Global stocks climbed and the dollar slipped to a three-month low as fresh signs emerged of a softening in China’s Covid stance and Federal Reserve Chair Jerome Powell confirmed that the pace of interest rate hikes was set to slow.

(Bloomberg) — Global stocks climbed and the dollar slipped to a three-month low as fresh signs emerged of a softening in China’s Covid stance and Federal Reserve Chair Jerome Powell confirmed that the pace of interest rate hikes was set to slow.

Europe’s Stoxx 600 index rose as much as 1.1%, with tech shares gaining as much as 3% and a range of regional indexes on the cusp of bull-market territory, having gained almost 20% from lows hit in September. A gauge of global shares touched a three-month high, although US index futures edged lower, a day after Powell’s comments helped the S&P 500 close out November with a second month of gains for the first time in more than a year.

Sentiment in Asia got an extra boost after China’s top official in charge of the fight against the coronavirus, Vice Premier Sun Chunlan, said the country’s efforts to combat the virus are entering a new phase with the omicron variant weakening and more Chinese getting vaccinated. Beijing also indicated some Covid patients could isolate at home.

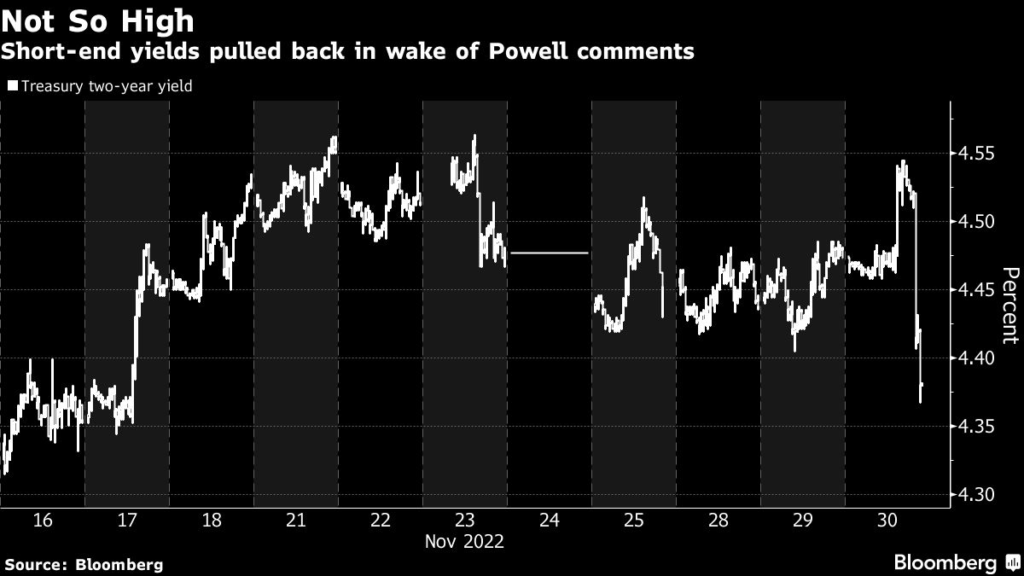

The buoyant mood knocked the dollar lower against its Group-of-10 counterparts for the third straight day, while Treasury 10-year yields stayed just off two-month lows hit in the wake of Powell’s comments. The yen advanced more than 1% and the euro touched a five-month peak.

“There is no one-way bet any more on dollar strength,” said Sarah Hewin, senior economist at Standard Chartered in London. “We had a good signal about a pivot from Powell, so the market has dialed back its expectations on peak rates.”

Powell’s remarks confirmed expectations the Federal Reserve will raise interest rates 50 basis points this month in a departure from a run of four 75 basis point hikes. Pricing in the swaps market indicates the Fed funds rate will peak below 5% in May. Prior to Powell’s comments, the market anticipated a peak above that level occurring in June.

Investors will likely switch focus to how economic growth will fare in coming quarters. Key gauges of US activity have painted a mixed third-quarter picture. Job openings fell in October — a hopeful sign for the Fed as it seeks to curb demand — while Friday’s jobs report, is currently forecast to show employers added 200,000 workers to payrolls in November.

There are also signs that cooling growth is affecting corporate earnings, especially in the tech sector. While the rate-sensitive Nasdaq jumped 4.5% on Wednesday, tech shares broadly fell in premarket trading, led by software maker Salesforce, whose earnings outlook appeared to reflect a weaker economic environment.

Thursday’s PMI numbers from S&P Global showed a slump in Asian and European factory activity and businesses bracing for more cutbacks in spending from customers.

Elsewhere in markets, oil fluctuated after a three-day rally as investors assessed the latest signals that China may be softening its Covid Zero policy and looked ahead to an OPEC+ meeting that will set supply levels for 2023.

Key events this week:

- S&P Global PMIs, Thursday

- US construction spending, consumer income, initial jobless claims, ISM Manufacturing, Thursday

- BOJ’s Haruhiko Kuroda speaks, Thursday

- US unemployment, nonfarm payrolls, Friday

- ECB’s Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 rose 0.7% as of 9:56 a.m. London time

- Futures on the S&P 500 were little changed

- Futures on the Nasdaq 100 fell 0.2%

- Futures on the Dow Jones Industrial Average fell 0.2%

- The MSCI Asia Pacific Index rose 1.7%

- The MSCI Emerging Markets Index rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro rose 0.3% to $1.0439

- The Japanese yen rose 1.3% to 136.31 per dollar

- The offshore yuan fell 0.6% to 7.0899 per dollar

- The British pound rose 0.7% to $1.2148

Cryptocurrencies

- Bitcoin was little changed at $17,111.26

- Ether fell 1.1% to $1,282.69

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.62%

- Germany’s 10-year yield declined nine basis points to 1.84%

- Britain’s 10-year yield declined five basis points to 3.11%

Commodities

- Brent crude was little changed

- Spot gold rose 0.5% to $1,778.16 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Rita Nazareth and Richard Henderson.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.