Hon Hai Precision Industry Co., maker of most of the world’s iPhones, warned consumer electronics revenue will fall this quarter as it grapples with a Covid outbreak that walled off its main production base in central China.

(Bloomberg) — Hon Hai Precision Industry Co., maker of most of the world’s iPhones, warned consumer electronics revenue will fall this quarter as it grapples with a Covid outbreak that walled off its main production base in central China.

The company, known also as Foxconn, reported earnings that missed estimates for the third quarter and said revenue growth will be flat for the current three-month period.

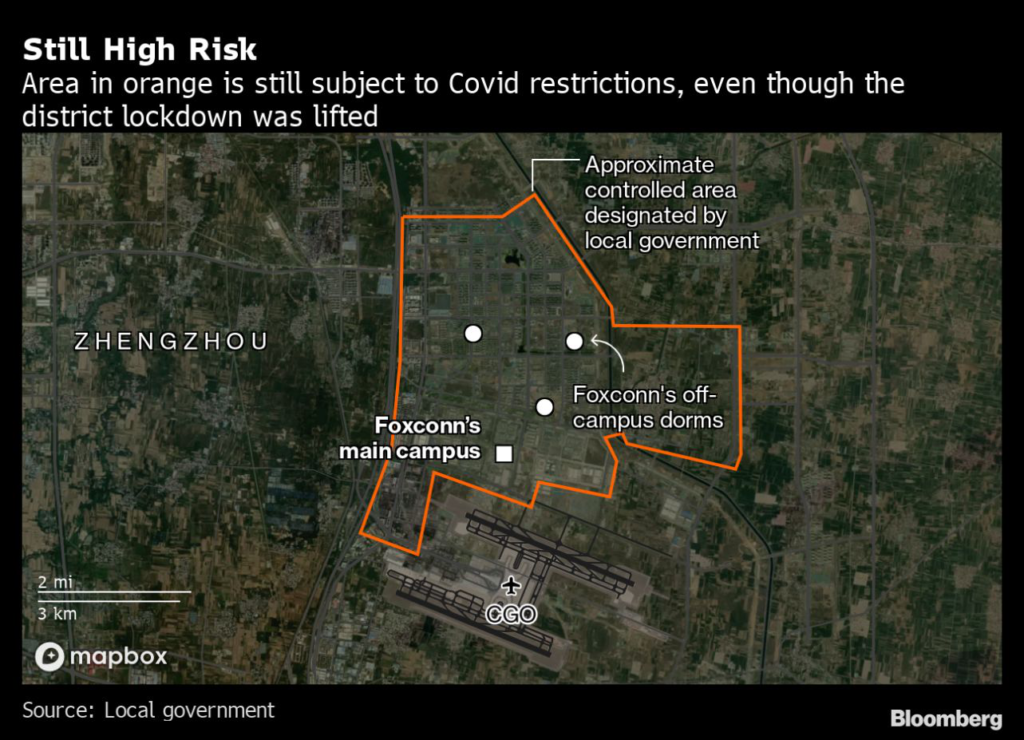

Hon Hai is now trying to resume full production after a coronavirus flareup in October triggered a lockdown last week around its biggest factory in Zhengzhou, severely curtailing the flow of goods and people it needs to sustain iPhone assembly.

Executives reiterated that they were working with the government to control the outbreak and get the plant back up and running.

Foxconn’s warning on revenue underscores the toll of China’s Covid Zero policy, a rigid system of sudden lockdowns and mass testing that’s depressed the world’s No.

2 economy. The curbs at the factory dubbed “iPhone City” — a giant complex housing some 200,000 workers that cranks out an estimated four out of five of the world’s latest iPhones — dealt a blow to Apple Inc.

and its most important supplier, which had struggled to stem an exodus of workers.

Harsh Covid restrictions are exacerbating the fallout from weakening demand for consumer electronics worldwide.

On Thursday, Pegatron Corp., Apple’s other big iPhone-making partner, warned that sales would fall in 2022 led by a 15%-20% slide in notebook revenue in the fourth quarter.

Read more: Pegatron Sees Overall Sales Falling Slightly in 2022

In Japan, key chip equipment supplier Tokyo Electron Ltd.

slashed its forecast for operating profit this year by 24%, explaining that memory chip makers are pulling back on capital spending. The company said it will likely also lose out because of US restrictions on selling cutting-edge chip-gear to China.

Foxconn’s net income rose 5% to NT$38.8 billion ($1.22 billion) in the September quarter, versus the NT$41 billion average estimate, the device maker said Thursday.

Revenue climbed 24% to NT$1.75 trillion, exceeding the estimate of NT$1.52 trillion. Shares of the company fell 2% in Taipei.

In the first half, the company had surpassed profit expectations thanks in part to effective management of supply during Covid lockdowns, when it secured support from local governments to keep up a critical flow of components.

Foxconn has said it’s managing the Zhengzhou lockdown in concert with the authorities.

If Foxconn can get its production back on track soon and the Covid situation under control, sales should still take a hit in the first half of November before gradually recovering, analysts at Citigroup Inc.

wrote in a Nov. 6 note.

The disruption coincides with the US holiday shopping season as well as a sharp slowdown in demand for electronics worldwide. Apple warned Sunday it would ship fewer premium devices than anticipated because of the Zhengzhou lockdown.

The US company, which is grappling with tepid demand for less expensive iPhone 14s, expects to produce at least 3 million fewer iPhone 14 handsets than originally anticipated this year.

The company and its suppliers now aim to make 87 million devices or fewer, compared with a target of 90 million units earlier, Bloomberg News reported this week.

Foxconn intends to raise capital spending in 2023 and most of that will go toward its already giant production base, Chairman Young Liu told analysts on Thursday.

Longer term, Foxconn is also making a play to expand in electric vehicles.

The world’s largest contract manufacturer has targeted 5% market share in EVs in 2025, helped by its acquisition of Lordstown Motors Corp.’s electric pickup trucks factory in Ohio.

–With assistance from Vlad Savov.

(Updates with Tokyo Electron forecast in sixth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.