FTX’s US-based account holders are more likely than customers elsewhere in the world to get access to their assets on the bankrupt crypto platform, according to the man in charge of tracking down that money.

(Bloomberg) — FTX’s US-based account holders are more likely than customers elsewhere in the world to get access to their assets on the bankrupt crypto platform, according to the man in charge of tracking down that money.

John J. Ray III, who’s in charge of FTX’s restructuring, told a panel of US lawmakers that he’s optimistic they’ll be able to recover and return funds to FTX.US customers sooner and more fully than those on the FTX.com platform, which is largely for international users.

“There’s a general truth to the statement that the US exchange will suffer less,” Ray told the House Financial Services Committee Tuesday.

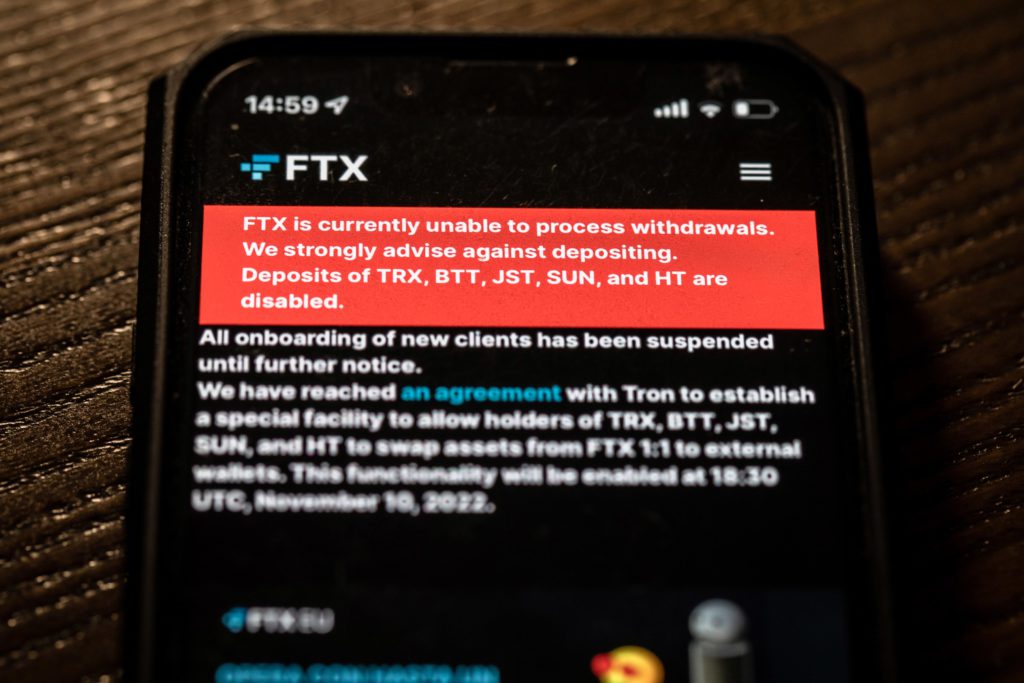

Ray said he didn’t agree with FTX’s former chief executive officer Sam Bankman-Fried that the US platform is completely solvent and that customer accounts could be unfrozen at any time. Bankman-Fried, who was arrested Monday night and faces a series of criminal charges for wire fraud and conspiracy, was also scheduled before he was taken into custody to also appear at Tuesday’s hearing.

Ray, who said that so far they’ve recovered more than $1 billion in assets, set it was “premature” to say that US customers will receive all the assets they had on the platform prior to the bankruptcy filing last month.

US customers had less exposure to losses because FTX executives pulled more money from FTX.com, rather than FTX.US to lend to Alameda Research, the hedge fund largely controlled by Bankman-Fried. Ray said there are about 2.7 million user accounts on the American platform and 7.6 million on the international platform, though noted the actual number of individuals involved in likely lower because some users had multiple accounts.

US users weren’t supposed to trade on the FTX.com platform, but Ray said a small number of people — a couple hundred — had accounts on the platform.

Ray didn’t give a timeline for when customers would have access to their accounts, but said its a process that would take months. The next step will be assigning losses to user accounts, he said.

“It’s a mining exercise at this point. At the end of the day, we’re not going to be able to recover all the losses here,” Ray said. “Money was spent that we’ll never get back.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.