The rand and SA bond markets failed to join a global rally spurred on by comments from US Federal Reserve chair Jerome Powell on Wednesday that the Fed would slow the pace of its interest rate hikes.

The sell-off is due to the Section 89 panel report, which found that Ramaphosa may have contravened the Constitution and anti-corruption laws with his dealings at the Phala Phala game farm.

There have also been growing calls for Ramaphosa to step down as head of state and president of the ANC with speculation rife that the president will resign imminently.

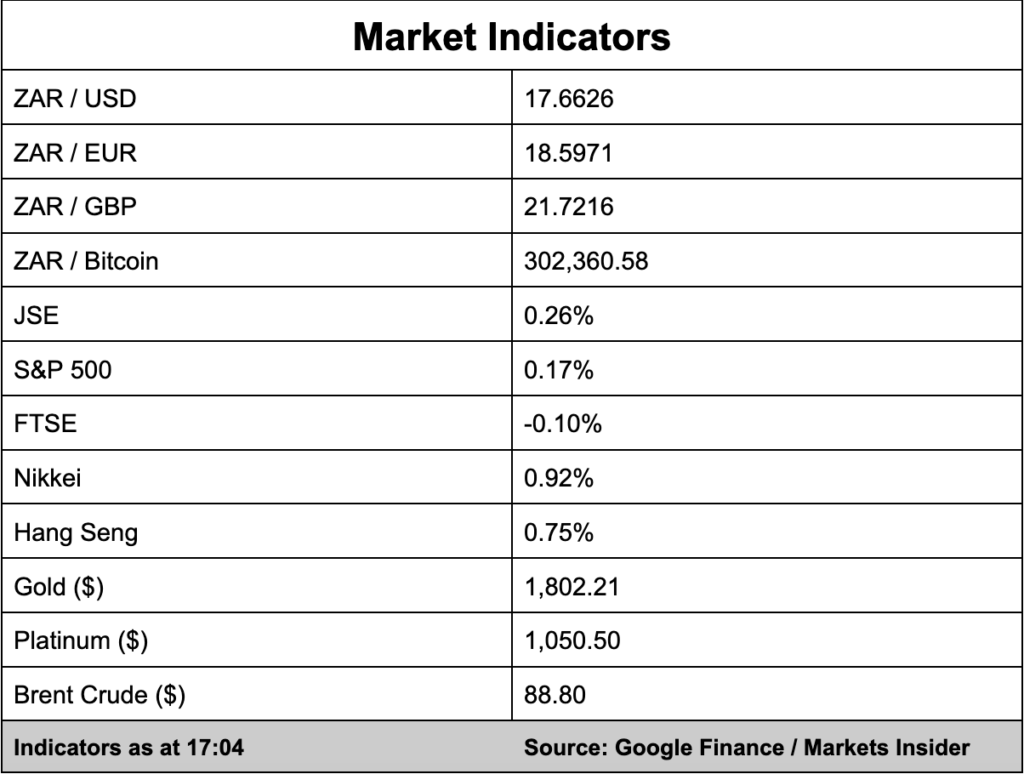

Despite market uncertainty around Ramaphosa’s position as head of state, the JSE closed 0.26% higher.

While in the currency markets, the rand has fallen sharply due to the uncertainty of Ramaphosa’s position declining over 3% against the US dollar and slipping more than 4% to the British pound.

Meanwhile, global markets cheered Powell’s comments and rallied significantly on the back of them with Business Day describing it as “a textbook risk-on pattern.”