Analog Devices Inc., one of the largest makers of semiconductors used in industrial equipment and cars, gave a bullish forecast for the current period, indicating that demand in those two markets is holding up better than the broader chip industry.

(Bloomberg) — Analog Devices Inc., one of the largest makers of semiconductors used in industrial equipment and cars, gave a bullish forecast for the current period, indicating that demand in those two markets is holding up better than the broader chip industry.

First-quarter revenue will be about $3.15 billion, the company said in a statement Tuesday. Excluding certain items, profit will be about $2.60 a share. Analysts estimated sales of $3.02 billion and earnings of $2.39 a share.

The outlook helped reassure investors after a rocky stretch for the chip business, which is coping with a slowdown in technology spending and the fallout from new rules on exports to China. Semiconductors used in vehicles and factory equipment have remained a bright spot, even as some of the industry’s largest companies, including Intel Corp., Nvidia Corp. and Micron Technology Inc., warn of a slowdown.

While orders did decelerate in the first half of the fourth quarter, they leveled out at what the company considers normal levels and have stayed that way into the current period, Chief Financial Officer Prashanth Mahendra-Rajah said in an interview.

“We take stabilizing orders as a good sign,” he said. “For right now, for the current quarter and a little bit ahead, we feel good.”

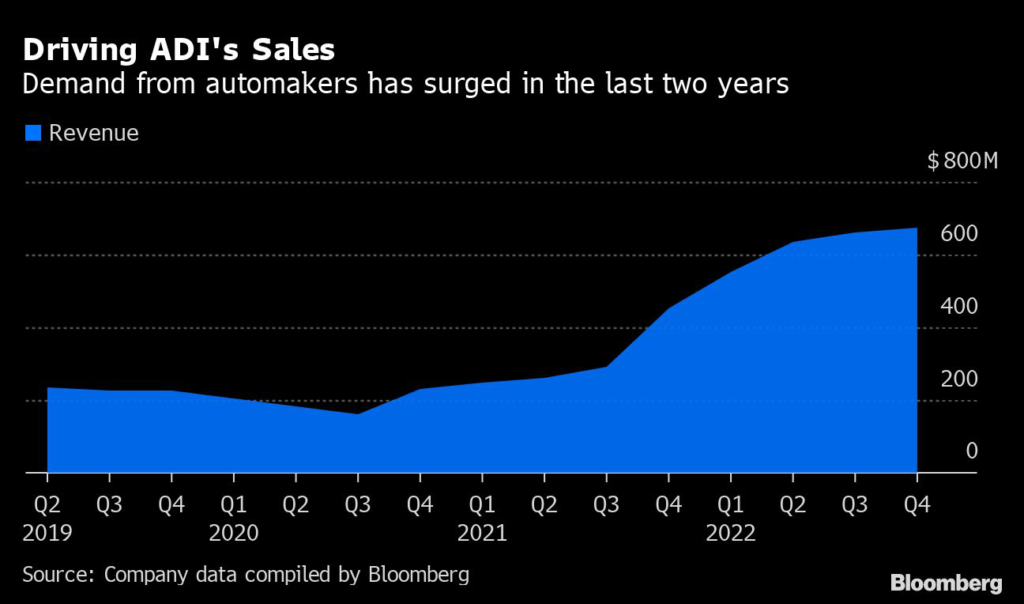

The company’s automotive business is benefiting from that industry’s migration to more battery-powered vehicles. Analog Devices makes semiconductors that control those batteries. It’s also a major supplier of the systems that move video signals around cars, meaning it’s getting more orders as cars increasingly become equipped with cameras as part of driver-assistance packages.

By region, China and Asia are show the biggest amount of weakness due to the worsening economy, he said. Europe and North America have held up relatively well. Analog Devices gets about 20% of its sales from China.

Analog Devices shares rose more than 5% in New York trading at midday. They had fallen 9.4% this year through Monday’s close, though that’s a better performance than the Philadelphia Stock Exchange Semiconductor Index, which is down 32%.

Based in Wilmington, Massachusetts, Analog Devices specializes in analog and embedded computing components, a sector led by Texas Instruments Inc.

Analog chips convert real-world things — like sound and pressure — into electronic signals. And the rush to add automation to factory equipment and buildings stirred new demand in recent years. The move toward battery-powered cars has also fueled the market.

Automotive revenue rose 49% from a year earlier, Analog Devices reported. Industrial-related sales were up 40%, and its consumer division — its smallest unit – an increase of 19%.

Revenue was $3.25 billion in the period, which ended Oct. 29. That yielded a profit of $2.73 a share, excluding some items. Analysts estimates had called for sales of $3.15 billion and earnings of $2.59 a share.

–With assistance from Debby Wu.

(Updates with comments from CFO from fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.