policy. Meanwhile, the Chinese foreign ministry said it was not aware of any such plans.

“Business surveys showed on Tuesday that Asia’s factory output weakened in October as global recession fears and China’s zero-COVID policy hurt demand, adding to persistent supply disruptions and darkening recovery prospects,” comments forex trading house TreasuryONE.

The start of a recession is not normally good for emerging markets, and they could come under further strain should the rumours of a recession become reality, adds TreasuryONE.

In the currency market, the rand is trading slightly stronger against the dollar at R18.25 having started the day at R18.28/$.

TreasuryONE said it expects investors to trade cautiously ahead of the Fed’s decision due tomorrow evening.