Chinese stocks listed in the US climbed for a third day, adding to a record rally this month fueled by optimism over reopening bets as some parts of the country loosened lockdown restrictions.

(Bloomberg) — Chinese stocks listed in the US climbed for a third day, adding to a record rally this month fueled by optimism over reopening bets as some parts of the country loosened lockdown restrictions.

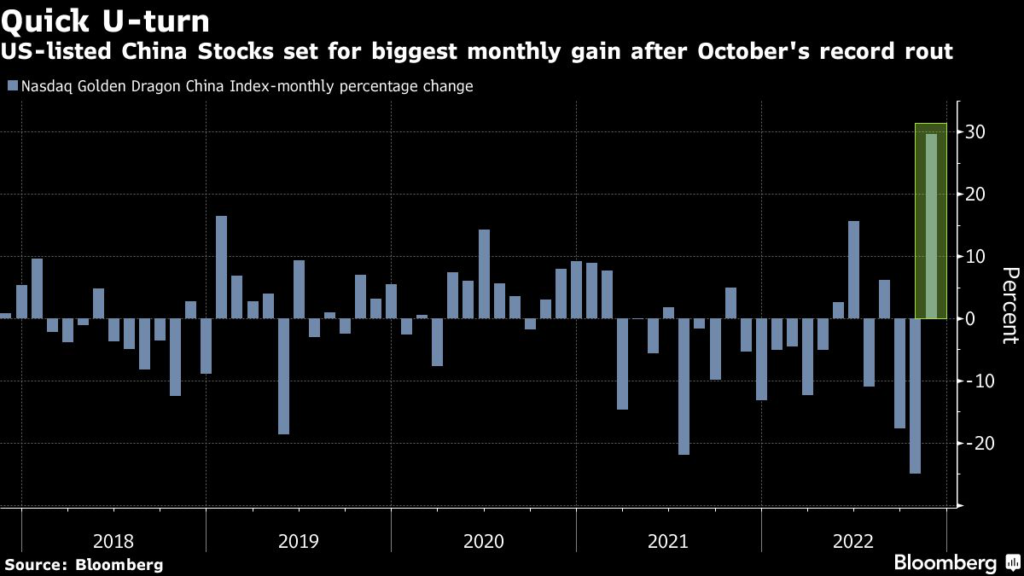

The Nasdaq Golden Dragon China Index gained 6% Wednesday, putting the benchmark on pace for a 37% surge this month that has added about $177 billion in market value. Bilibili Inc., JD.com Inc. and Pinduoduo Inc. were among the biggest gainers in November, advancing at least 45% each.

November’s rally is a dramatic turnaround from October’s 25% plunge when fresh lockdowns started being implemented in China and the Communist Party Congress dashed hopes for more market-friendly policies.

Strong quarterly earnings results from some of the nation’s biggest tech companies, the loosening of some of Beijing’s strict virus approach and a rescue package for the property sector has driven a reversal of bearish bets and lured investors back to the market after the selloff last month.

While the timeline of reopening remains highly uncertain, authorities have been taking incremental but clear steps toward winding down Covid restrictions. On Tuesday, markets rallied as the top health body said it will bolster vaccinations among senior citizens, while warning against any excessive control measures.

China is now mulling rolling out a fourth Covid shot, according to a report based on people familiar. Guangzhou, a southern manufacturing hub, lifted lockdowns in most parts of the city and replaced those with targeted restrictions. While the city home to Apple Inc.’s largest manufacturing site in China, Zhengzhou, also lifted a lockdown of its main urban areas put in place five days ago.

The shift has spurred hopes that China is laying the grounds for an eventual Covid Zero exit, prompting traders to place bets even as a spike in infections and nationwide protests suggest the path to reopening will be rocky.

Even after this rally, the Nasdaq Golden Dragon China Index is 27% lower this year, with some bumpy rides and more volatility expected.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.