(Bloomberg) — Australia is set to make sweeping changes to financial services laws that will tighten safety nets on the cryptocurrency market and pave the way for possible competition in the clearing of equity trades.

(Bloomberg) — Australia is set to make sweeping changes to financial services laws that will tighten safety nets on the cryptocurrency market and pave the way for possible competition in the clearing of equity trades.

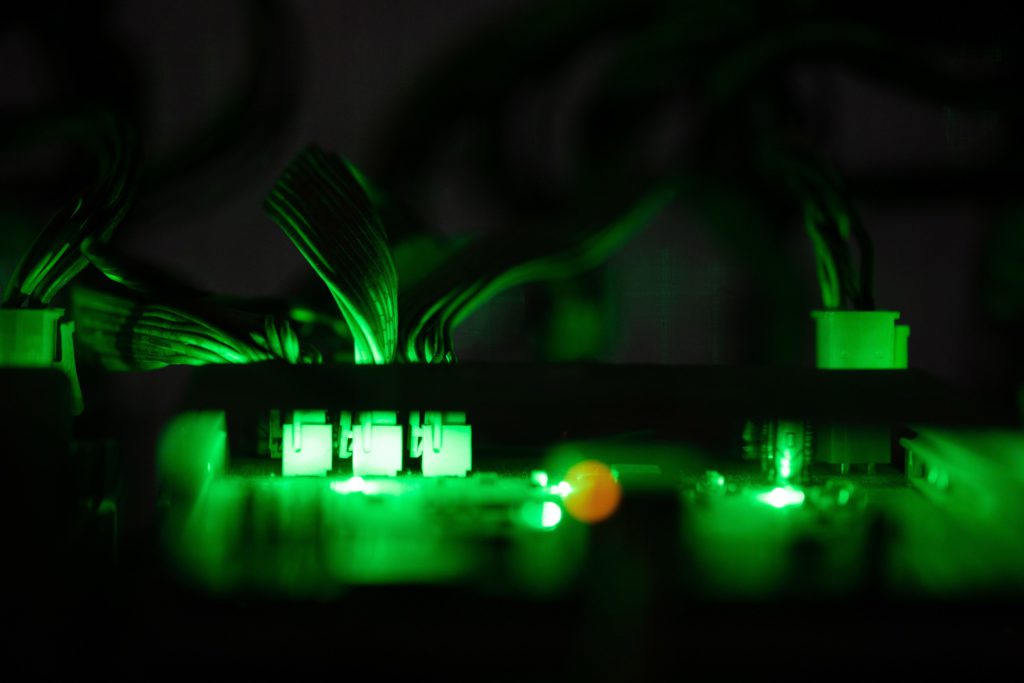

Under considerations outlined on Wednesday, the government will examine which crypto tokens should be covered under finance laws and also seek to strengthen Australia’s payments system. In cash equities, proposed legislation will either allow competition in clearing and settlement if a rival to ASX Ltd. emerges or give regulators more powers in the event of its ongoing dominance.

“The one constant in finance is change. It’s fast moving, dynamic and our regulatory frameworks haven’t kept up,” Treasurer Jim Chalmers said in the statement. “Our reforms are about starting to fix that in pursuit of a financial system that is stronger and more secure.”

The government said its consultation paper Wednesday will form the basis of a new “strategic plan” for the payments system to be passed in the first quarter of 2023, with changes in other areas also expected next year.

Regulators around the world are looking to tighten their grip on digital assets as the recent bankruptcy of the FTX exchange highlighted a significant lapse of risk controls. Meantime in Australia, ASX, which has a monopoly on the clearing and settlement of stock trades, is under pressure following its years-long abandonment of a technology upgrade that was backed by blockchain technology.

“The digital age has brought new opportunities and risks to finance,” Chalmers said. “Our plan is about opening up space for further innovation while making sure we have the right regulatory approach in place to keep consumers, businesses and the system safe.”

The government is also considering cryptocurrency custody and licensing settings to safeguard consumers and is expected to consult on a framework for that next year before introducing legislation.

A regulatory framework will be set up for the so-called buy now, pay later sector, according to the plans, that will make it easier for companies to ascertain whether or not they require a license.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.