Simmering tensions between the crypto industry’s two richest executives are spilling over into the already battered digital-asset market.

(Bloomberg) — Simmering tensions between the crypto industry’s two richest executives are spilling over into the already battered digital-asset market.

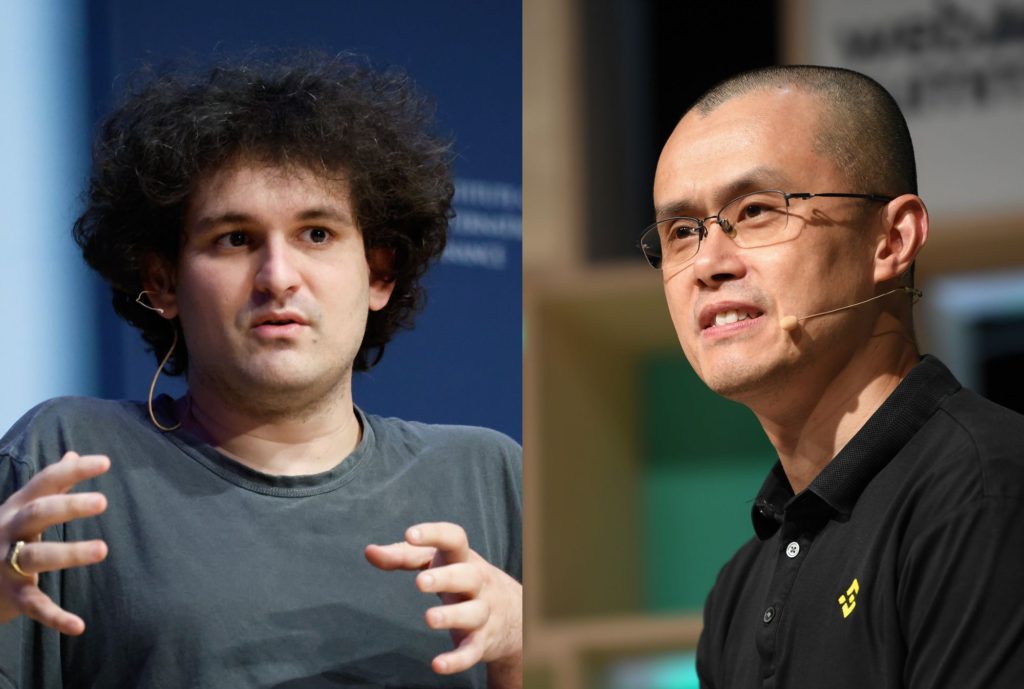

On Sunday, Zhao “CZ” Changpeng, the billionaire chief executive of Binance Holdings Ltd.

took to Twitter to announce plans to sell Binance’s roughly $530 million holding of FTT, the native token of Sam Bankman-Fried’s FTX. Binance and FTX run the world’s largest and seventh-largest crypto exchanges.

Zhao said his decision was triggered by “recent revelations.” In a Nov.

2 article, news site CoinDesk said much of the balance sheet of Bankman-Fried’s trading house Alameda Research is comprised of the FTT token. FTT’s price fell in high trading volumes after Zhao’s announcement and traders rushed to withdraw funds from FTX.

Caroline Ellison, CEO of Alameda, responded on Sunday to the CoinDesk story by saying “that specific balance sheet is for a subset of our corporate entities, we have >$10b of assets that aren’t reflected here.” Ellison later offered to buy all the FTT tokens from Binance at a price of $22.

The coin was trading just above that level on Monday.

Prices of most cryptocurrencies fell on Monday, even as equities advanced. Solana, a token backed by FTX and Alameda, was among the biggest decliners.

FTT’s trading volume surged to the highest in more than a year, which “suggests market makers are working overtime to maintain liquidity amid high selling pressure,” Clara Medalie, head of research at analytics firm Kaiko, wrote in an email.

“Overall, FTT is a relatively illiquid token on open markets, so Binance’s plans to liquidate all FTT tokens they hold is quite a significant market event,” she added.

“Alameda will likely dedicate considerable resources to ensure the price of FTT doesn’t crash.”

Zhao didn’t specify what “revelations” he was referring to. A Binance spokesperson declined to comment.

FTX said on Monday it was “churning through” Bitcoin withdrawal transactions, making some changes to “help speed it up.”

“A competitor is trying to go after us with false rumors,” Bankman-Fried said in a tweet on Monday.

“FTX is fine. Assets are fine.”

The dust-up between the two magnates comes at a fraught time for the industry, which has been rocked by a series of scandals this year, ranging from the implosion of the TerraUSD stablecoin to a string of bankruptcies among crypto lenders.

The sector is “still suffering from PTSD,” said Anto Paroian, CEO of cryptocurrency hedge fund ARK36.

Supporting FTT

Binance’s holding of FTT is a legacy of its investment in FTX, which it sold last year for about $2.1 billion according to Zhao.

The CEO said he’d try to sell the FTT tokens “in a way that minimizes market impact.” The process may take a couple of months to complete, he added.

Zhao and Bankman-Fried have been trading barbs on Twitter in the past few months, feuding over issues ranging from lobbying US politicians to allegations of frontrunning trades.

In a string of tweets on Sunday, Zhao first denied that selling FTT was a “move against a competitor,” although a later posting seemed to imply unhappiness with FTX.

Zhao is worth $18.9 billion, according to the Bloomberg Billionaires Index, while Bankman Fried’s wealth stands at $15.4 billion.

Crypto lender Nexo withdrew around $177 million in Ether and $10.8 million in stablecoin USDC from FTX over 24 hours, while asset manager Arca withdrew more than $31 million in Ether and USDT, according to data from researcher Nansen.

Nexo co-founder and managing partner Antoni Trenchev declined to comment, as did Arca.

In his Twitter thread on Monday, Bankman-Fried sought to allay investor concerns, saying that “FTX has enough to cover all client holdings” and that it’s processing all withdrawals “and will continue to be.” He ended it with an appeal to his longtime rival.

(An earlier update corrected the title of Nexo’s Trenchev.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.