Democratic lawmakers who received millions of dollars in campaign donations from Sam Bankman-Fried say they will be ready to grill the former FTX CEO about the exchange’s collapse.

(Bloomberg) — Democratic lawmakers who received millions of dollars in campaign donations from Sam Bankman-Fried say they will be ready to grill the former FTX CEO about the exchange’s collapse.

Liquidators appointed by a Bahamian court to take over FTX Digital Markets Ltd.’s affairs said there’s “significant” concern that FTX management lacked authority to put the crypto businesses into bankruptcy in the US.

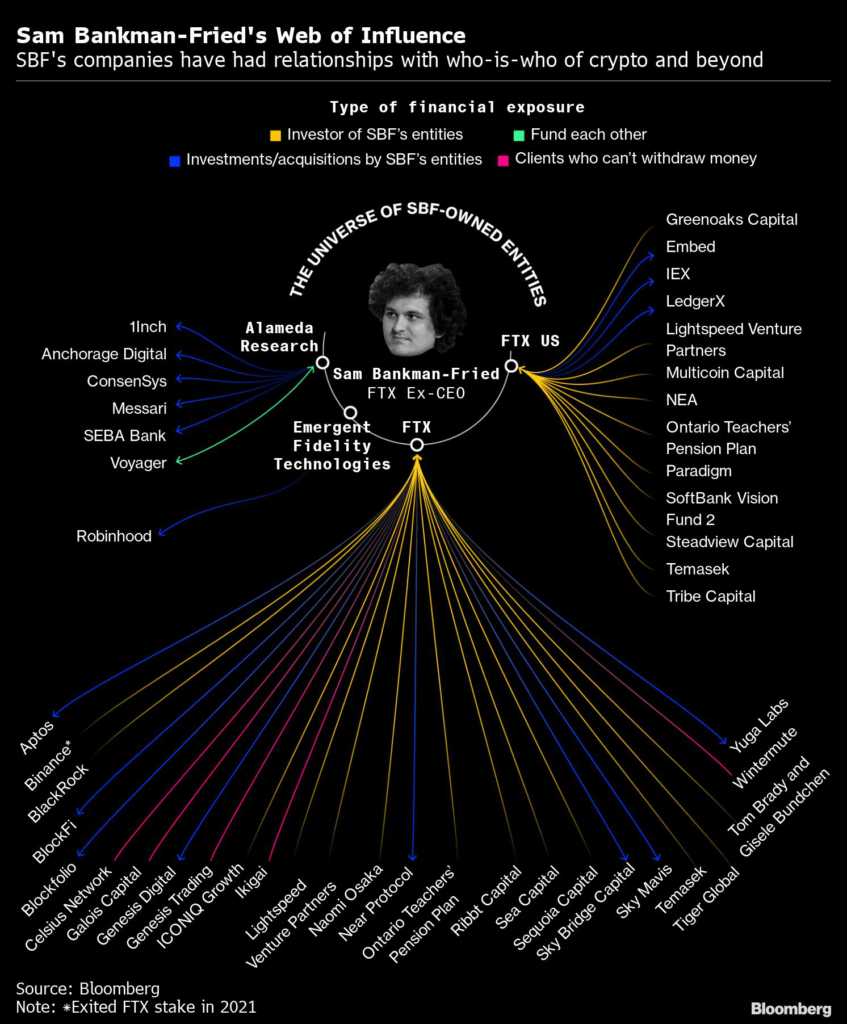

The embattled cryptocurrency mogul and two other top FTX executives received massive loans from affiliated trading arm, Alameda Research. Advisers overseeing the bankruptcy of FTX Group are struggling to locate the company’s cash and crypto, citing poor internal controls and record keeping.

Key stories and developments:

- Flash Boys Exchange IEX Wants New Crypto Path After FTX Blowup

- Ontario Teachers Writes Off FTX Stake, Citing Potential Fraud

- Here Are the Wildest Parts of the New FTX Bankruptcy Filing

- FTX Offers a Master Class in Crypto Market’s Flaws: Editorial

- Odd Lots: Understanding the Collapse of Sam Bankman-Fried’s Crypto Empire

(Time references are New York unless otherwise stated.)

Fintechs Still Pushing Crypto, Distance Themselves From FTX (1:00 p.m. HK)

FTX’s bankruptcy filing last week is the latest headwind for fintech companies that have grown rapidly in tandem with the surge in digital asset trading.

Revolut, a finance app based in London, told users this week it did not have “material exposures” to FTX but was monitoring the situation. “This is a good reminder that crypto is very volatile: the value does go down, as well as up,” it said in an email. Crypto has already shrunk from about 35% of Revolut’s revenue last year to less than 5% this year.

Block Inc.’s Cash App, which allows consumers to transfer money or buy stocks and cryptocurrencies, said in a statement it was “Bitcoin-first” and committed to a “truly” decentralized payments system “not controlled by any person, bank, country, or corporation.”

Bitcoin Heads for a Weekly Gain (11:50 a.m. HK)

Bitcoin is up some 3% this week, topping global stocks, while a gauge of the leading 100 virtual coins has added about 0.5%. That compares with Bitcoin’s 23% slide last week as FTX collapsed.

Crypto historians might argue the counterintuitive Bitcoin performance will continue. Since a low in 2018, Bitcoin has posted a weekly loss of at least 20% six times apart from the recent slide. The token jumped almost 9% on average over the subsequent month, according to data compiled by Bloomberg.

Bahamas Regulator Takes Control of FTX Assets (8:00 a.m. HK)

The Bahamas Securities Commission said in a statement it directed the transfer of all digital assets of FTX Digital Markets to a wallet that the commission controls for safekeeping.

“Urgent interim regulatory action was necessary to protect the interests of clients and creditors of FDM,” it said, adding that its understanding is that FDM is not a party to US Chapter 11 bankruptcy proceedings. It said it would engage with regulators and authorities in multiple jurisdictions.

Ontario Teachers Writes Off FTX Stake (7:10 a.m. HK)

The pension plan said it will write down its stake in FTX to zero, taking a $95 million loss barely a year after making its first investment.

Teachers said the writedown will have only a “limited impact” because it’s less than 0.05% of the pension fund. “However, we are disappointed with the outcome of this investment, take all losses seriously and will use this experience to further strengthen our approach,” the fund said in a statement Thursday.

Bankman-Fried-Backed Lawmakers Ready To Grill Former CEO (5:01)

Lawmakers who received millions of dollars of campaign donations from Sam Bankman-Fried could soon get something else from the former FTX chief executive officer: testimony under oath.

Recipients of those political contributions say they’re prepared to grill Bankman-Fried about why his crypto exchange suddenly crashed, potentially causing billions of dollars in losses for millions of FTX account holders. Before the collapse, he donated tens of millions of dollars from his crypto-empire fortune to benefit Democrats, making him the second-largest donor to the party this election.

FTX’s ‘Zombie’ Token Still Has Value (3:34 p.m.)

A cryptocurrency whose sponsor went belly up, with no obvious use and a sordid role in a complicated deception? And still there’s about $500 million of the tokens sloshing around on digital trading platforms.

That’s the FTT token from the now-bankrupt exchange FTX, whose demise has cast a pall on the crypto space that industry participant say could take years to be lifted. The token reached a high of nearly $85 in September of last year, and though it’s seen its price drop roughly 98% since then, it still sports an eye-popping hypothetical market value on different exchanges and platforms.

Liquidators Concerned That FTX Had No Authority to File Bankruptcy (1:07 p.m.)

Liquidators, appointed by a Bahamian court to take over FTX Digital Markets Ltd.’s affairs said they have “significant” concern that FTX management, led by Sam Bankman-Fried, lacked authority to put the crypto businesses into bankruptcy in the US.

More than 100 FTX-related entities filed for Chapter 11 in the US Bankruptcy Court for the District of Delaware after insolvency proceedings for Bahamas-based FTX Digital began on the island on Nov. 10.

Bankman-Fried Received $1 Billion Loan (11:39 a.m.)

FTX co-founder Samuel Bankman-Fried, one of his related companies, and two other top executives at the collapsed cryptocurrency exchange received massive loans from affiliated trading arm, Alameda Research, according to a bankruptcy court filing Thursday.

Alameda’s receivables included $4.1 billion in combined loans to “related parties,” according to a footnote in a document filed by John J. Ray III, who was appointed to oversee FTX as its chief executive officer during the proceedings. That includes $1 billion to Bankman-Fried, $2.3 billion to Paper Bird Inc., an entity majority owned by Bankman-Fried, $543 million to Nishad Singh, head of engineering at FTX, and $55 million to Ryan Salame, head of FTX Digital Markets.

Democratic Senators Want Answers (11:14 a.m.)

Democratic Senators Elizabeth Warren and Dick Durbin seek information from FTX founder Sam Bankman-Fried on FTX’s collapse, in a letter to Bankman-Fried and the crypto exchange’s newly appointed CEO John Jay Ray III.

New FTX CEO Can’t Locate Company’s Cash, Crypto (9:29 a.m.)

Advisers now overseeing the carcass of Sam Bankman-Fried’s FTX Group are struggling to locate the company’s cash and crypto, citing poor internal controls and record keeping.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information,” John J. Ray III, the group’s new chief executive officer who formerly oversaw the liquidation of Enron Corp., said in a sworn declaration submitted in bankruptcy court.

FTX Lawyers Accuse Bankman-Fried of Undermining Bankruptcy (8:39 a.m.)

Embattled cryptocurrency mogul Sam Bankman-Fried is undermining efforts to reorganize his crumbling empire with “incessant and disruptive tweeting” that appears aimed at moving assets away from the control of a US court in favor of one in the Bahamas, US lawyers for the bankrupt crypto platform FTX said in a court filing.

FTX, which is now under the control of John J. Ray III — a restructuring lawyer who oversaw the liquidation of Enron — asked a federal judge in Wilmington, Delaware, to transfer a competing bankruptcy case filed in New York by Bahamian liquidators to Delaware.

–With assistance from Amanda Fung and Dara Doyle.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.