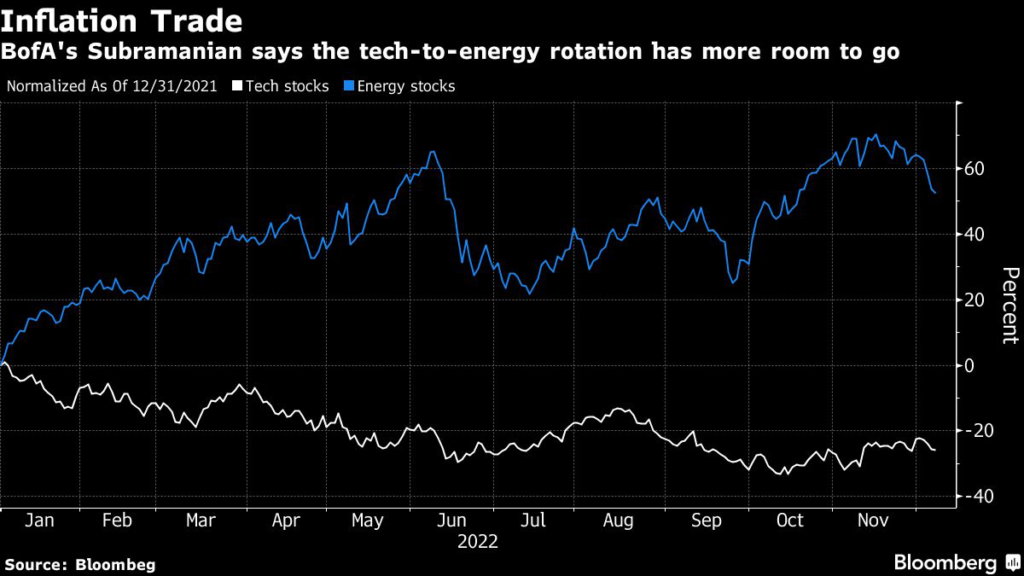

Early in 2022 when technology shares sold off and energy rallied, Savita Subramanian thought professional investors at least by December would have ditched their long-held affection for growth stocks and embraced the inflation trade.

(Bloomberg) — Early in 2022 when technology shares sold off and energy rallied, Savita Subramanian thought professional investors at least by December would have ditched their long-held affection for growth stocks and embraced the inflation trade.

Not so. The reality is money managers largely still prefer internet and software companies over oil and gas producers.

“The lesson is that investors have muscle memory of making money in tech stocks for 10 plus years and that needs to go away,” the head of US equity and quantitative strategy at Bank of America Corp. said on Bloomberg TV. “Cycles take a lot longer to play through than everybody expects.”

Subramanian called tech shares “value traps” despite a 27% drop in the S&P 500 sub-index tracking the sector. A major reason that the rotation into energy has further room to run, she says, is that the industry faces a shortage of supply. By contrast, tech companies suffer an overcapacity due to the buildup during the pandemic-induced demand and now have to lay off workers.

“We need a full washout and we haven’t seen that,” said Subramanian, ranked by third-best quant strategist in this year’s Institutional Investor survey.

The trajectory of consumer prices and the Federal Reserve’s tightening policy have become almost the only thing that matters for investors this year. For some trend-following investors riding the inflation trade — shorting technology stocks and Treasury bonds while going long on commodities and dollar — there were huge gains in the first 10 months. But now with signs of inflation cooling, the trade has since stumbled, sparking debate whether it’s time to play the old gridlock scenario when growth stocks shine.

While recent data have pointed to a softening, pricing pressures will likely remain stuck at elevated levels, Subramanian says, particularly when China reopens its economy after prolonged Covid restrictions. In her view, investors should stay invested in stocks despite growing warnings that the S&P 500 may sink to new lows in the first half of next year.

“Not having exposure to stocks and sticking all your money in bonds and cash is a mistake at this point,” she said. “I do think that we are going to go down and then up. The problem is, that is an increasingly consensus view. So I think the bigger risk heading into the first half is actually not being invested in equities.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.