Chairman Ryan Cohen’s ‘Oz-like’ quality has helped minimize losses in the video-game seller’s stock.

(Bloomberg Markets) — It’s been a rough year: Global markets have lost trillions of dollars in value, and consumers are being pinched by inflation. In the face of it all, some meme-stock die-hards remain undeterred.

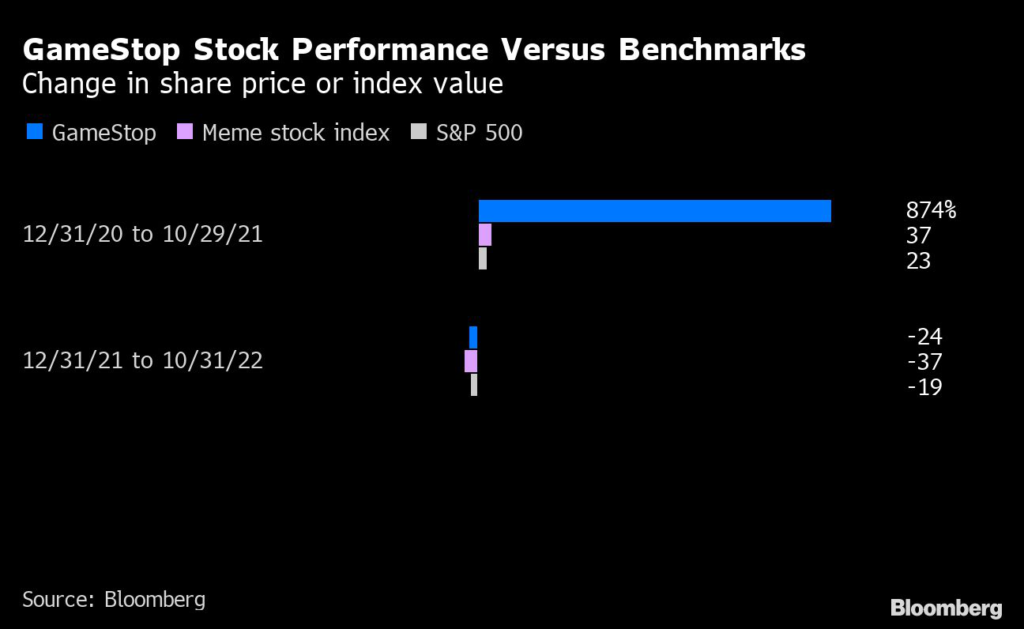

Individuals who bought GameStop Corp. early in the frenzy are still sitting on massive paper returns that outshine those of other speculative investments. Since the end of 2020, the video game retailer’s stock was up 501% as of Oct. 31, compared with the 3% rise for the benchmark S&P 500 and the 26% drop in a basket of 37 meme stocks tracked by Bloomberg.

These retail traders have embraced the motto “HODL,” or “hold on for dear life,” in a bet that the stock will see another surge even as Wall Street professionals remain skeptical, forecasting pain on the horizon. Three of the four analysts who track GameStop recommend clients sell shares—an unusually high percentage given that sell ratings generally make up less than 6% of all ratings. One particularly vocal critic is Michael Pachter at Wedbush Securities Inc., who notes that the company posted its first fiscal fourth-quarter loss in 2021. “Fundamentally, GameStop remains a mess,” he says.

Still, shareholders whom Pachter calls “Reddit Raiders” continue to crowd chatrooms and other social media platforms to discuss the potential windfall coming from their investment. Hundreds of thousands of accounts participate in Reddit threads dedicated to celebrating GameStop, while investment theories are featured in various Discord chats rife with spam, lewd memes and emoji.

Skepticism is either ignored or derided as “FUD,” an acronym for “fear, uncertainty and doubt,” or with a clown emoji. Attempts to interview dozens of online investors were met with distrust of the media that even spurred a Reddit thread of its own.

Many of the online accounts supporting GameStop say they’re in the stock because of Ryan Cohen, the founder of pet retailer Chewy Inc. who’s GameStop’s chairman and largest shareholder. The entrepreneur became an idol to amateur investors after he gained a seat on the board in January 2021. His iconic appeal was cemented by his tweets hitting back at critics, including a poop emoji with an image of a Blockbuster store (in response to comparisons of GameStop to the largely defunct movie rental franchise) and an apparent screenshot from a Pets.com television ad (a nod to those who compared Chewy to the failed pet goods retailer).

“I support Ryan Cohen, and I support what he’s done with GameStop,” says one man who would identify himself only as Daniel W., adding that he’s a 41-year-old New Yorker and that the largest position in his personal portfolio is GameStop. “Once I learned who he was and his past successes, it made me believe that he has the potential to be successful again.”

The retailer was in deep trouble before Cohen and the band of individual investors came to the rescue. Video gamers had been downloading new titles instead of visiting stores, and GameStop’s investors weren’t sure how it could support its more than $1 billion in debt and lease liabilities. Hedge funds were borrowing the stock heavily to sell it short, hoping to profit from its swoon.

Cohen set about hiring employees from Amazon.com Inc. to help with a new focus on digital sales. Frenzied stock purchases by retail traders helped fuel a short squeeze, forcing hedge funds to capitulate and buy the stock themselves at a loss. The rise in the stock price helped GameStop raise $1.67 billion from share sales, which it used to nearly wipe out its debt and invest in a marketplace for nonfungible tokens (NFTs) for gamers. That digital strategy has come at a cost: The company has lost more than $600 million since early 2021, and analysts expect the losses to continue in the coming quarters. Pachter, whose $6 price target is one of the lowest on Wall Street, says Cohen is spending too much on NFTs.

“The guy is the pied piper of retail—he’s not the Warren Buffett of retail,” he says. “I cannot explain the phenomenon of the cult of Ryan Cohen, because he’s not doing anything with GameStop.”

Cohen, who declined to comment for this story, has burned investors before. He disclosed a stake in Bed Bath & Beyond Inc. in March, triggering a buying frenzy, only to set off a stock plunge when he dumped it entirely in August and pocketed a $68.1 million profit.

“There’s an Oz-like quality to him,” says Peter Atwater, an adjunct professor of economics at William & Mary, a university in Williamsburg, Virginia. “Those mystics have an aura and an appeal all to themselves, because you can create whatever fantasy story you want to support that appeal.”

Since the start of 2021, individual investors have purchased over $768 million worth of GameStop, more than eight times the amount they bought in the three years prior, according to data compiled by Vanda Research. The bulk of the initial gains has been wiped out, erasing more than $16 billion in market value from a January 2021 peak.

“I don’t want to sell,” says Daniel. “There’s no fear on my end to hold through the storm that we’re in or that’s coming. I’m going to hold as long as I can financially hold.”

That sums up the mentality of the remaining investors who clutch the stock with their diamond hands and us-versus-them ethos: You can only lose money on an investment if you sell it.

Lipschultz covers equity markets for Bloomberg News in New York.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.