The JSE opened to weaker Asian markets on Monday as fears of stricter lockdowns in China following a spike in daily covid-19 cases weighed on sentiment to see the local bourse close the start of the new week 0.88% lower.

A week after China outlined its plans to make its covid-19 approach more targeted, the first coronavirus deaths in months have sparked fresh fears that the virus might make a comeback in the Asian nation.

Global markets will look to minutes from the latest US Federal Reserve meeting, due out on Wednesday, for guidance as to whether the American central bank will continue to aggressively raise interest rates, despite positive-looking recent inflation numbers.

Locally, the South African Reserve Bank monetary policy committee will conclude its last meeting for the year on Thursday, when it is expected to announce a further hike to the repo rate.

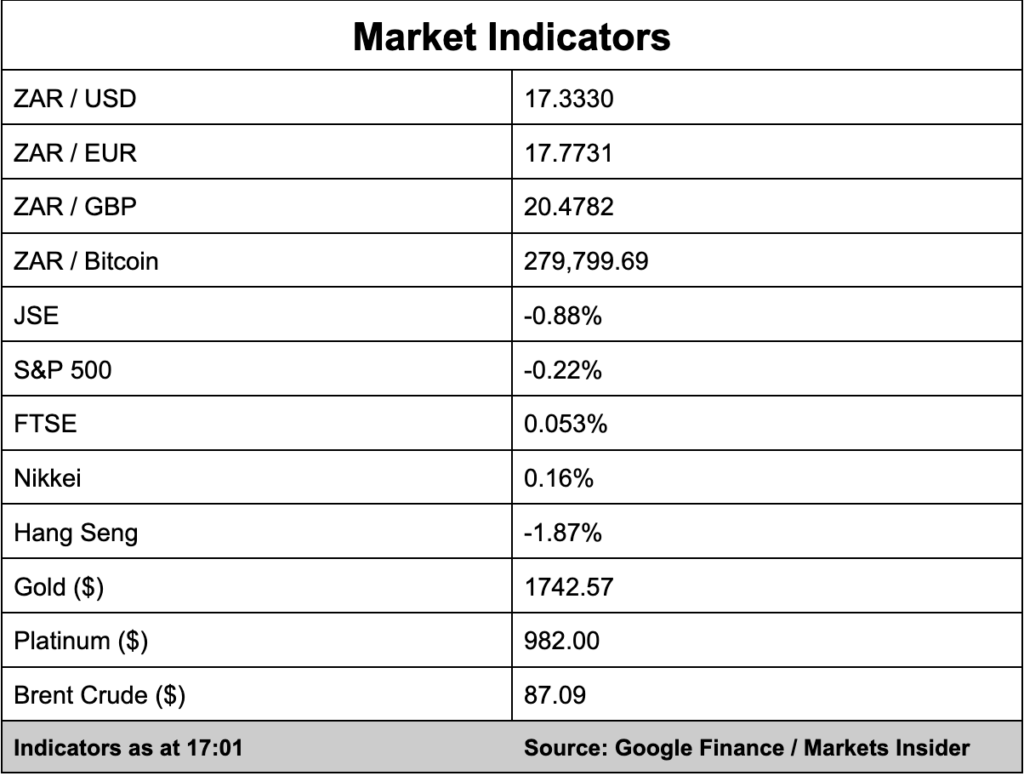

In the currency markets, the rand slid more than 1% during morning trade but has since halved its losses and is currently trading at R17.33 against the greenback.

In company news, Barloworld (1.73%) said it expects its car rental business, Avis Budget, to list on the JSE as Zeda from December 13.

Barloworld shareholders will receive one Zeda share for each Barloworld share held, subject to JSE approval.