A cold week in Europe is sending short-term power prices soaring as grid operators balance supply and pay power stations to keep the region’s lights from flickering.

(Bloomberg) — A cold week in Europe is sending short-term power prices soaring as grid operators balance supply and pay power stations to keep the region’s lights from flickering.

After Monday marked the tightest day of the year so far for Britain’s electricity grid, strains appeared to recede Tuesday even as temperatures are forecast to stay below average for the rest of the week.

Intraday prices for Tuesday’s early evening peak at 5 p.m.-6 p.m. eased to about a fifth of Monday’s level as a return of wind power added to supply.

At the same time, France, Germany and the Nordics are facing similarly chilly weather that is boosting power demand. Even with government caps on energy bills across the region, cold temperatures come at a high cost to consumers, who need to spend at already-record prices per unit — now largely set by regulators and governments — to keep their homes warm and lights on.

“The rest of the week will continue to see very high prices,” said Fabian Ronningen, an analyst at Rystad AS. “The peak may be reached in the UK for now, but in France and Germany we could still see higher prices happen later in the week.”

French prices on Tuesday between 5 p.m.-6 p.m. traded as high as €835 per megawatt-hour on Epex Spot SE. In Germany, they hit €1,000 between 2 p.m.-3 p.m, and in Sweden day-ahead prices are seeing the highest levels in 11 years.

Less power is traded in the short-term intraday markets than changes hands months or years in advance, but it’s where companies fine tune their demand — including some industrial users who may hedge less volume in advance.

They are also an indication of how tricky it may be for grid operators to hold supply steady. Vitol Group sold power for £6,000 on Monday in Britain, a record for gas generators in the balancing mechanism designed to fine-tune supply and demand — a cost that will be spread across consumer bills.

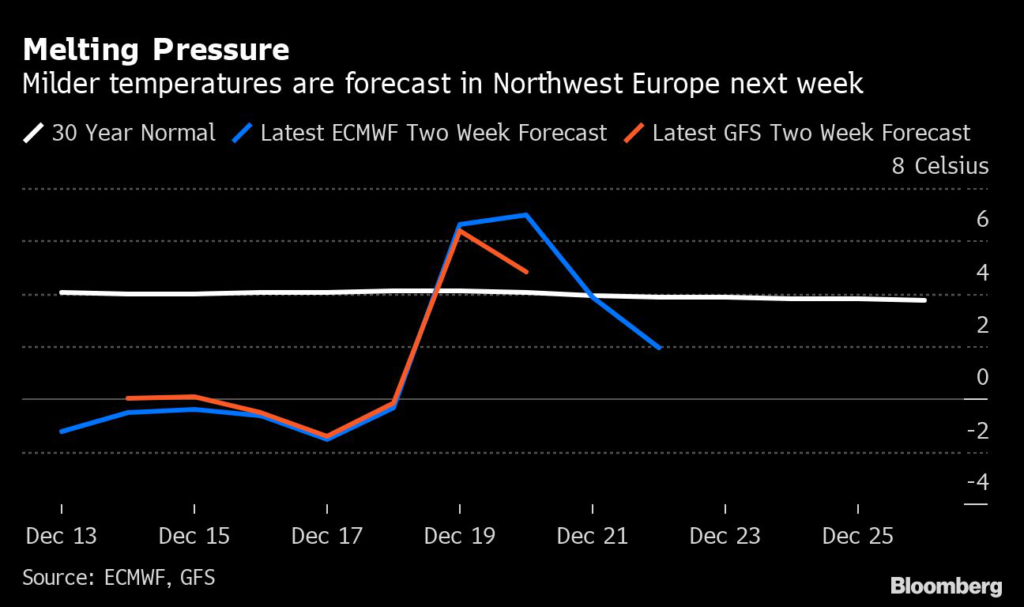

Milder weather is expected across Europe next week, helping to ease demand.

France is bringing back its nuclear reactors, which are crucial to powering the country’s electric-heavy heating systems. Electricite de France SA’s plants, which can generate over two-thirds of the country’s power, were at over 41 gigawatts of output on Tuesday morning.

“We all hope that we will reach 45 gigawatts during January, which would take us into a zone that’s a bit more comfortable,” Emmanuelle Wargon, president of the French Energy Regulatory Commission, said on BFM Business television on Tuesday morning. “We’re still waiting for three reactors to restart in coming days, so we should be able to reach this 45 gigawatts of output rather quickly.”

Power prices for delivery further into the future fell as the price of gas dropped. Strong liquefied natural gas supplies are set to ease the cost of running Europe’s gas-fired power stations, which generally set the price in the market.

–With assistance from Francois de Beaupuy.

(Updates with Swedish day-ahead prices in sixth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.