Germany is offering loan guarantees to commodity trading houses to buy energy and key metals, as Russia’s invasion of Ukraine sparks a global scramble for resource security.

(Bloomberg) — Germany is offering loan guarantees to commodity trading houses to buy energy and key metals, as Russia’s invasion of Ukraine sparks a global scramble for resource security.

Trafigura Group, the world’s biggest trader of copper, has already agreed to supply German customers with non-Russian metals for the next five years, helped by $800 million in bank credit that’s ultimately guaranteed by the German government. The trading house is now discussing a similar deal for liquefied natural gas, according to people familiar with the situation, and commodity bankers are pitching more deals that would have state guarantees to other traders.

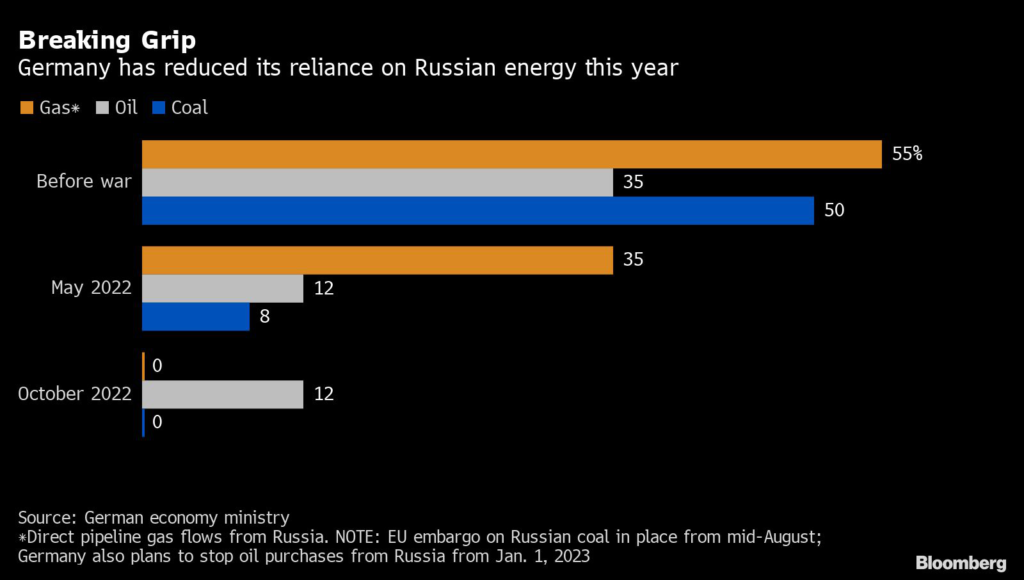

The war has forced Germany to retool its entire energy policy after years of tight dependence on Russia for supplies of oil, gas and metals. That urgency has meant Berlin is willing to put taxpayer funds on the hook, even if it means backstopping privately owned and highly profitable commodity trading houses.

The deals “show it’s dawning on the developed world that strategic sourcing matters,” said Jean-Francois Lambert, who runs a consultancy on commodity trade and structured finance. “In these times, when you need the flexibility or to be nimble, you go to the trading houses and nowhere else. Other European governments will have to start thinking along the same lines.”

It comes amid a broader shift in thinking about natural resources in Europe and the US, where governments had left commodity production and trading to the private sector in recent years, even as the likes of Japan and China backed state and private companies to secure supplies. US President Joe Biden’s Inflation Reduction Act, signed in August, includes provisions to support domestic production of battery metals, and the European Union has also sounded the alarm.

A spokesman for the German Economy Ministry said a pre-existing program known as the untied loan guarantees is being used to increase Germany’s security of supply, and talks continue on developing the measures further. He didn’t give details. Trafigura declined to comment.

Germany is also making more high-profile diplomatic efforts to secure alternative sources of energy, and Chancellor Olaf Scholz has traveled to Saudi Arabia and Qatar. But there’s still not much sign of clear progress securing more LNG.

Commodity traders may provide a quicker, more agile solution.

The untied loans program is managed via Euler Hermes AG — an export credit unit that’s now part of Allianz SE — and has historically been used to facilitate German companies investing in resource development abroad. But the recent deals offer credit guarantees to non-German traders to directly procure commodities.

For the traders, Germany’s insurance guarantees enable bankers to jump through internal hurdles to offer more credit to their trading clients at a time when high commodity prices and volatility have left many reluctant to add more exposure to the sector.

But the measure could prove controversial at home. Opposition Christian Democrat lawmaker Stefan Rouenhoff said the government instead should be helping German industry secure raw materials abroad.

“Agreements with foreign commodity traders do not make a sustainable contribution to strengthening our security supply,” he said.

Read: How Europe Became So Dependent on Putin for Its Gas: QuickTake

–With assistance from Kamil Kowalcze and Elena Mazneva.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.