Global markets are buoyed by signs from China that the Asian country may soon relax its aggressive Covid-19 policies. Public unrest and protests have given investors hope that China may ease its covid-zero policy sooner than expected.

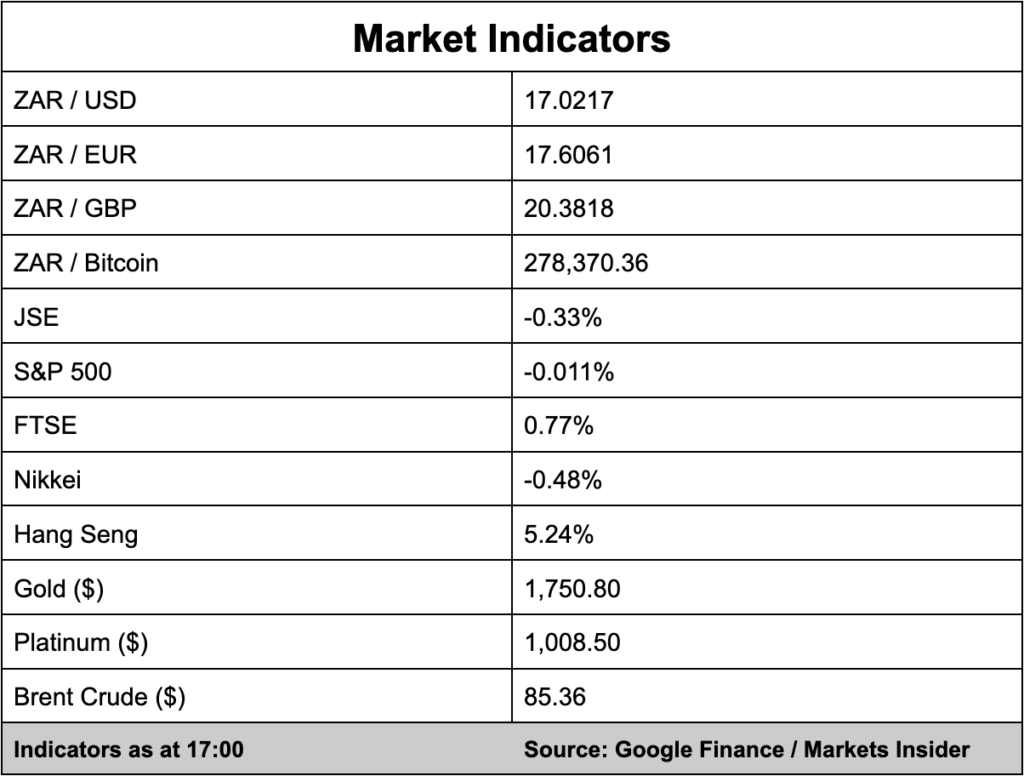

The JSE lifted during the morning session with the main index trading as much as 1.1% higher but the local bourse spun in the afternoon, reversing its gains, and ultimately closing 0.33% lower.

Protestors across China threatened to take to the streets on Monday evening, but a heavy police presence meant many stayed away. Investors will look to the US Federal Reserve again this week, with Fed chair Jerome Powel due to speak on Wednesday.

Many economists expect Powell to strike a hawkish tone despite the prospect of inflation cooling down.

In the currency markets, the rand opened at R17.08/$ this morning and is currently trading at R17.02 versus the greenback.

In other news, South Africa’s unemployment rate declined for a third consecutive quarter even while record blackouts have disrupted businesses and negatively affected the economy.

The unemployment rate dropped to 32.9% for the three months to the end-September, down from 33.9% in the previous quarter.