A reopening-led rout in China’s bond market is pushing up borrowing costs for banks, increasing focus on Thursday’s central bank plans to ensure there is enough cash in the financial system for the medium-term.

(Bloomberg) — A reopening-led rout in China’s bond market is pushing up borrowing costs for banks, increasing focus on Thursday’s central bank plans to ensure there is enough cash in the financial system for the medium-term.

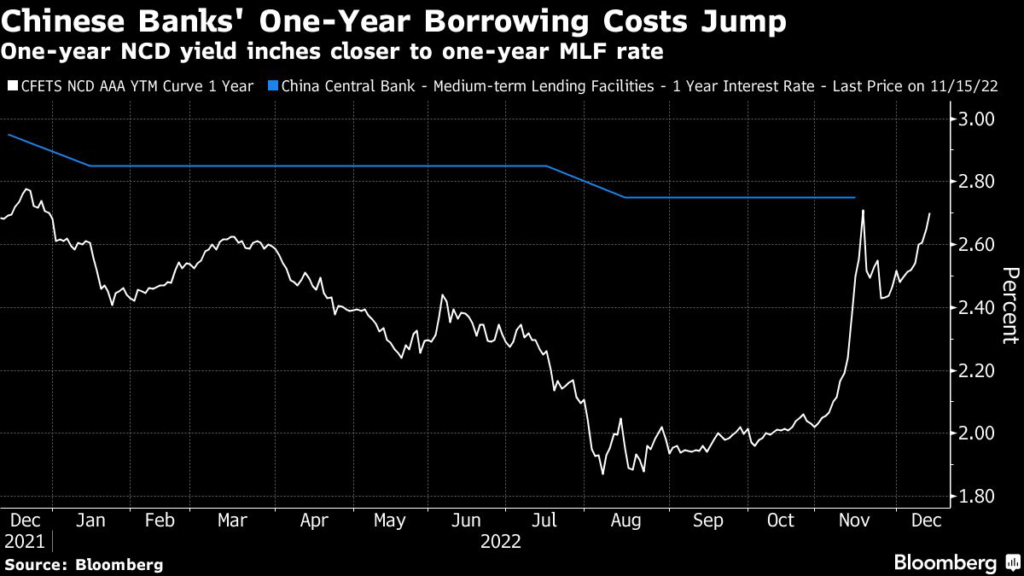

While short-term money market rates stay anchored thanks to the People’s Bank of China’s reserve requirement ratio cut last month, the rate on one-year negotiable certificates of deposits has jumped due to heavy retail redemptions. The yield of around 2.7% on the notes is just five basis points below the PBOC’s one-year MLF rate, which means it’s becoming more attractive for lenders to borrow from the central bank.

The PBOC will have an opportunity to ease the funding stress on Thursday when 500 billion yuan ($71.8 billion) of policy loans come due. A Bloomberg survey shows five out of seven analysts and economists expect a full rollover after the Covid Zero pivot spurred a rapid sell-off in government bonds. However, a net injection of cash would be the first since March.

“We believe interbank liquidity could be under some pressure as 2022 comes to an end, and the PBOC may intend to increase long-term liquidity injection,” as banks’ demand for MLF increase, Mary Xia, a rates strategist at UBS Securities Co. in Beijing wrote in a note.

Although the survey predicts the one-year MLF rate to be left unchanged at 2.75% on Thursday, the PBOC has room to provide more support. Huachuang Securities Co. Chief Macro Analyst Zhang Yu sees a likely rate cut in December. “It is golden timing to cut rates” as the yuan has advanced toward 6.95 per dollar and Treasury yields have eased, she wrote in a note this week after data showed subdued credit expansion in November.

China’s 10-year government bond futures climbed as much as 0.5% Wednesday, the biggest rise in four months and one of their largest gains this year on optimism authorities will ease the market stress.

READ: China’s Economy Likely Worsened Before Abrupt Covid Policy Shift

The central bank may have a strong incentive to soothe the bond market as continued turmoil amplified by retail redemptions could impact corporate funding plans and delay economic recovery. Net issuance of corporate bonds plunged in November, according to PBOC data. Yields on government bonds have risen this month even after regulators were said to have asked the nation’s biggest insurers to buy bonds being offloaded as retail customers.

(Updates with bond futures move in sixth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.