Investors in Snap Inc., one of the smaller social media networks, may be among the biggest beneficiaries of Twitter’s loss of advertisers.

(Bloomberg) — Investors in Snap Inc., one of the smaller social media networks, may be among the biggest beneficiaries of Twitter’s loss of advertisers.

Twitter could lose almost a third of its ad revenue as brands pull back from the site, according to estimates from MKM Partners LLC.

Meta Platforms Inc.’s Instagram and Facebook would win the biggest chunk of that business, though the incremental sales would be about 1% of Meta’s total revenue, MKM says.

However, that same revenue would make a big difference for the Snapchat parent’s much smaller operation, and possibly help revive the stock, which has lost more than three quarters of its value this year.

“What is bad for Twitter might actually be good for Snapchat,” said Dennis Dick, market structure analyst and head trader at Triple D Trading Inc.

Companies including Volkswagen AG, General Mills Inc.

and Pfizer Inc. have scaled back or stopped advertising on Twitter, concerned that new owner Elon Musk’s looser moderation policies will make the site less hospitable. General Motors CEO Mary Barra told CNBC in an interview on Tuesday that the automaker continues to evaluate advertising on Twitter following its suspension.

Musk has acknowledged that the defections led to a “massive drop” in revenue.

He said over the weekend that Apple Inc., the largest advertiser on the platform, has “fully resumed” business with Twitter after mostly stopping a few days earlier.

To be sure, any benefit that Snap enjoys from the pullback on Twitter advertising may be offset by the broader economic gloom.

Dick said he’s concerned the overall digital ad pie might get smaller in 2023, and analysts agree that a weakening economy is prompting businesses to cut down on costs, including ad spending.

Snap could draw about 5% to 8% of the ad dollars that marketers would have spent on Twitter, said Rohit Kulkarni, who follows the stock for MKM.

Even if Snap only draws 5% of brands’ ad dollars from Twitter, that should help the company handily beat fourth-quarter revenue estimates, said Bloomberg Intelligence analyst Mandeep Singh.

For social-media companies that have been swept along in this year’s bear market in technology stocks, any boost from Twitter’s woes would be welcome.

While higher interest rates from the Federal Reserve have hurt the whole sector, Snap in particular has suffered from increased competition, difficulty in tracking users and the weakening ad market.

A second-half rebound in tech stocks hasn’t helped social media: Shares in Meta and Snap have slumped 24% and 23%, respectively, since June 30, while the Nasdaq 100 Index is up 2.5%.

Analysts have slashed estimates for Snap’s fourth-quarter revenue by 20% over the past six months, to $1.3 billion, according to Bloomberg data.

If Snap ends up getting new advertisers on the platform, that’s a long-term positive as once advertisers shift their dollars to a platform, they are unlikely to abandon it in the near term, said Singh.

“Snap is an attractive alternative to Twitter advertisers, and any marginal share shift would be a clear needle-mover for Snap’s fundamentals,” Kulkarni said.

Tech Chart of the Day

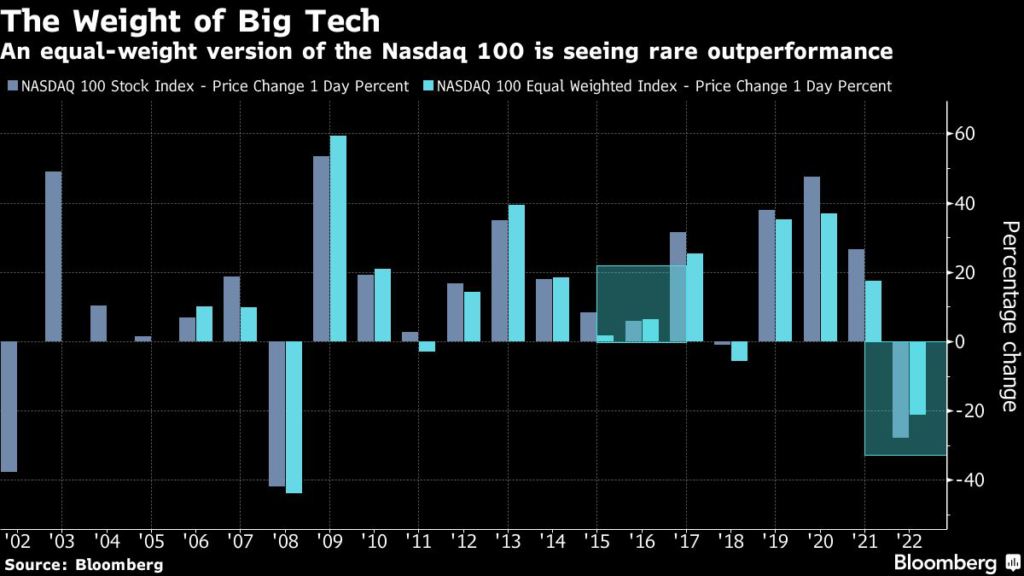

The Nasdaq 100 Index is down 28% this year, and in a measure of both the influence that big tech holds and the group’s year-to-date weakness, an equal—weight version of the index is down 21% over the same period.

This has put 2022 on track to be the first year since 2016 where the equal-weight version of the index did better than the traditional version, which is weighted by the market value of its members. Among notable mega-cap laggards this year, Amazon.com Inc.

is down 45% and Nvidia Corp. is down 44%.

Top Tech Stories

- Apple Inc. was sued by two women who say its AirTag devices make it easy for stalkers to track and terrorize victims.

- Apple retail employees pushed back on unionization efforts at a location in St.

Louis, with staffers saying they don’t want to be represented by the International Association of Machinists & Aerospace Workers, a labor group that recently attempted to organize the store.

- US labor board prosecutors have determined that Apple violated federal law by interrogating and coercing employees in Atlanta, the latest legal salvo over the company’s response to organizing efforts.

- Apple will begin letting customers in eight European countries repair their own devices, expanding a program that rolled out in the US earlier this year.

- Apple retail employees pushed back on unionization efforts at a location in St.

- Hon Hai Precision Industry Co.

reported sales for November were down 11.4% from the prior year after some shipments were affected by a Covid outbreak in the Chinese city of Zhengzhou, where the company operates the world’s largest iPhone assembly complex.

- Apple Chief Executive Officer Tim Cook and Advanced Micro Devices Inc.

CEO Lisa Su will join President Joe Biden on Tuesday at an Arizona event for Taiwan Semiconductor Manufacturing Co., where the chipmaker will announce plans to bolster its investment in the state to $40 billion and build a second factory.

- Twitter Inc.

is facing new legal fallout from mass layoffs under Elon Musk’s management, including complaints from some workers that severance payments are less than promised and from other employees that the company retaliated against them for exercising protected labor rights.

- Stewart Butterfield, chief executive officer of Salesforce Inc.’s Slack, is leaving after less than two years, another blow to the software giant that has been roiled by an executive exodus in recent weeks.

- Musk’s brain implant company Neuralink Corp.

is under federal investigation for allegedly violating the Animal Welfare Act amid staff complaints its animal testing is being rushed, Reuters reported.

- Intel Corp. is hitting all the targets it has set on a path to regain leadership in semiconductor manufacturing, according to the executive responsible for the effort.

–With assistance from Ryan Vlastelica.

(Updates with GM comments in fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.