Chinese and US assets will be key focuses for traders when activity in major macro markets gets underway for the new week in the Asia-Pacific on Monday.

(Bloomberg) — Chinese and US assets will be key focuses for traders when activity in major macro markets gets underway for the new week in the Asia-Pacific on Monday.

Investors will be looking to the outcome from a meeting between US President Joe Biden and China’s Xi Jinping as leaders from around the world gather at the Group-of-20 summit in Indonesia.

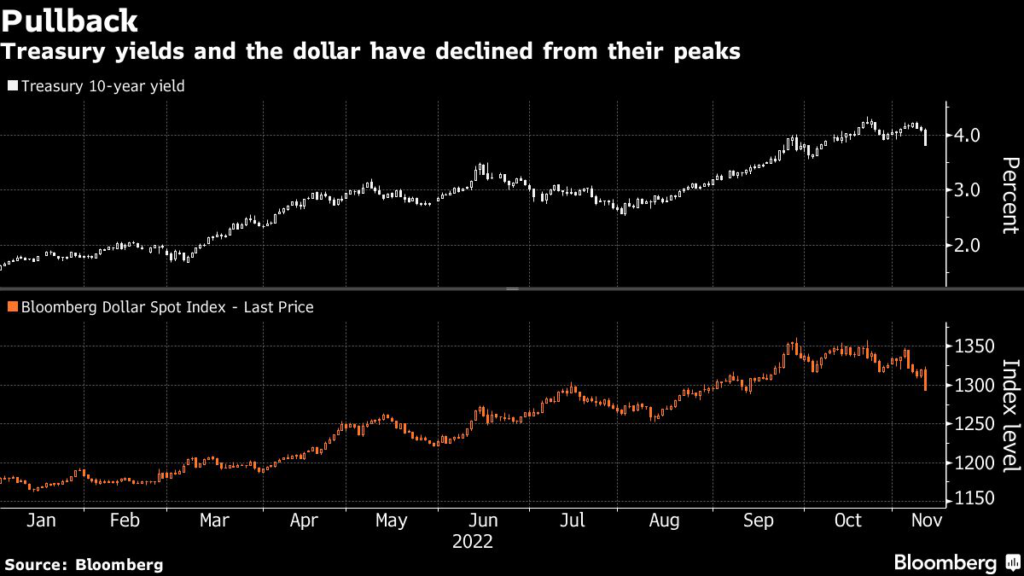

The dollar, which last week notched its worst week since the early days of the Covid pandemic, will be center stage along with the yuan, a possible barometer of developments around China’s Covid Zero and housing policies. Foreign-exchange markets open around 5 a.m. Sydney time. Meanwhile, US Treasury markets will reopen on Monday following a holiday closure on Friday.

New government plans to rescue China’s ailing property sector will be front of mind along with the policy and legislative prospects for the US as the balance of power in Congress remains unresolved. The Democratic Party will keep control of the Senate, but the House of Representatives is up in the air still with ballot counting ongoing in a number of districts following last week’s midterm elections.

On top of that, there are questions about when and how lawmakers in Washington might move to resolve questions around the approaching debt ceiling, which is on track to be breached at some point in 2023. US Treasury Secretary Janet Yellen said it would be “great” to get it done this year — a move that would involve passing legislation before the new Congress is sworn in.

The response of key Federal Reserve policy makers to last week’s slower-than-expected consumer-price index reading will be critical for market direction more broadly, with Christopher Waller and Lael Brainard both scheduled to speak early this week.

Treasury yields tumbled last week and stocks surged after the inflation slowdown stirred hope among investors that the Fed won’t need to lift interest rates quite as much as anticipated before, while the Bloomberg Dollar Spot Index notched its biggest weekly drop since the early days of the pandemic. Any pushback by officials could cause a rethink of those moves, while encouragement could see them extend.

All this is taking place against a backdrop of ongoing uncertainty in the crypto world, which could risk spilling over into other markets. Revelations about the collapse of Sam Bankman-Fried’s FTX empire, which last week filed for bankruptcy, continue to roil various crypto assets and investors.

Meantime, Turkish assets are also set to be in the frame following a suspected bomb attack in one of Istanbul’s popular tourist districts that killed at least six people and wounded 53, highlighting the threat of a revival terrorism in one of the Middle East’s biggest economies.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.