The fallout from FTX.com’s blowup has so far been contained to the crypto world. The relative calm won’t last if Bitcoin’s swoon takes it to levels last seen in 2019.

(Bloomberg) — The fallout from FTX.com’s blowup has so far been contained to the crypto world. The relative calm won’t last if Bitcoin’s swoon takes it to levels last seen in 2019.

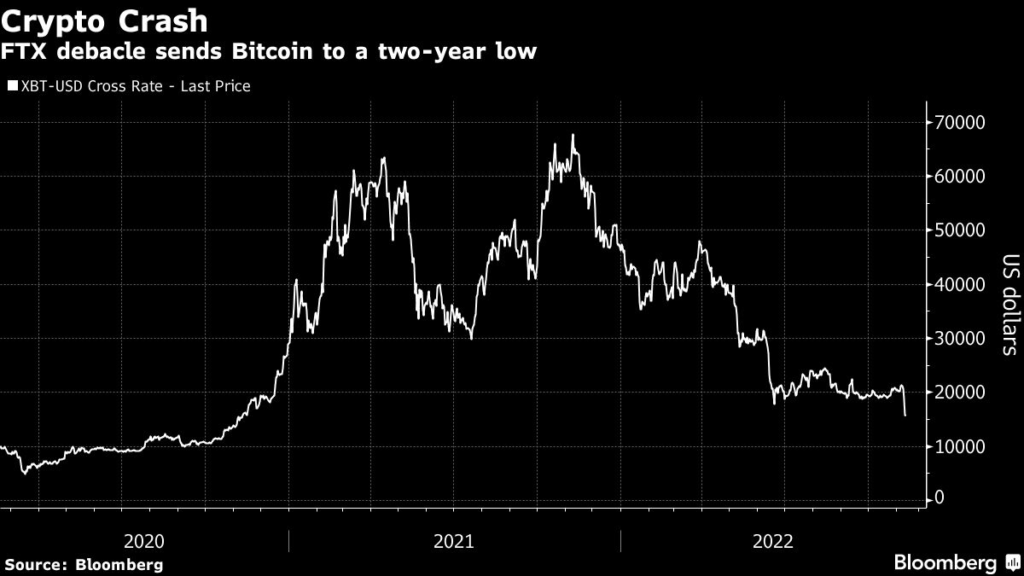

That’s the view of Julian Emanuel, Evercore ISI’s chief equity and quantitative strategist, who says that if the biggest digital token plunges past its pre-pandemic high of around $13,850, the hit to investor sentiment could spread to other asset classes. Bitcoin sank 16% Wednesday to below $16,000 for the first time in two years.

Stocks did drop the most in a week Wednesday, halting a three-day rally as the crypto drama and mixed results in US midterm elections soured sentiment before a key inflation report. And while it’s nearly impossible to determine what level of threat the crypto meltdown poses to the broader market, Emanuel is now warning that the mere specter of contagion can start to drag other assets lower.

“Price action could dictate both fundamentals and psychology,” he said in a note. “Bitcoin below the 2019 high at $13,850 will elevate stress, ending the current equity bear-market rally.” It would also reinforce his team’s view that Oct. 13 marked a recent low but not “the” low of the yearlong selloff in American stocks, he said.

The rout in cryptocurrencies snowballed Wednesday afternoon in New York, after exchange Binance walked away from its planned takeover of rival FTX, run by Sam Bankman-Fried. Bitcoin is down more than 23% in two days. The coin had reached a record high of almost $69,000 a year ago.

Read more: Crypto Market Rout Deepens as Binance Drops FTX Takeover Offer

The spectacular blowup of one of crypto’s most respected businesses has rekindled concern that the entire industry is on shaky ground as central banks around the world ratchet up interest rates to combat runaway inflation. Going by the value of all the digital tokens, the sector had already shed around $2 trillion in value before FTX’s troubles this week.

The debacle has ensnared some of the biggest names in finance. Tiger Global Management, Third Point and Altimeter Capital Management are among hedge funds that recently participated in funding rounds for Bankman-Fried’s once-high-flying crypto exchange, Bloomberg News reported.

Plenty others have also partaken, with Brevan Howard Asset Management’s Alan Howard, the family office of Paul Tudor Jones and Millennium Management founder Izzy Englander chipping in as angel investors, as well as celebrities like Tom Brady and Gisele Bündchen.

Though a lot of big investors and funds have exposure to crypto, in most cases, it might be small, says Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors LLC.

“Overall, the economy just doesn’t have a lot of crypto exposure,” he said in an interview at Bloomberg’s New York headquarters on Wednesday. “From here, it’s going to be more limited. But to the extent that it’s the days where liquidity is driving markets, it should affect both huge parts of the equity markets as well as bond markets.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.