US jobs data Friday will be closely watched for an insight into the state of the economy

European stock markets and oil prices steadied Friday before key US jobs data and an oil output decision by OPEC and its Russia-led allies.

Asian stock markets and the dollar dropped following another volatile week for markets generally.

“Traders are jockeying for position ahead of the moderately high-risk (US jobs) event,” noted SPI Asset Management’s Stephen Innes.

The data will provide the most recent snapshot of how the world’s top economy is faring in light of rising US interest rates to combat the highest inflation in decades.

Traders are growing confident that the Federal Reserve will slow its pace of rate hikes after Fed boss Jerome Powell this week indicated that the days of jumbo 0.75-percentage-point increases were over.

At the same time, Powell and other Fed officials have lined up to warn that rates would continue to rise and stay elevated, with the possibility of no cut until 2024.

– OPEC+ –

Focus was also on OPEC+, which may decide Sunday to slash oil production further to boost prices for its members, which include Saudi Arabia and Russia.

“There remains considerable uncertainty around the action OPEC+ will take when it meets…, although there’s every chance that the meeting will be delayed or that discussions take longer than normal, as a result of the price cap being finalised by the EU,” noted OANDA trading platform analyst Craig Erlam.

Beyond the economic gloom, the big unknown in the oil equation currently is Russian oil, as Western nations seek to decouple themselves from Moscow’s energy supplies as fast as possible.

The EU has decided to ban member states from buying Russian oil exported by sea from December 5, “putting at risk over two million barrels per day,” according to estimates by ANZ analysts.

Investors are also scrutinising a European Commission-proposed $60 per barrel price cap on Russian crude, which is designed to reinforce the effectiveness of the EU embargo.

Prices have fallen heavily in recent weeks on expectations of weaker Chinese demand.

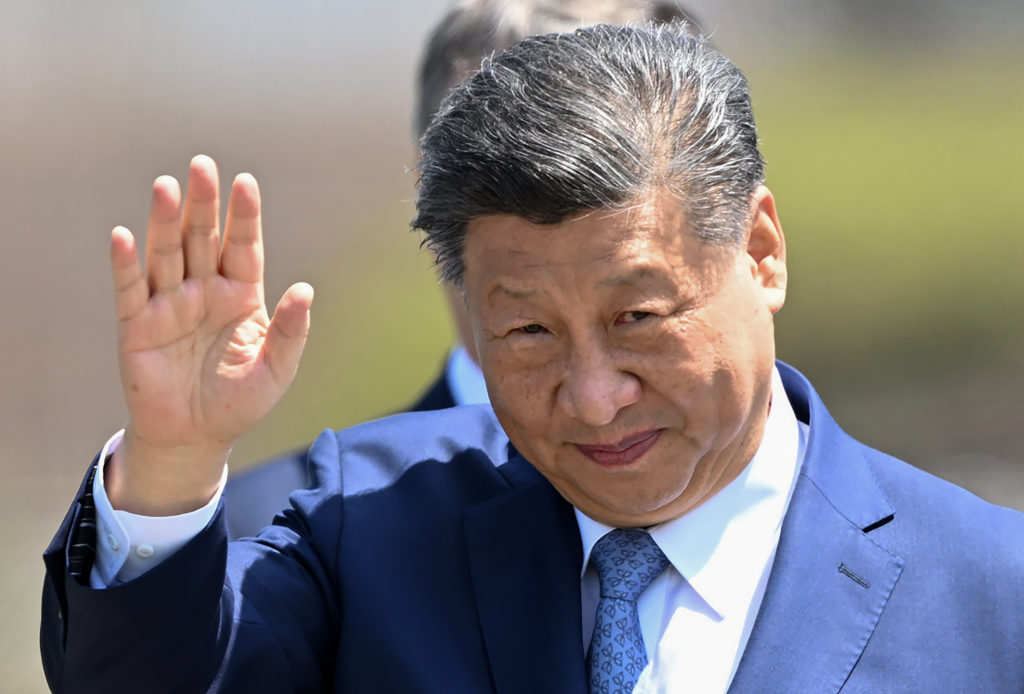

There are signs, however, that China is edging towards a pivot from its draconian Covid-zero strategy, which has seen the lockdown of tens of millions and strangled the giant economy this year.

The move came after widespread protests across the country earlier in the week against almost three years of heavy-handed containment measures and calls for more political freedoms.

Observers say they expect officials to signal a shift in priorities at a key meeting later this month, with a focus turning to kickstarting the economy, though with vaccination rates low the move will likely be gradual.

“The language (at the meeting) will prioritise economic growth more than it did the last couple of years,” said Arthur Budaghyan at BCA Research. “Economic conditions are worsening, and policymakers’ pain point is being reached.”

– Key figures around 1200 GMT –

London – FTSE 100: DOWN 0.2 percent at 7,540.43 points

Frankfurt – DAX: UP 0.3 percent at 14,530.90

Paris – CAC 40: DOWN 0.2 percent at 6,742.29

EURO STOXX 50: DOWN 0.1 percent at 3,982.08

Tokyo – Nikkei 225: DOWN 1.6 percent at 27,777.90 (close)

Hong Kong – Hang Seng Index: DOWN 0.3 percent at 18,675.35 (close)

Shanghai – Composite: DOWN 0.3 percent at 3,156.14 (close)

New York – Dow: DOWN 0.6 percent at 34,395.01 (close)

Euro/dollar: UP at $1.0534 from $1.0529 on Thursday

Dollar/yen: DOWN at 134.09 yen from 135.34 yen

Pound/dollar: UP at $1.2277 from $1.2251

Euro/pound: DOWN at 85.82 pence from 85.91 pence

Brent North Sea crude: UP 0.5 percent at $87.27 per barrel

West Texas Intermediate: UP 0.2 percent at $81.35 per barrel