Israel has weathered recent global economic storms better than most and nearly four years of government instability at home thanks to deep structural changes in its $482 billion economy.

(Bloomberg) — Israel has weathered recent global economic storms better than most and nearly four years of government instability at home thanks to deep structural changes in its $482 billion economy.

The resilience will likely outlast what’s shaping up as the most right-wing government in Israel’s history following the country’s fifth election in less than four years.

It’s set to bring back the nation’s longest-serving prime minister, Benjamin Netanyahu, who was removed from office in 2021 after 12 years in power.

The disconnect from turmoil at home “reflects the significant structural changes that Israel’s economy has undergone, most notably a large improvement in its balance of payments, leaving it less susceptible to capital flows due to political uncertainty,” Goldman Sachs Group Inc.

economists including Clemens Grafe said in a report.

Netanyahu Set for Return in Coalition With Israeli Far Right

Israel is in a sweet spot. With the budget back in surplus for the first time in over a decade and an unemployment rate that touched a record low this summer, Israel boasts a currency that’s more likely to react to US stocks than to any shocks at home.

“The primary factors affecting trade for the shekel, i.e.

local natural gas production and the export of high-tech services, have both benefited from the supportive policy of the government, regardless of political sides and even stability,” Yonie Fanning, market economist for Mizrahi-Tefahot, said in a note to clients.

Netanyahu, once nicknamed “Mr.

Economy” for his time as finance minister in the early 2000s, is poised to retake power even as he fights corruption charges against him — which many in Israel say should disqualify him from office.

The empowerment of the nation’s far right has raised doubts about the future of Israel’s democracy, and the rift between its Jewish citizens and Arab minority is likely to deepen.

It’s also likely to rule out any immediate solution to the Palestinian question, a driver of friction with neighbors and periodic outbursts of violence.

A Former General Has Her Focus Set on Israel’s Skewed Economy

Meanwhile, unease over the country’s high cost of living is widespread, and there are signs that a boom in investment driven by the vaunted high-tech sector is waning.

Poverty is rampant among both Arabs and ultra-orthodox Jews, leaving Israel as one of the world’s most unequal high-income countries.

“The overall economy, when you look at the growth number, when you look at the labor market, is still very strong,” said Rafi Gozlan, chief economist at IBI Investment House Ltd.

Here’s a snapshot of the economy the next leader will inherit:

Israel bounced back strongly from the pandemic, with gross domestic product expanding by more than 8% last year and on track to grow in 2022, according to the central bank.

Although Israel’s unemployment rate ticked up slightly, it remains near June’s low of 3.3%.

Shortages of workers in key sectors are adding to pressure on wages and inflation, which has been above the government’s 1%-3% target range since the start of the year.

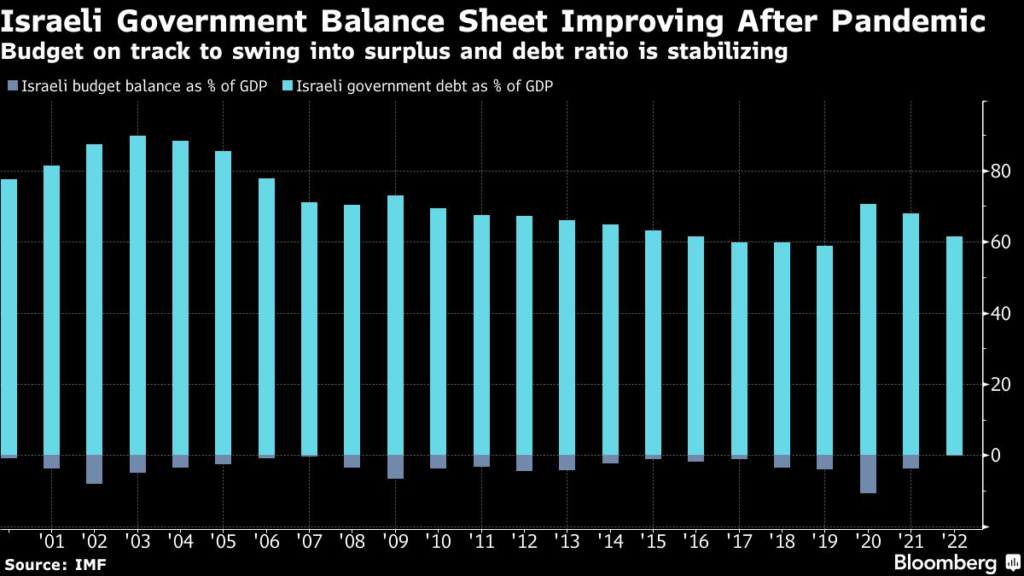

When Netanyahu was ousted from power in June 2021, Israel’s budget was deeply in the red and government debt as a percentage of economic output was on the rise.

Public finances have been on the mend since then.

Earlier this year, Israel recorded its first 12-month budget surplus for 15 years — and its highest as a percentage of GDP for 35 years — fueled by a rise in government revenue.

The country’s debt ratio, which ballooned to 71.9% during the pandemic in 2020, declined last year and is set to approach 60% in 2022, according to the International Monetary Fund.

But challenges abound, especially as tech funding dries up with the end of easy money and soaring global inflation.

Capital investment in Israel’s high tech sector was $2.6 billion in the third quarter, a decline of almost 70% from the final three months of last year, and a drop of almost 40% from the second quarter of this year, according to a recent report from IVC and LeumiTech.

Israel also remains one of the most expensive places to live among the world’s developed economies.

Netanyahu has campaigned against the current government’s handling of the growing cost of living, stoked in part by increases in housing prices, and said he wants to reduce it.

The government of incumbent Prime Minister Yair Lapid has tried to highlight the progress it made on structural reforms, including changes to the import tariffs, and boosting the number of housing starts.

But the payoff won’t be immediate and may benefit Lapid’s successor.

“I think you have a lagging effect on housing,” Gozlan said.

“You can see it already on the demand and I believe in a quarter or two you’re going to see it also on the price.”

(Adds economist comment paragraph 5)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.