Federal prosecutors moved at warp speed to charge FTX founder Sam Bankman-Fried, defying expectations that a criminal case over the cryptocurrency exchange’s collapse would take months or even years to build.

(Bloomberg) — Federal prosecutors moved at warp speed to charge FTX founder Sam Bankman-Fried, defying expectations that a criminal case over the cryptocurrency exchange’s collapse would take months or even years to build.

The eight-count indictment against Bankman-Fried unsealed Tuesday came barely a month after FTX filed for bankruptcy protection on Nov. 11. By comparison, Enron Corp. Chief Executive Officer Jeffrey Skilling, who was ultimately convicted of fraud and other counts, wasn’t charged until more than two years after that company’s 2001 collapse.

Gene Rossi, a former federal prosecutor, said such a swift indictment suggests federal investigators quickly accumulated a substantial amount of evidence through grand jury subpoenas and witness testimony.

“To indict someone of his stature so early tells me they had an avalanche of evidence,” Rossi said. “To indict this early, when they didn’t have to, tells me that they have incredibly powerful evidence.”

Misappropriated Billions

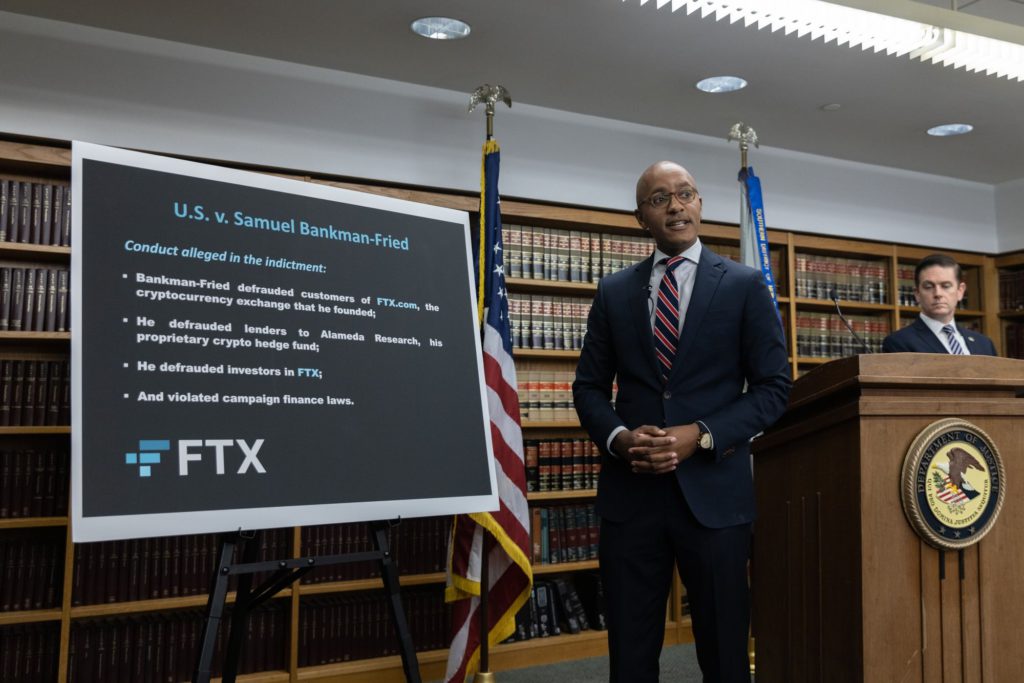

The charges against Bankman-Fried include wire fraud, conspiracy to commit securities fraud and several other counts for allegedly misappropriating billions of dollars in FTX customers funds for personal use and risky bets by sister trading house Alameda Research. Manhattan US Attorney Damian Williams on Tuesday called the case “one of the biggest financial frauds in American history.”

Complex fraud cases usually take far longer to investigate as prosecutors and federal agents sift through documents, interview witnesses and present evidence to grand juries.

But FTX’s bankruptcy-appointed Chief Executive Officer John J. Ray III, who also oversaw Enron’s liquidation, testified before Congress on Tuesday that he believed the fraud at the cryptocurrency exchange wasn’t particularly complex.

“The FTX Group’s collapse appears to stem from the absolute concentration of control in the hands of a very small group of grossly inexperienced and unsophisticated individuals,” Ray testified. He called the alleged misuse of FTX customer funds by Bankman-Fried’s inner circle straightforward embezzlement.

Sam Buell, a Duke University law professor and former lead prosecutor for the Justice Department’s Enron Task Force, said the 14-page indictment against Bankman-Fried “quite bare bones relative to what you would normally expect in a major fraud prosecution.” Buell said the lack of detail could suggest prosecutors felt pressure to act quickly.

Marc Litt, a former federal prosecutor in Manhattan, agreed. He likened the speed with which prosecutors acted to the December 2008 indictment of Bernard Madoff, who was charged days after a lawyer for the investment manager’s sons told the US Securities and Exchange Commission about the fraud at their father’s brokerage firm.

Litt said prosecutors likely felt they had to move swiftly in both cases.

Rossi said the government was probably “gravely concerned” that Bankman-Fried would try to flee to a jurisdiction where he could not be extradited. Bankman-Fried, who ran FTX from the Bahamas, was arrested there Monday evening.

At a Tuesday arraignment in a Bahamian court, Bankman-Fried’s lawyer said his client planned to fight extradition to the US. Legal experts said such a fight could delay the case for months or even years, potentially negating the swiftness of the indictment.

Williams declined to address the extradition process on Tuesday.

The US attorney has previously stressed the need to speed up high-profile, white-collar cases. Williams told Bloomberg in June that his goal is to bring such cases while the facts that gave rise to them are still relatively fresh in people’s minds.

At that time, he cited the office’s April charges against Archegos Capital Management’s Bill Hwang, which came about a year after his family office imploded. Hwang has pleaded not guilty and is scheduled to go on trial next year.

“We have been managing these investigations with the goal toward charging them as quickly as possible,” Williams said in June.

–With assistance from Greg Farrell.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.