Cathie Wood’s funds added to a stake in crypto exchange Coinbase Global Inc. after its key rival Binance signed an agreement to buy FTX’s non-U.S. business.

(Bloomberg) — Cathie Wood’s funds added to a stake in crypto exchange Coinbase Global Inc. after its key rival Binance signed an agreement to buy FTX’s non-U.S. business.

Three Ark funds bought more than 420,000 shares in Coinbase on Tuesday, according to Wood’s firm Ark Investment Management LLC’s daily trading disclosures. Prior to this, Ark funds bought shares in the US company on Oct. 24, their first purchase since July.

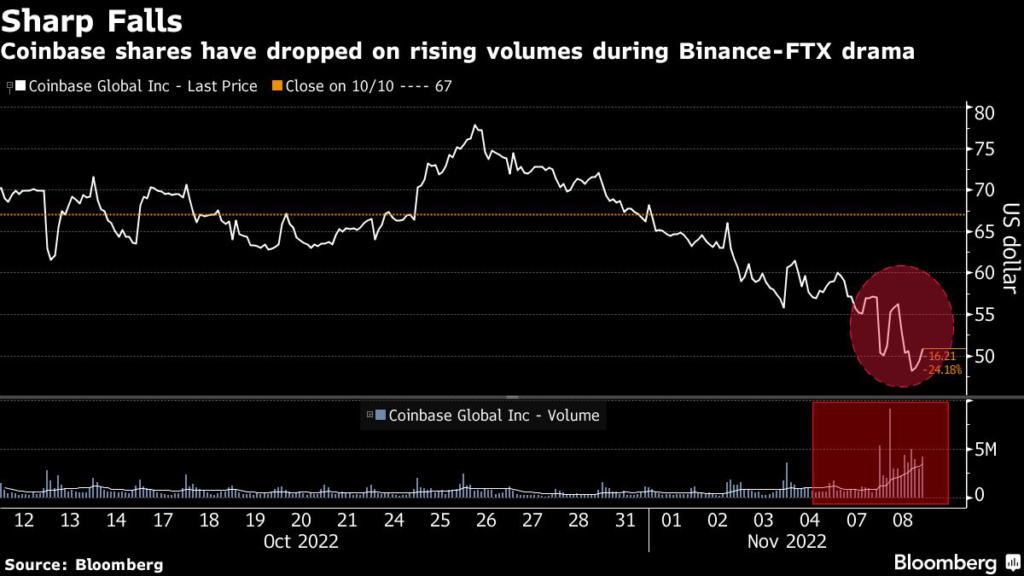

Ark picked up shares as Coinbase plunged 11% on Tuesday to the lowest since July 1, amid concerns over how the potential acquisition of FTX by Binance will reshape the more than $1 trillion industry that is already dealing with a prolonged market downturn.

Cryptocurrencies also tumbled as traders worry that the potential deal could signal more trouble brewing within the industry. Bitcoin fell as much as 3.8% on Wednesday, extending a 9.6% drop in the previous session. The world’s largest coin by market value had, at one point on Tuesday, dropped to a two-year low.

READ: Asian Crypto Stocks Follow US Peers Lower as Bitcoin Plunges

Billionaire Changpeng “CZ” Zhao shocked the crypto world Tuesday with a move to take over FTX.com, the troubled firm led by his chief rival and onetime disciple, Sam Bankman-Fried. The acquisition doesn’t involve FTX.US, a separate exchange also founded by Bankman-Fried.

Coinbase Chief Executive Officer Brian Armstrong said the liquidity crunch that prompted Binance’s tentative agreement with FTX wouldn’t happen at Coinbase because the company doesn’t engage in “risky behaviors.” His firm has no plans to buy FTX US, he said in a Bloomberg Television interview.

Wood’s firm is the fourth largest shareholder of Coinbase, holding more than 7.7 million shares or 4.3% stake in the company as of Sept. 30.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.