CEO RJ Scaringe seems to conclude partnering with Mercedes to expand into Europe would be biting off more than his company can chew.

(Bloomberg) —

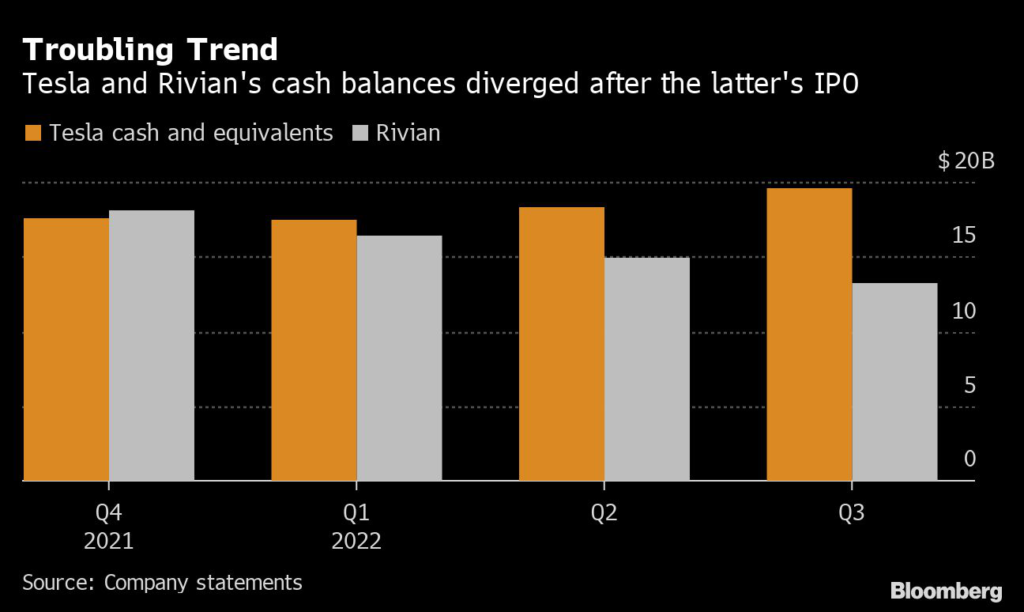

Rivian went public just over a year ago with big plans to take on Tesla and more cash to work with than Elon Musk’s car company.

The fact that the former already has gone through about a quarter of the money it debuted with helps explain why the company abruptly called off plans for a joint venture with Mercedes-Benz announced only three months ago.

Rivian has its hands full trying to make R1T pickups and R1S sport utility vehicles for consumers, plus electric delivery vans for Amazon. It’s burning through about $1.5 billion a quarter by operating its lone assembly plant in Illinois at roughly half capacity, yet plans to spend $5 billion on a new factory near Atlanta. CEO RJ Scaringe apparently concluded that, in partnering with Mercedes to jointly produce electric vans in Europe, Rivian would be biting off more than it can chew.

“As we evaluate growth opportunities, we pursue the best risk-adjusted returns on our capital investments,” Scaringe said Monday. “At this point in time, we believe focusing on our consumer business, as well as our existing commercial business, represent the most attractive near-term opportunities to maximize value for Rivian.”

The comments contrast with how Rivian pitched itself as it was going public. The company told investors it planned to enter Western Europe “in the near term,” followed by markets in Asia, and would localize production and supply chains in those regions.

A lot has changed since then. The capital markets that were wide open to EV makers — via a blockbuster IPO in Rivian’s case, or deals with special purpose acquisition companies for the likes of Lucid and Fisker — are now much less welcoming. When Rivian announced in October that it was dismissing 6% of its employees, Scaringe cited the need “to continue to grow and scale without additional financing in this macro environment.”

Rivian ended last year with around $18.4 billion in cash and equivalents. That’s dropped to $13.3 billion at the end of the third quarter. The company never disclosed how much it might invest in the Mercedes partnership, and the German company didn’t release details Monday on how much it will spend to expand its engine and battery plant in Poland to produce medium and large vans that will hit the market in 2025.

Analysts at Robert W. Baird praised Rivian’s decision to shelve the project with Mercedes, writing in a note that management was “keeping both eyes on the ball.”

For its jilted German partner, Rivian’s about-face was an unwelcome surprise. Mercedes saw teaming with the startup as a chance to share tech and investment as it electrifies its van lineup. While the company will still invest in making vans at its Polish plant, further expansion to make room for Rivian is now on hold.

“They will need to think about and might consider finding an industrial partner,” Bernstein analyst Daniel Roeska said of Mercedes.

Rivian’s cancellation of a preliminary agreement with Mercedes adds to setbacks for Europe’s auto sector, which has been struggling with tepid demand, surging energy costs and the generous incentives the US is now offering for battery production and electric vehicle purchases.

Volkswagen may abandon plans for a new €2 billion ($2.1 billion) EV factory in Germany, with new CEO Oliver Blume starting to rethink some of the costly projects announced by his predecessor, Herbert Diess. Battery maker Northvolt said last month it may delay building a factory in Germany, citing Europe’s steep energy bills and US President Joe Biden’s efforts to woo investment.

The allure of the Inflation Reduction Act might also be coming into play in Rivian’s case.

“We believe the IRA bill may be causing the company to re-evaluate the attractiveness of domestic manufacturing relative to commercial van production in Europe,” Joe Spak, an analyst at RBC Capital Markets, wrote in a report.

–With assistance from Edward Ludlow.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.