Global markets are mixed on Wednesday as investors breathed a sigh of relief after a rocket that struck a village in Poland, killing two people, was identified as a stray Ukrainian missile and not a Russian rocket as was initially reported on Tuesday.

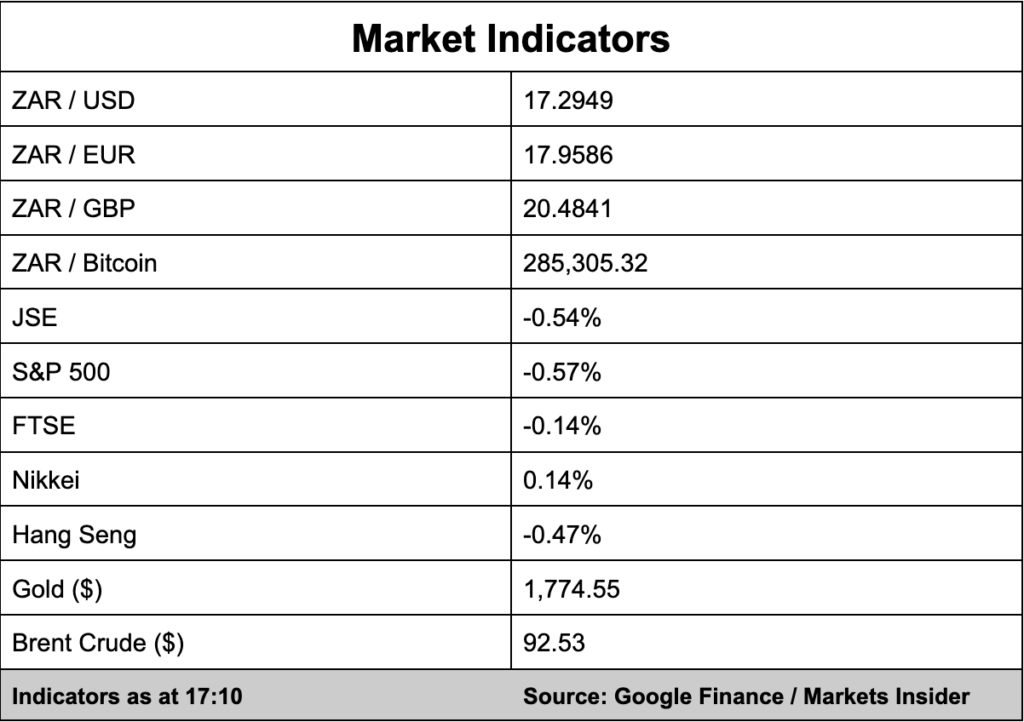

The JSE closed 0.54% lower with the All Share Index at 72,607 points.

In the currency market, risk sentiment turned negative for emerging market currencies on Tuesday after news of the missile strike in Poland – when it was first believed to be a Russian rocket strike.

Today, the rand strengthened to R17.29/$ having closed the previous day at R17.30 and opening Wednesday morning at R17.40 against the greenback.

In company news, Naspers (5.96%) and Prosus (6.08%) rallied significantly following the release of Chinese tech firm Tencent’s latest earnings report. Naspers/Prosus have exposure to the Asian tech juggernaut because Prosus is Tencent’s largest shareholder.

Tencent said revenue fell 2% in the third quarter, which underlines the stress the Chinese tech industry has been under since Beijing implemented its covid-zero policy.

“China’s internet industry has made peace with a new era of sedate growth, shifting focus to enhancing profitability from chasing market share after Beijing’s crackdown wiped more than $1 trillion off their combined market value in 2021,” reports Bloomberg.

The tech firm gained 2.22% on Hong Kong’s Hang Seng.

Retailer Woolworths added 3.80% after experiencing a robust recovery in its Australian business and a good winter sale in South Africa. In a trading update, for the 20 weeks that ended November 13, the group said turnover and concession sales rose by 23.3% year-on-year.

Retail peer Spar saw its share price slump 12.67% after less than stellar financial results for the year ended September 30, 2022. The group reported that its diluted headline earnings per share decreased by 2.9% to about R11.59 per share in its year to end-September, while its full-year dividend has been halved to 400 cents.

Analysts have called the results “very weak” while investors have made their displeasure known, wiping nearly R5 billion in value from the stock.