ASML Holding NV, China Tourism Group Duty Free Corp., Nike Inc. and cash were among recommendations pitched by investors at the annual Sohn Australia conference on Friday.

(Bloomberg) — ASML Holding NV, China Tourism Group Duty Free Corp., Nike Inc. and cash were among recommendations pitched by investors at the annual Sohn Australia conference on Friday.

Below is a summary by sector of what companies and assets were tipped at the event in Hobart, Tasmania, and by who, according to reports in the Australian Financial Review and The Australian.

Cash

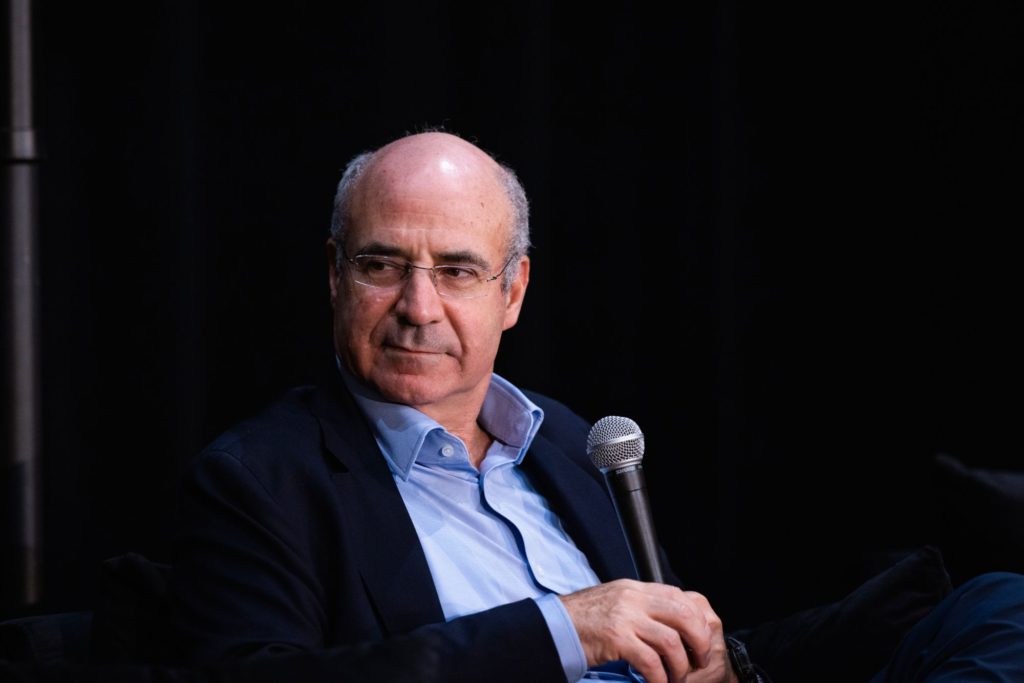

Cash is the best asset in the current rising interest rate environment, said Bill Browder, co-founder of hedge fund Hermitage Capital LLP. “Yielding cash while waiting for dry powder to buy things when they get really cheap” is a sound strategy, Browder said, according to the Australian Financial Review.

He joins a number of investors, including GIC Pte.’s Jeffrey Jaensubhakij and AustralianSuper Pty Ltd.’s Mark Delaney, who have said recently that they’ve built up cash piles that will enable them to react quickly when an investment thesis aligns.

Read: Investment Giants With $2.3 Trillion Bet on More Market Turmoil

Tech

Nick Griffin, chief investment officer of Munro Investment Holdings Pty Ltd., tipped Dutch semiconductor manufacturing equipment maker ASML on expectations that its earnings should accelerate, according to The Australian.

The stock has fallen in line with peers, but should see exponentially more growth in the future, he said. ASML shares are down about 20% this year, dragged by waning global demand for PC-related chips as customers shun big-ticket purchases.

Eminence Capital LP’s chief executive officer Ricky Sandler pitched software monitoring company New Relic Inc., saying the firm is misperceived as a market share loser because of its transition to a new product platform over the last two years, the AFR reported. Shares of the Nasdaq-listed company have lost half of their value this year.

Tim Carleton, portfolio manager at Auscap Asset Management Ltd., said Sydney-listed Carsales.com Ltd.’s revenue exposure to international markets presents an opportunity, according to the AFR. He argued that the online automotive classifieds business isn’t a tech stock, but has been sold off like one. Shares erased losses on Friday after the nod. The stock has retreated 11% this year.

FACT Capital LP founder Joyce Meng picked Keywords Studios Plc, calling it the “picks and shovels” of the video game industry, The Australian reported. She sees a 72% upside to the stock, using conservative cost of capital.

Consumer

Claremont Global’s Bob Desmond gave the nod to Nike. The sportswear brand is “increasingly taking control of its distribution and turning into a technology power,” he said, according to the AFR.

Perpetual Investment Management Ltd. portfolio manager Anthony Aboud touted French lottery firm La Francaise des Jeux SAEM, The Australian said. The company’s appeal lies in the growth of its online business, which has seen sales jump from 5% to 11% since its initial public offering.

Tribeca Investment Partners Pty Ltd. portfolio manager Jun Bei Liu selected CTG Duty Free, anticipating that its compounded growth will top 40% per annum over the next three years.

“They want to go to Europe, the US, wherever the Chinese tourist is going — it is going to collect a whole lot of luxury brands to make them exclusive,” she said, the AFR reported.

Materials

Regal Funds Management Pty Ltd.’s Tim Elliott chose Champion Iron Ltd., saying it needs to rise 43% to trade in line with iron ore rivals like Fortescue Metals Group Ltd. and Rio Tinto Group on a one-year, forward-consensus Ebitda. He also highlighted some drivers of upside value that could double its share price without assuming an increase in the iron ore price.

The stock is “the most under-appreciated and exciting play on decarbonization that’s completely under the radar,” he said, the AFR reported.

Champion Iron’s Sydney-listed shares closed up 1.2% after the pick. It also rose as iron ore headed for a third weekly advance after Chinese property policies boosted demand optimism.

Health

Cooper Investors Pty Ltd. Chief Investment Officer Peter Cooper named European lab testing service Eurofins Scientific SE as his top stock recommendation. He said the volumes are rising 5% every year in the testing industry and “one of the attributes of the service is it’s really cheap,” The Australian reported.

(Updates with additional speakers, context throughout)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.