(Bloomberg) — Bond investors just don’t seem to buy what the Federal Reserve is selling: that monetary-policy rates will keep moving higher and stay there for an extended period of time.

(Bloomberg) — Bond investors just don’t seem to buy what the Federal Reserve is selling: that monetary-policy rates will keep moving higher and stay there for an extended period of time.

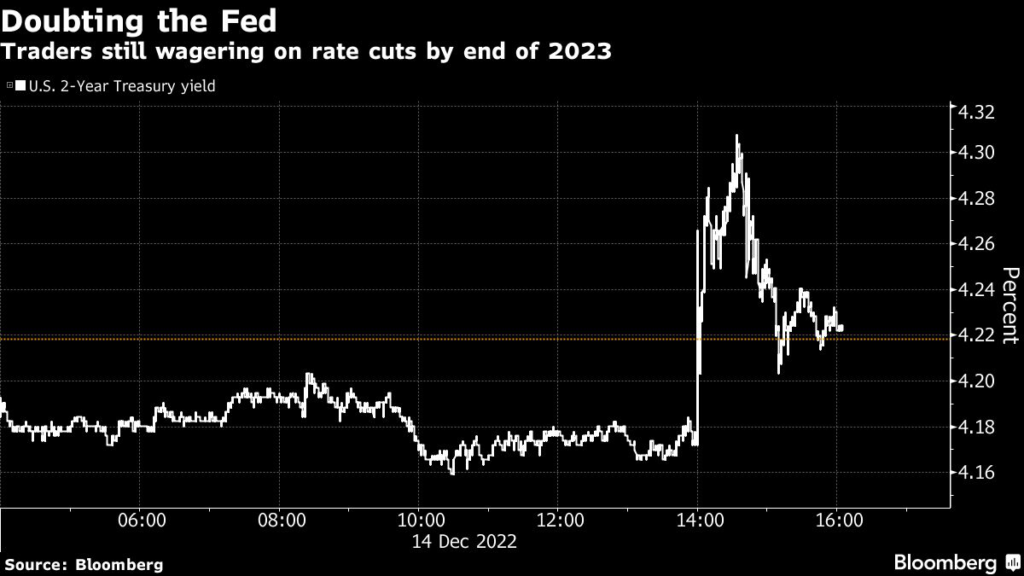

The policy sensitive two-year Treasury yield initially surged higher after Fed officials’ quarterly forecasts released Wednesday showed they expect the central bank to push its key rate to over 5% in 2023, according to the median estimate of policy makers.

That’s well above what futures traders are pricing in.

But that jump was soon almost entirely erased, even as Powell signaled that the central bank still has “some ways to go” in its campaign to rein in the biggest bout of inflation since the early 1980s.

Other bonds saw yields down on the day after Powell’s press conference.

The reaction likely reflects some signals in the Fed’s forecasts that point to a steep slowdown in growth, which may have bolstered speculation that the Fed will still wind up cutting rates next year to get the economy going again.

Officials cut their 2023 growth forecasts, for example, and see an expansion of just 0.5%, and increased their forecast for the unemployment rate. The median estimate for the Fed’s policy rate in 2024 is also now around 4.1%.

The dot plot revisions and downgrades for growth and employment are “as close to a recession call from the Fed as I can ever recall,” said George Goncalves, head of US macro strategy at MUFG Securities Americas Inc.

“This is a Fed that wants to make sure the inflation job is done.”

Swaps traders expect the Fed to continue easing up on the pace of its rate hikes as it did Wednesday, when it made the widely anticipated decision to raise rates by half a percentage point after four straight three-quarter point moves.

The rate is now in a range of 4.25% to 4.5%.

In its statement, the Fed said it anticipated further increases to make policy tight enough to pull inflation back toward its 2% target. Powell underscored that message before reporters.

Read more: Powell Says Fed Still Has a ‘Ways to Go’ After Half-Point Hike

When asked about the rate cuts being priced into the market, Powell said in a response to a question that officials at the Fed were not even pondering yet the idea of easing ahead.

“Our focus right now is really on moving our policy stance to one that is restrictive enough to ensure a return of inflation to our 2% goal over time,” Powell said.

“It’s not on rate cuts. I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to 2%.”

Bill Dudley, a Bloomberg Opinion columnist and senior adviser to Bloomberg Economics, says the market appear to be ignoring the Fed’s message Wednesday.

“If you look at what Powell said and what the projections were, these were hawkish remarks and hawkish projections,” Dudley said on Bloomberg TV.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.