Crypto markets stabilized Tuesday as investors grow hopeful that the fallout from FTX’s insolvency might remain somewhat contained.

(Bloomberg) — Crypto markets stabilized Tuesday as investors grow hopeful that the fallout from FTX’s insolvency might remain somewhat contained.

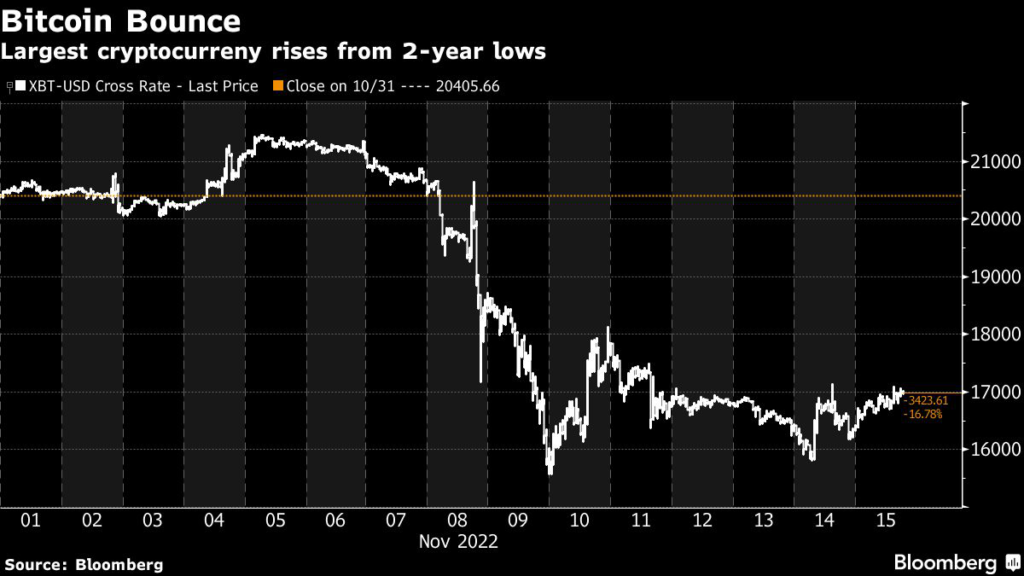

Bitcoin, the largest token, climbed as much as 4.4% to $17,102, while second-ranked Ether advanced as much as 5%. Smaller cryptocurrencies known as altcoins such as Solana and Polkadot also advanced for a second day.

The modest gains provides some much-needed reprieve after the most recent plunge. Bitcoin dipped last week to its lowest price since November 2020 as the meltdown of crypto exchange FTX rattled investors.

Since Sam Bankman-Fried’s digital empire filed for Chapter 11 bankruptcy protection on Friday, investors have been wary of contagion. Even so, no major crypto-related entities have seen the same outcome since, boosting optimism that the fallout may be more muted than at once feared.

“It looks bad but we’ve seen a lot of smoke but not that much fire just yet,” said Ilan Solot, co‑head of digital assets at Marex Solutions. “That gives a little bit of a sense of the calm.”

Cryptocurrencies rose alongside broader markets, with gains in the tech sector pushing US stocks higher. The S&P 500 advanced as much as 1.8% after producer prices confirmed a slowdown in inflation.

Fairlead Strategies’ Will Tamplin said that crypto’s stabilization comes after oversold conditions last week.

Bitcoin futures slid below the spot price, something that did not occur in previous selloffs, according to Solot. Those conditions could be the result of “speculative shorts” or “proxy hedging,” he wrote in a note.

Despite the gains, Bitcoin prices have sunk close to 18% over the past week, and the token has only briefly broken above $17,000 over the past several days of trading.

“The insolvency has short-term led to a distorted derivatives market and harmed liquidity,” wrote Arcane’s Bendik Schei and Vetle Lunde in a note. “We believe this will cause prolonged headwinds related to contagion, regulation, and institutional presence.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.