Short sellers have reaped almost $50 billion of gains this year from betting against some of the biggest technology companies, and some bears see further profits in 2023.

(Bloomberg) — Short sellers have reaped almost $50 billion of gains this year from betting against some of the biggest technology companies, and some bears see further profits in 2023.

Even after this year’s 28% slump in the Nasdaq 100 Index, many of the stocks are still expensive relative to their estimated sales or earnings, skeptics say, a sign that some of the froth from a multiyear bull market still remains to be blown away.

The 10 most-shorted companies have delivered $49.2 billion in combined mark-to-market gains for bears through Friday, according to data-analytics firm S3 Partners. Tesla Inc. leads with almost $12 billion in paper profits for shorts, followed by Amazon.com Inc. and Meta Platforms Inc. The top 10 also includes Apple Inc. and Microsoft Corp.

“The reason we are so attracted to the technology sector is because there are still a ridiculous amount of companies out there that are trading at 10, 15, 20 times price to sales,” said Brad Lamensdorf, a manager of the AdvisorShares Ranger Equity Bear ETF. Such multiples are “absurd,” he said, adding that “the odds of that position being profitable over time for an investor is so low that they are a great pool to fish from.”

Short sellers — who borrow shares and sell them, hoping to buy them back at a lower price to profit from the difference — struggled during the years-long bull market, when high valuations didn’t seem to matter.

That changed this year: Soaring inflation prompted a series of interest rate increases by the Federal Reserve, causing investors to flee once-popular growth and tech stocks.

Tesla is a prime example: The electric-car company was the most shorted stock in 2020 and 2021, but by the end of those years short sellers were sitting on about $35 billion and $10 billion of paper losses, respectively, as the shares rallied.

The stock topped out late in 2021 at about 18 times sales, and it’s lost half its value this year, when it was again the most shorted stock and the most profitable one for the bears.

Another favorite of the shorts, used-car retailer Carvana Co., has tumbled 98% this year. Short sellers have $4.3 billion in mark-to-market profits on bets against the stock, according to S3.

Representatives of Apple and Carvana didn’t have any immediate comment on the short interest in their shares, while Microsoft declined to comment. Tesla, Meta and Amazon weren’t immediately available to comment.

Many of the most-shorted stocks also were among the most-owned stocks by individual investors, meaning the mom-and-pop set took a big hit in the bear market.

Investment portfolios belonging to retail traders suffered a $350 billion blow this year, according to data compiled by Vanda Research. The list is topped by Tesla, which accounts for about 10% of the average self-directed global retail trader’s portfolio, according to the firm.

Even after this year’s selloff, the Nasdaq 100 trades at 21 times forward earnings, slightly above its 10-year average.

It’s likely “that investors will make money shorting tech again in 2023,” said Matt Maley, chief market strategist at Miller Tabak + Co. “History tells us that bear markets for the tech group do not end until the biggest names become at least somewhat cheap.”

Tech Chart of the Day

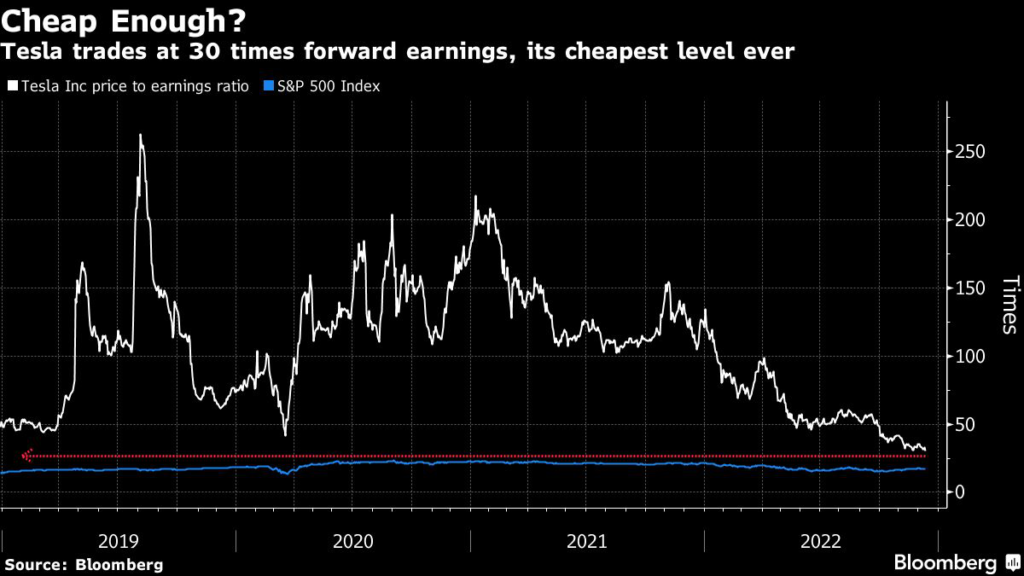

This year’s selloff has pushed Tesla’s valuation to the lowest ever in its 13 years as a publicly traded company. Tesla’s stock is down 52% this year, trading at 30 times projected earnings. Yet skeptics say the valuation may not be low enough, given that the electric-car maker is grappling with slowing in sales in China, the world’s largest car market, at a time when Chief Executive Officer Elon Musk is spending much of his time working on his new acquisition, Twitter Inc.

Top Tech Stories

- Oracle Corp. reported quarterly sales that exceeded analysts’ estimates on a strong effort from its Cerner digital health records unit, overcoming softer demand for information technology services in a choppy economy.

- Japan and the Netherlands have agreed in principle to join the US in tightening controls over the export of advanced chipmaking machinery to China, according to people familiar with the matter, a potentially debilitating blow to Beijing’s technology ambitions.

- Japan’s newly formed chip foundry venture Rapidus Corp. said it is seeking to invest several trillion yen to help reboot the country’s semiconductor industry.

- Twitter resumed selling its Twitter Blue premium offering, which gives users a blue verification badge by their names, following a weeks-long pause because some subscribers were using the paid service to impersonate well-known accounts.

- Sony Group Corp. led a big jump in video-game hardware sales in the US last month, in the latest sign of improving PlayStation 5 supply.

- Elon Musk’s SpaceX is offering to sell insider shares at a price that would raise the closely held company’s valuation to about $140 billion, according to people familiar with the matter.

- The $5.7 billion of Tesla shares that Musk donated to an unnamed organization at the end of 2021 went to his own charitable arm, instantly making it one of the largest foundations in the US.

- Uber Technologies Inc. said it’s investigating the hack of a third-party vendor that reportedly resulted in the leak of data from the ride-hailing company, including employee email addresses.

- GoTo Group jumped Tuesday by the most since May as some brokers upgraded the battered stock following weeks of sharp selloff. The Indonesian ride-hailing and e-commerce provider surged 15%, snapping 16 straight sessions of losses.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.