Asian stocks are poised to open on the back foot Thursday as US stocks fell after the Federal Reserve signaled interest rates will climb higher than anticipated next year.

(Bloomberg) — Asian stocks are poised to open on the back foot Thursday as US stocks fell after the Federal Reserve signaled interest rates will climb higher than anticipated next year.

Equity futures for Australia and Japan declined while contracts for Hong Kong eked out a gain. US shares snapped a two-day rally, ending off their lows in a volatile session.

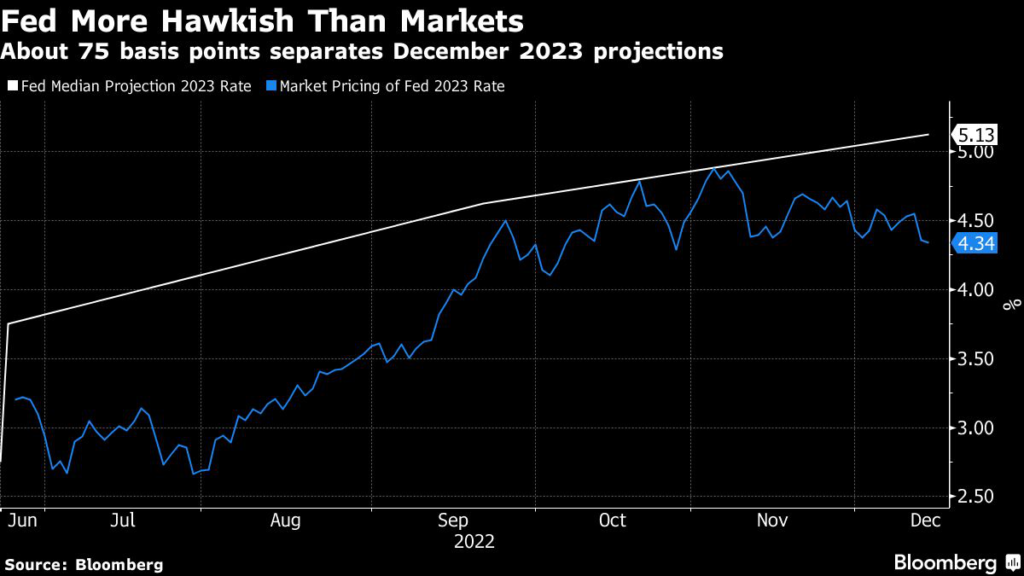

Fed Chair Jerome Powell said the central bank has a “ways to go” in its campaign to rein in inflation. Policy makers projected rates would end next year at 5.1%, a higher level than previously indicated. Ahead of the decision, traders bet rates would reach about 4.8% in May.

“Asian markets will take their lead from the US markets,” said Anthony Doyle, head of investment strategy at Firetrail Investments. “The theme of today for Asian markets is defensives holding up the most, so sectors like healthcare, food and beverages, and transport.”

Read: Wall Street’s Optimism Dims as Fed Decision ‘Screams Hawkish’

Australian bonds fell slightly, taking the 10-year yield up by two basis points to 3.38%. In the US Wednesday, Treasuries whipsawed after the hawkish decision and Powell’s comments, with policy sensitive two-year rates spiking higher before ending the day little changed. The dollar fell for a second day.

The Federal Open Market Committee raised its benchmark rate by 50 basis points to a 4.25% to 4.5% target range. Powell left the door open to a similar hike at the next meeting in February or a step down, while pushing back on bets for reversing course next year.

Swaps traders expect policy makers to continue on the slower path as it did Wednesday, with Fed-dated contracts pricing in 33 basis points of hikes at the next meeting and peak around 4.87% by May, broadly in line with Tuesday’s close.

On Thursday’s economic front in Asia, China is due to release a raft of data including industrial production and retail sales as a closely watched economic policy meeting in Beijing is set to start. Also on traders’ watchlists are Australian employment and Japanese trade figures.

Later, policy decisions will be front and center in Europe, with the Bank of England and European Central Bank seen following the Fed with half-point hikes in rates.

Key events this week:

- China medium-term lending, property investment, retail sales, industrial production, surveyed jobless, Thursday

- ECB rate decision and ECB President Lagarde briefing, Thursday

- Rate decisions for UK BOE, Mexico, Norway, Philippines, Switzerland, Taiwan, Thursday

- US cross-border investment, business inventories, empire manufacturing, retail sales, initial jobless claims, industrial production, Thursday

- Eurozone S&P Global PMI, CPI, Friday

Some of the main moves in markets as of 7:41 a.m. Tokyo time:

Stocks

- The S&P 500 fell 0.6%

- The Nasdaq 100 fell 0.8%

- Nikkei 225 futures fell 0.6%

- Australia’s S&P 200 Index futures fell 0.8%

- Hang Seng Index futures rose 0.1%

Currencies

- The euro was little changed at $1.0681

- The Japanese yen was little changed at 135.45 per dollar

- The offshore yuan fell 0.1% to 6.9519 per dollar

Cryptocurrencies

- Bitcoin was little changed at $17,824.92

- Ether was little changed at $1,311.26

Bonds

- The yield on 10-year Treasuries declined two basis points to 3.48%

- Australia’s 10-year yield advanced two basis points to 3.38%

Commodities

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Georgina Mckay and Rheaa Rao.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.