China’s economic activity contracted further in November amid a record Covid outbreak, with growth likely to remain weak and the central bank expected to add more stimulus to bolster the recovery.

(Bloomberg) — China’s economic activity contracted further in November amid a record Covid outbreak, with growth likely to remain weak and the central bank expected to add more stimulus to bolster the recovery.

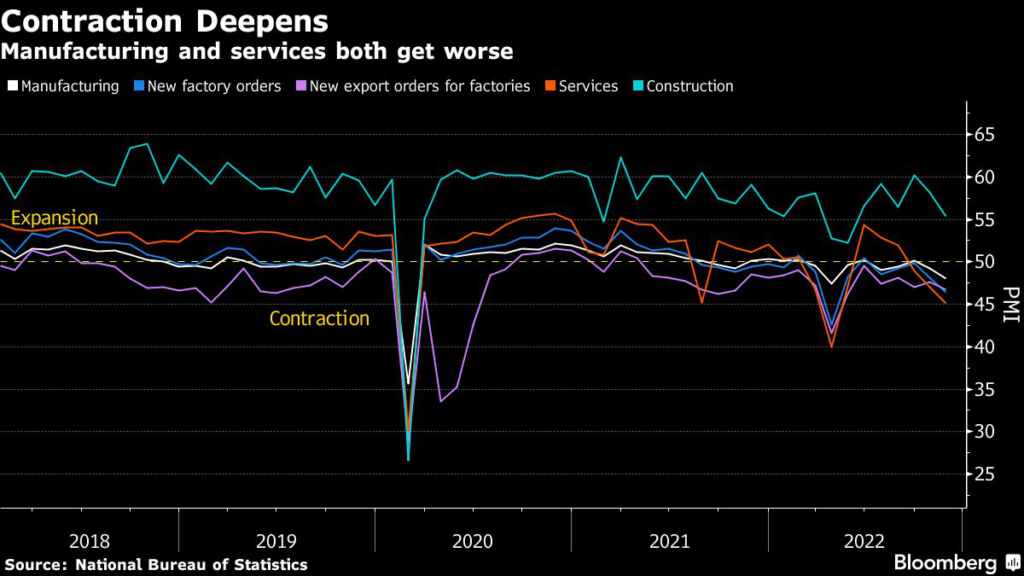

The official manufacturing purchasing managers index fell to 48 this month, the National Bureau of Statistics said on Wednesday, the lowest reading since April and worse than an estimate of 49 in a Bloomberg survey of economists.

The non-manufacturing index, which measures activity in the construction and services sectors, declined to 46.7 from 48.7 in October, also lower than the consensus estimate of 48.

A reading below 50 indicates contraction, while anything above suggests expansion.

The economy is suffering increasing damage and residents have taken to the streets to protest tighter Covid controls in several major cities recently.

Economists expect growth to slow to around 3% this year, putting pressure on officials to step up stimulus to spur the recovery next year.

“Policymakers are working at full steam to create strong impetus for growth with stimulus packages,” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc.

He sees China’s economy as likely to return to a potential growth rate of over 5% “no earlier” than the second quarter of next year, assuming less disruptions from Covid outbreaks and curbs.

China’s benchmark CSI 300 Index of stocks rose 0.28% as of the mid-day break, led by energy and telecom service shares.

The yuan traded onshore strengthened 0.18% to 7.1449 per dollar as of 11:31 a.m. local time, while the yield on 10-year government bonds was up 2 basis points at 2.91%.

Manufacturing PMI gauges measuring output, new orders, raw material inventories and employment all contracted in November at a faster pace than the month before.

A sub-index measuring suppliers’ delivery times also fell further, a sign of supply disruptions.

What Bloomberg Economics Says…

Recovery will be slow as China works out ways to live with the virus, but each new sign of economic weakness is likely to nudge in the direction of loosening Covid Zero.

Any new approach will need to strike a delicate balance: boosting economic activity without allowing an unmanageable spread of the virus.

— Chang Shu and David Qu

For the full report, click here.

Economic activity will likely continue to weaken in December and the first quarter of next year, according to Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd., adding that a reopening-fueled rebound seems set for the second half of 2023.

“At this early stage of reopening, more cities face rising number of Covid patients,” he said.

“These cities have to impose restrictions to ‘flatten the curve.’ The economic cost is inevitable.”

As Covid outbreaks spread, more companies are seeing infections rise among their employees.

About 53% of Chinese firms reported a Covid case in their workforce in November, according to a survey of more than 2,400 companies across the nation by China Beige Book International. That was the highest in data back through January last year.

About a quarter of China’s total gross domestic product is now affected by lockdowns, according to a recent estimate from Nomura Holdings Inc.

That was higher than the firm’s previous peak recording of 21% in April, when the whole of Shanghai was shut down to curb Covid cases.

“In November, Covid outbreaks brought negative impact to some firms’ production and operation.

Production activity slowed, and product orders declined,” Zhao Qinghe, a senior statistician at the NBS, said in a statement.

While the government has taken steps to help the economy recently — including lowering the amount of cash banks must hold in reserves and offering financing support to property developers — the policies aren’t likely to be enough to shore up household and business confidence.

Bloomberg Economics downgraded its GDP growth forecast for this year to 3% from 3.5%, and trimmed next year’s projection to 5.1% from 5.7%.

The International Monetary Fund said Tuesday it may have to trim its forecast for China’s growth because of Covid restrictions and property sector turmoil.

The lender currently sees China’s GDP expanding 3.2% this year and 4.4% in 2023.

Several economists say the central bank could provide more stimulus in the coming months as the global outlook makes it somewhat more favorable for China to ease monetary policy.

Adjustments to the reserve requirement ratio and banks’ loan prime rate are “possible early next year,” said Zhou Hao, chief economist at Guotai Junan International Holdings Ltd.

–With assistance from Fran Wang and James Mayger.

(Updates with more comments and economist commentary.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.