Volatile trading pushed stocks between losses and gains in Asia as investors weighed Covid developments in China and awaited a speech from Federal Reserve Chair Jerome Powell later Wednesday.

(Bloomberg) — Volatile trading pushed stocks between losses and gains in Asia as investors weighed Covid developments in China and awaited a speech from Federal Reserve Chair Jerome Powell later Wednesday.

Hong Kong’s benchmark equities opened lower, snapped higher and then began sliding again in the first hour of trading. It was a similar picture for mainland shares.

Australian shares erased early losses after inflation eased and Japan’s market remained in the red following data that showed a sharper-than-expected decrease in industrial production.

US futures edged higher after stocks on Wall Street closed down and ahead of the speech by Powell on the economy and the labor market.

Treasuries were little changed while a dollar gauge declined. The offshore yuan fell as China’s factory and services activity contracted further in November as record Covid cases prompted widespread movement curbs.

Amid the turmoil, a gauge of global stocks was on course for a second monthly advance, which has trimmed its loss so far this year to 18%. Bonds were also poised for a monthly gain, along with losses for 2022 on new par with equities.

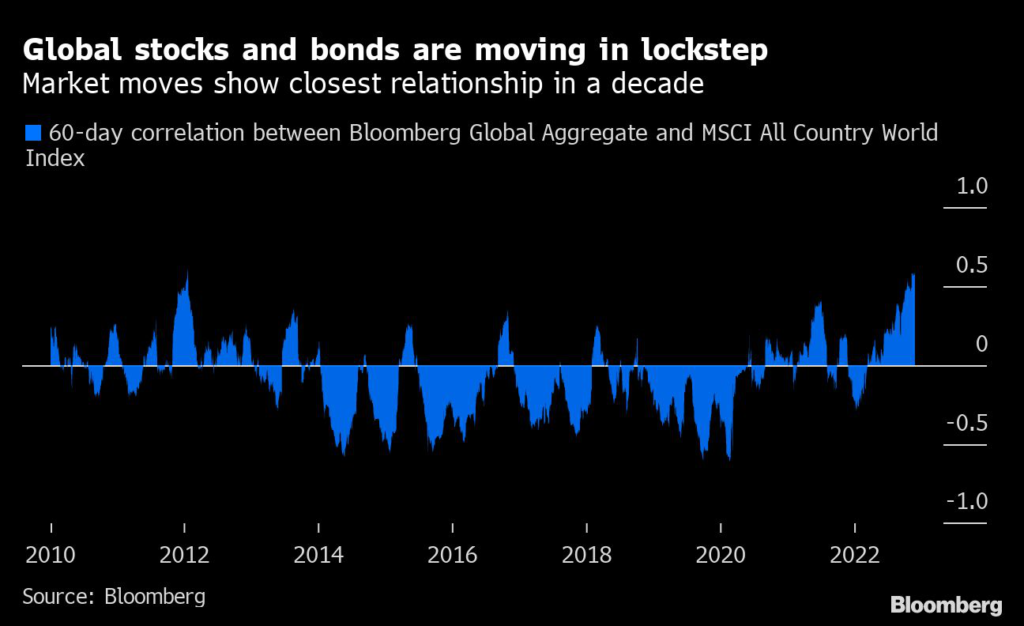

In fact, the lockstep moves in stocks and bonds brought their correlation this week to highest level since 2012, heaping pressure on investors seeking to hedge risk by splitting their portfolios between the two asset classes.

The declines in equities on Wall Street Tuesday were led technology companies. A slump in Amazon shares followed a large debt offering from the retailing giant.

A series of investment grade debt deals was one factor that lured investors from Treasuries, which fell in the US, sending yields higher.

Oil rose for a third day Wednesday after industry data pointed to a substantial draw in US crude stockpiles and investors counted down to an OPEC+ meeting that may see the group agree to cut production.

Gold headed for its biggest monthly gain since May 2021 as the dollar fell on signs the Fed is preparing to slow the pace of interest-rate hikes.

Elsewhere, Bitcoin and other leading crypto assets spiked higher in the Asian trading session.

Key events this week:

- EIA crude oil inventory report, Wednesday

- Fed Chair Jerome Powell speech, Wednesday

- Fed releases its Beige Book, Wednesday

- US wholesale inventories, GDP, Wednesday

- S&P Global PMIs, Thursday

- US construction spending, consumer income, initial jobless claims, ISM Manufacturing, Thursday

- BOJ’s Haruhiko Kuroda speaks, Thursday

- US unemployment, nonfarm payrolls, Friday

- ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 11:39 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 fell 0.7%

- The Topix index fell 0.6%

- The Hang Seng Index was little changed

- The Shanghai Composite Index was little changed

- Euro Stoxx 50 futures rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro rose 0.1% to $1.0341

- The Japanese yen was little changed at 138.69 per dollar

- The offshore yuan fell 0.2% to 7.1554 per dollar

Cryptocurrencies

- Bitcoin rose 3.4% to $17,022.64

- Ether rose 4.6% to $1,274.84

Bonds

- The yield on 10-year Treasuries was little changed at 3.74%

- Japan’s 10-year yield was little changed at 0.25%

- Australia’s 10-year yield declined two basis points to 3.59%

Commodities

- West Texas Intermediate crude rose 0.8% to $78.82 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.