European equity futures edged higher and Asian stocks pared gains after Chinese technology shares came off their intraday highs.

(Bloomberg) — European equity futures edged higher and Asian stocks pared gains after Chinese technology shares came off their intraday highs.

Hong Kong’s benchmark erased all its advance to trade slightly lower while contracts for US equities were flat. Investors are awaiting results of the quarterly index reshuffling later Friday for Hong Kong’s benchmark gauge.

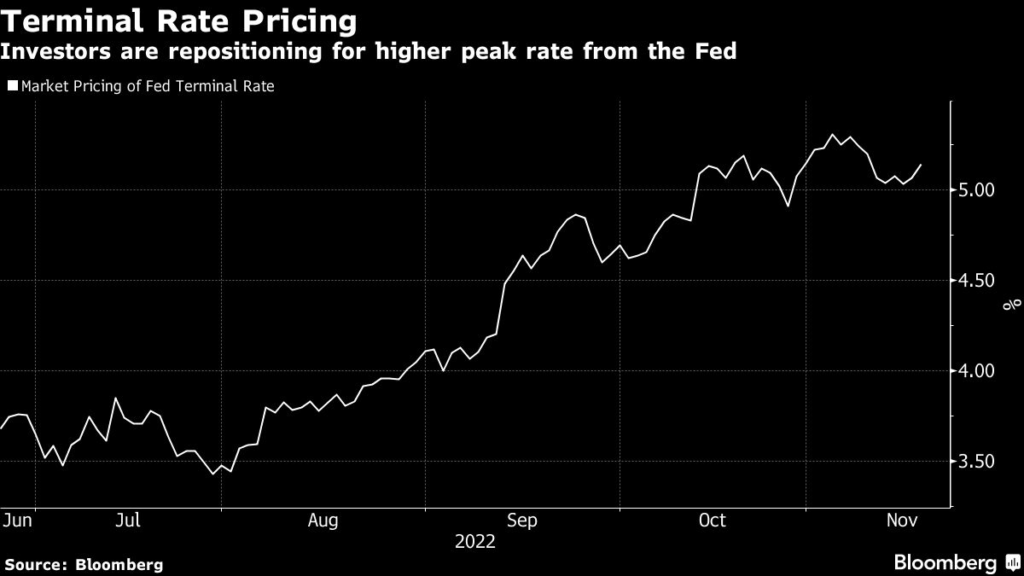

Treasury yields steadied after the previous day’s jump when St. Louis Fed President James Bullard said policymakers should increase interest rates to at least 5% to 5.25% to curb inflation. He also warned of further financial stress ahead.

The dollar steadied. Oil was poised for a weekly loss as concerns over a worsening demand outlook filtered through the crude market.

With inflation only starting to ease and a gauge of US retail sales increasing at the fastest pace in eight months, Fed speakers in recent days have emphasized that they need to go further to extinguish prices pressures. Bullard’s comments came a day after San Francisco Fed President Mary Daly said a pause in rate hikes was “off the table.” Their hawkish tone was echoed by Minneapolis Fed President Neel Kashkari on Thursday afternoon.

“The market believes that inflation is on the down trend. We also believe that, but the fact of inflation having peaked is not a reason for the Fed to turn and cut rates,” Paul Christopher, head of global market strategy at Wells Fargo Investment Institute, said on Bloomberg Radio. “That’s the fundamental disconnect that still exists between the Fed and the market.”

On Thursday, fresh data showing weekly jobless claims came in below the forecast further underscored the strength of the labor market. US mortgage rates posting their biggest weekly decline since 1981 briefly improved sentiment, even though Freddie Mac’s chief economist said there’s a long road ahead for the housing market.

If the Fed keeps increasing at the current pace, “by the time they get the information that they’ve been successful in slowing the economy and slowing inflation, it might be too late,” Ellen Hazen, chief market strategist at F.L.Putnam Investment Management, said on Bloomberg Television. “It’s just too soon to know exactly how this is going to play through the economy and that’s the biggest risk.”

In Japan, inflation hit its fastest clip in 40 years in October. The outcome puts the Bank of Japan in an even more awkward position as it tries to explain the need to stick with monetary stimulus to pursue stable price growth.

Elsewhere, gold edged higher. Bitcoin was on course for a weekly gain even as the collapse of Sam Bankman-Fried’s FTX empire continues to rattle the crypto market.

Key events this week:

- US Conference Board leading index, existing home sales, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 6:42 a.m. in London. The S&P 500 fell 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.2%

- Japan’s Topix index was little changed

- South Korea’s Kospi index was little changed

- Hong Kong’s Hang Seng Index fell 0.5%

- China’s Shanghai Composite Index fell 0.4%

- Australia’s S&P/ASX 200 Index rose 0.2%

- Euro Stoxx 50 futures rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0365

- The Japanese yen rose 0.2% to 139.94 per dollar

- The offshore yuan rose 0.1% to 7.1394 per dollar

Cryptocurrencies

- Bitcoin rose 0.5% to $16,770.57

- Ether rose 0.8% to $1,215.61

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.75%

- Australia’s 10-year yield was little changed at 3.61%

Commodities

- West Texas Intermediate crude rose 0.5% to $82.08 a barrel

- Spot gold rose 0.2% to $1,763.36 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rheaa Rao.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.